AI stocks have skyrocketed in value. One little-known gem looks ready to join the pack.

The AI craze has taken the market by storm, dominated by chipmaker Nvidia. Over the last three years, Nvidia stock has skyrocketed in value by nearly 400%. But there are other AI stocks worth considering right now. One in particular — a little-known gem with a relatively small market cap — looks ready for a bull run.

This AI stock has huge potential upside

If you want to invest in AI stocks with maximum potential upside, take a close look at SoundHound AI (SOUN 6.21%). It’s rare to find a company with this much growth potential trading at such a discounted valuation.

SoundHound was founded in 2005 by some experienced tech entrepreneurs. As its name suggests, its target category is sound, whether that’s voice-enabled AI assistants or music recognition apps. Wherever humans interact with sound, SoundHound wants to improve the experience using AI.

One of SoundHound’s first success stories was with personal vehicles. In 2015, for example, its partnership with Hyundai resulted in the first music recognition service that shipped standard. In this case, Hyundai Genesis owners were able to chat with their car about what music was currently playing. That innovation, mind you, was nearly a decade ago. In the years since, SoundHound has partnered with more than a dozen other vehicle manufacturers including Jeep, Dodge, Kia, Honda, and Fiat to augment the driver experience through AI voice and sound services.

More recently, SoundHound expanded into additional end markets. It’s signed fast casual restaurants like Applebee’s, Five Guys, and Chipotle to deals that will test SoundHound’s AI capabilities in drive-thrus, which could help lower costs and boost efficiency. And SoundHound also signed deals to power smart televisions, call centers, and healthcare services.

Any industry, product, or service that uses verbal communication is a potential use case for SoundHound’s technology, which is backed by more than 200 patents. Every new deal gives the company more data to train its models on, and thus advances its ability to sign more clients and strengthen its technology even more.

Is SoundHound on the cutting edge?

It’s not hard to imagine the upside potential for SoundHound’s business model, and thus upside in its stock price. Valued at just $1.6 billion, the company is one of the lowest-valued AI companies on the public market.

AI giant Nvidia clearly sees value in what SoundHound is doing. Earlier this year, Nvidia invested nearly $4 million to take a 0.6% stake in the company. Around the same time, SoundHound revealed its new vehicle AI platform — powered by Nvidia chips — that can handle AI requests without any external connectivity.

“Among a range of use cases,” a company statement said, “the new solution will let drivers access SoundHound Vehicle Intelligence, a product that instantly delivers information directly from the car manual and other relevant data sources using natural speech.” With SoundHound, you can literally chat with your car about its maintenance history, performance issues, and recommendations for improving its drivability and lifespan. No bulky user manual required.

It is use cases like this that could eventually become standard in every vehicle sold. And SoundHound is leading the way. Not just in vehicle AI systems, either. It’s expanding into new categories seemingly every quarter, and it’s had no problem signing major clients to test the technology. But what about the valuation?

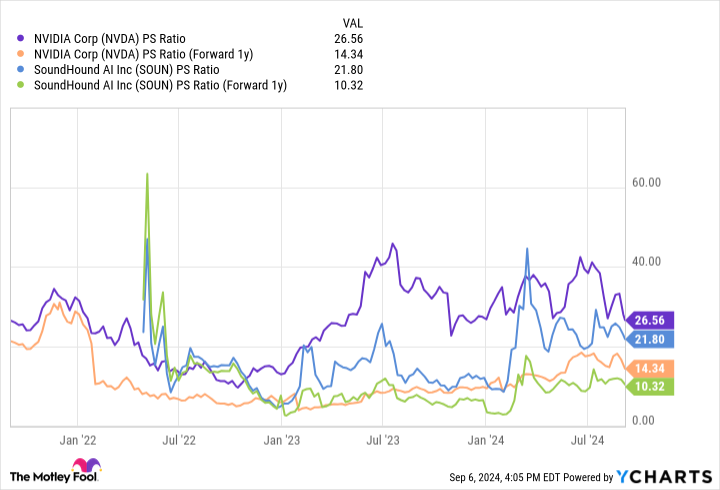

NVDA PS Ratio data by YCharts

On the surface, SoundHound stock looks ridiculously expensive at 21.8 times sales — nearly as expensive as Nvidia at 26.6 times sales. But both companies are growing revenue so quickly that these high multiples will quickly prove reasonable. On a forward price-to-sales basis — that is, what analysts believe each company will earn next year — SoundHound trades at 10.3 times forward sales, while Nvidia still trades at 14.3 times sales. From this perspective, SoundHound looks like the relative bargain. Last quarter, sales grew by 54%. And given its smaller size, it may prove able to keep up these high growth rates for longer than Nvidia.

Other investors may balk at SoundHound’s high multiples. But it’s the diminutive market cap that should get you excited. In many ways, the AI revolution has just begun. SoundHound’s early success and rapid growth rates should attract plenty of long-term investors.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Nvidia. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.