Led by some of the world’s most important AI companies, this ETF can make a great addition to investors’ portfolios.

You’d be hard-pressed to find a topic that has dominated the business and tech world over the past couple of years more than artificial intelligence (AI). It’s been more unavoidable than traffic in Los Angeles.

Despite being around for decades (yes, decades), AI was recently brought to the mainstream with the success of generative AI tools like OpenAI’s ChatGPT and Google’s Gemini (formerly Bard). Before then, AI was mainly operating behind the scenes. However, these consumer-facing applications allow the everyday person to interact with and get a gist of the potential of AI more directly.

If you’re interested in investing in what many consider the future of technology and have $1,000 available, the Vanguard Mega Cap Growth ETF (MGK -0.62%) is a great option to add to your portfolio.

Major tech companies make up the bulk of the ETF

This ETF focuses on large companies that have significant growth opportunities. While “megacap” is generally defined as companies with a market cap above $200 billion, the ETF contains companies well below that mark. For perspective, the smallest company in the ETF is Lululemon Athletica, whose market capitalization is around $35 billion.

Although it’s not a pure AI ETF, it contains many companies leading the charge on AI developments and innovation, and most of the companies it contains deal with AI in some capacity. A large portion of the ETF is dedicated to the “Magnificent Seven” stocks (over 57%):

- Microsoft: 13.6%

- Apple: 12.5%

- Nvidia: 11.7%

- Alphabet (both classes): 7.5%

- Amazon: 4.9%

- Meta Platforms: 4.8%

- Tesla: 2.5%

The ETF only contains 71 stocks, so it’s much smaller than other broad ETFs, but the concentration in high-performing companies gives it greater growth potential.

The role of Magnificent Seven stocks in the AI world

Nvidia has easily been the biggest beneficiary of the recent AI boom, with its stock up close to 650% in the past two years. Its GPUs — which are necessary for operating data centers and training AI models — have become one of the most in-demand products in the tech world.

Microsoft, Amazon, and Alphabet control the three largest cloud platforms in the world and have been using AI to enhance their products, improve efficiency, and provide comprehensive tools for businesses to implement technologies like machine learning and data analytics.

Meta Platforms has its Fundamental AI Research (FAIR) team, which focuses on research and advancing all things AI across the spectrum. Apple recently partnered with OpenAI to integrate ChatGPT into the next generation of its products, and it will likely play a large role in on-device machine learning. Tesla has been a pioneer in using AI to develop electric cars.

There are many aspects of AI, and investors are getting exposure to the full spectrum (minus semiconductors, for the most part) with a single investment in this ETF.

A history of outperforming the market

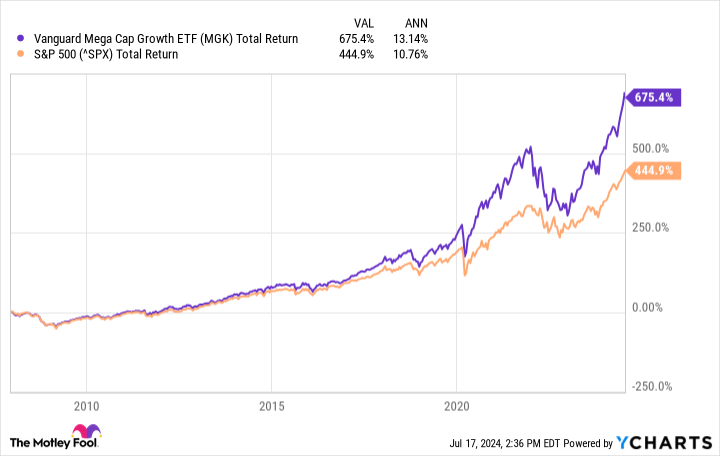

Since its December 2007 inception, this ETF has notably outperformed the market (based on S&P 500 returns), averaging over 13% annual total returns.

MGK Total Return Level data by YCharts

The ETF’s returns have been even greater in the past decade. It has averaged over 16.5% annual total returns, compared to the S&P 500’s 13.1% in that time span.

There’s no way to predict how the ETF will perform in the future, but it’s well equipped to continue outperforming the market — especially considering most of its holdings are also part of the S&P 500.

Be mindful of the ETF’s high concentration in top companies

The concentration of the ETF does come with some added risk, particularly if one of the top three holdings experiences a major correction. Nvidia, for example, is notably expensive by almost all standards, with a price-to-earnings (P/E) ratio close to 74. If the company doesn’t live up to its extremely high expectations, investors (many of whom are speculating) could jump ship and send the company’s stock plunging.

Microsoft and Apple are also expensive, with P/E ratios of around 38 and 35, respectively, so they’re also susceptible to corrections (though I’d argue nowhere close to Nvidia). That said, this ETF is a great option if you’re looking to gain exposure to companies leading the way in AI.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Lululemon Athletica, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.