Please think twice before attempting to juice your investment returns with this risky tool.

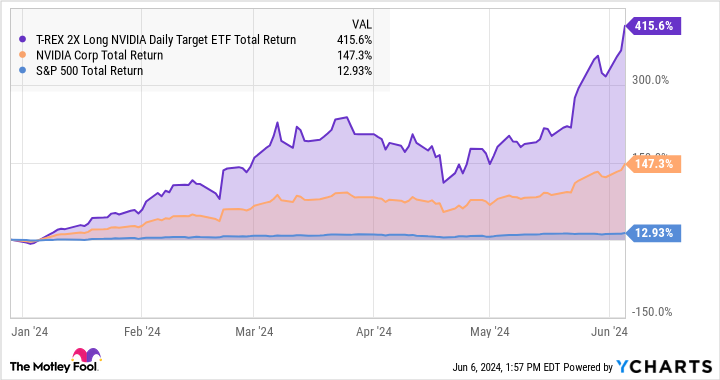

Chip designer Nvidia (NVDA -0.09%) is absolutely crushing the stock market these days. Nvidia’s stock has provided a total return of 147% since the start of 2024, leaving the S&P 500 (^GSPC -0.11%) index far behind at a 13% total return.

Nvidia’s price gains have created a monster, though. And another beastly investment looms even larger. I wouldn’t touch it with a 10-foot pole, a thousand-watt laser pointer, or an AI-generated digital finger.

Behind the curtains of Nvidia’s gains

First things first. I’m impressed by Nvidia’s mastery of the market for artificial intelligence (AI) accelerator chips. The company’s A100 and H100 processors are found in most of the supercomputers that trained today’s most powerful generative AI systems, starting with OpenAI’s ChatGPT. Looking ahead, the Blackwell platform should play a similar role in the next generation of large-scale AI systems.

So Nvidia’s stock is rising for all the right reasons, supported by incredible business results. Yet, the AI boom may have boosted Nvidia’s stock price further and faster than it should, especially since every semiconductor company worth mentioning is releasing serious competitors to this company’s solutions.

In other words, I wouldn’t recommend buying Nvidia shares today. And I most definitely want to stay away from the even more impressive gains of a certain exchange-traded fund (ETF), which takes Nvidia’s market returns and turns up the volume to 11.

The T-Rex 2x Long Nvidia Daily Target ETF (NVDX -0.31%) is a leveraged ETF, aiming to double the daily price moves of Nvidia’s stock. If Nvidia’s lofty valuation makes me nervous, the T-Rex fund’s amplified version looks downright terrifying:

NVDX Total Return Level data by YCharts

Upsides and downsides

The T-Rex ETF’s returns are exciting so far. The fund has more than doubled Nvidia’s recent gains, and it’s easy to jump to the conclusion that it will continue to win in the long run. As long as Nvidia’s stock is treating investors well, this amplified financial instrument should jump even higher.

But there are many downsides to this approach.

- The thrilling gains in good times are matched by steeper drops in market downturns. Remember the inflation-burdened market crash of 2022? The Invesco QQQ Trust (QQQ -0.09%), which tracks the tech-heavy Nasdaq-100 index, fell 32.6% that year. The leading 2x leveraged version of that fund, ProShares Ultra QQQ (QLD -0.23%), plunged 60.5% lower in the same period. Now imagine a share price correction to Nvidia’s stock, then double the expected pain. That’s where the T-Rex ETF would be going.

- Leveraged ETFs are inherently unstable animals. They weren’t designed to track market returns over the long haul, but to give day-trading speculators another tool for their short-term trades.

- Some leveraged ETFs see limited trading volumes, which may leave you up the creek without a paddle when you want to sell your shares. The T-Rex 2x Nvidia fund is also rather small with only $525 million of assets under management, and it has only been around since last October.

Long story short, the T-Rex ETF looks amazing while the sun is shining, but you don’t want to own it while it’s raining on Wall Street. The leveraged fund didn’t exist in 2022, but Nvidia’s stock price dropped by 50.3% that year. You can’t really double the price drop without breaking the laws of basic math — stock and ETF prices can never be negative.

Potential downside catalysts

I’m not saying that it will happen again, but economic drama can always undermine the growth-oriented tech sector without warning. And what if Intel (INTC 1.05%) or Advanced Micro Devices (AMD 0.65%) starts stealing large AI accelerator contracts out of Nvidia’s pocket? That’s another non-zero risk.

So I highly recommend staying away from the T-Rex 2x Nvidia fund while the underlying stock is soaring this high. Yes, it could keep winning for a while and maybe even in the long run. But are you really ready for the pain your wallet would feel in a serious price correction? Plain old Nvidia shares can provide all the risk-skirting excitement you need, if you still insist that its $3 trillion market cap can grow even larger.

Anders Bylund has positions in Intel and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.