Just because it might no longer be an acquisition prospect doesn’t mean it’s not a great growth prospect for you.

Like bargains? Investors should obviously be willing to pay a premium for the right stock. But if you can scoop up a great name at a discounted price, so much the better.

With this in mind, growth-seeking investors may want to consider stepping into HubSpot (HUBS -1.73%) stock while shares are down 31% from their April high. The reason for most of this weakness is obvious, but not necessarily sound. The doubters are looking past a couple of important key points here.

Alphabet changes its mind

If you’re not familiar with it, HubSpot is a software company. Its core business is customer relationship management (or CRM) solutions, although it also provides many of the ancillary tools needed to operate in today’s internet-centric marketplace. Content management, customer service, data analytics, and e-commerce are all in its wheelhouse. The $24 billion company did nearly $2.2 billion worth of business last year, up 25% from the prior year’s top line.

However, this strong growth pace isn’t the source of HubSpot’s recent notoriety. The company was thrust into the spotlight in April when Alphabet expressed interest in acquiring the smaller tech company.

But Alphabet reportedly changed its mind late last week, dragging Hubspot shares sharply lower as a result. Thanks to last week’s 19% tumble, shares are now down 31% from April’s peak.

This is understandable. An acquisition would have almost certainly materialized at a premium valuation, after all. Now that prospect is off the table.

The sudden swell of doubt, however, ignores a small handful of reasons you might still want to be a HubSpot shareholder, even if Alphabet doesn’t want to outright own it.

3 reasons Hubspot stock is worth buying here

Just because Google’s parent doesn’t want to acquire HubSpot after all doesn’t mean it’s not worth owning. Remember, an acquisition target must also be a good fit for the suitor, capable of creating synergies between the two entities. Alphabet just didn’t see enough potential synergies to justify what would have been an investment of at least $35 billion.

To draw any interest from a name like Alphabet, though, still speaks volumes about the quality and caliber of the prospective target. That’s the first key clue that you might be wise to own a stake in this mid-sized company.

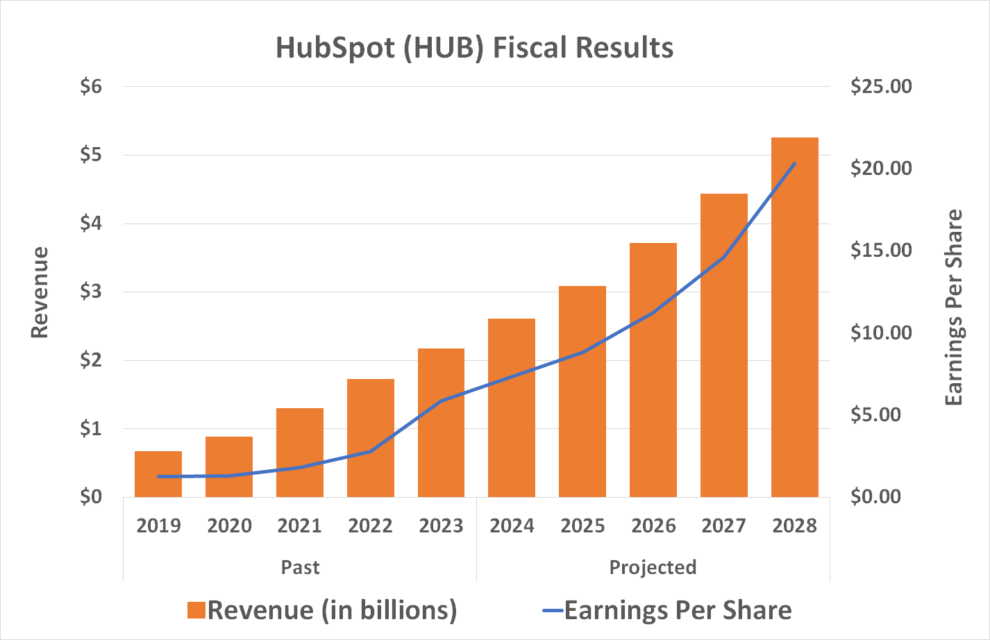

The other big bullish argument is the aforementioned growth rate. Alphabet’s abandoned interest in purchasing the company doesn’t negate HubSpot’s past and projected progress. Last year’s top-line improvement of 25% will likely be followed by 18% growth this year and next, with more of the same in the cards for the next few years after that. Earnings are growing at an even faster pace, and should also continue doing so through 2028.

Data sources: StockAnalysis.com, CNBC. Chart by author.

But what’s driving this growth? Although the company doesn’t offer a particularly unique product, HubSpot does offer its range of solutions in an integrated way that makes enterprises want to buy and use them. In 2022 and 2023, in fact, technology market research outfit Gartner ranked HubSpot as one of only a handful of “leaders” of the business-to-business (or B2B) marketing automation market, holding it up with familiar names like Microsoft, Salesforce, and Adobe.

That said, there’s a third, simpler reason to consider buying a new stake in HubSpot stock while it’s down as much as it is. That’s analysts’ current consensus price target. It stands at $660.33, up from where it was when the acquisition hullabaloo first got going. That’s nearly 40% above the stock’s present price.

Oh, and by the way… of the 31 analysts weighing in on this company, 22 of them rate HubSpot a strong buy.

Still a great growth investment

Of course, a lofty price target is no guarantee that HubSpot shares will immediately reverse course and begin logging gains again. They may sink even more, in fact, now that the selling floodgates are opened. Continued volatility is almost a certainty for the foreseeable future as well.

But if you’re an aggressive long-term investor who can stomach the volatility, this pullback is a buying opportunity. Alphabet didn’t necessarily feel it wasn’t a great company. HubSpot just wasn’t a great fit for Google’s parent. It’s a wonderful fit for most risk-tolerant growth investors’ portfolios.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Adobe, Alphabet, HubSpot, Microsoft, and Salesforce. The Motley Fool recommends Gartner and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.