This Vanguard index fund provides exposure to a plethora of artificial intelligence stocks, including Microsoft, Apple, Nvidia, Broadcom, and Advanced Micro Devices.

The Vanguard Information Technology ETF (VGT 0.12%) returned 1,500% during the last decade and a half, growing by 20.3% annually. At that pace, $400 invested monthly in the exchange-traded fund (ETF) would now be worth more than $350,000.

Those monster gains were due in part to artificial intelligence (AI) stocks Nvidia (NVDA -1.62%) and Broadcom (AVGO -1.19%), which soared 50,130% and 14,510%, respectively, during that 15-year period. Nvidia and Broadcom recently reset their share prices with stock splits. But the chipmakers retain compelling growth prospects, as do many other AI stocks.

Indeed, analysts at Swiss investment bank UBS believe “AI will be the most profound innovation and one of the largest investment opportunities in human history.” That makes the Vanguard Information Technology ETF a compelling buy for growth-focused investors.

Artificial intelligence could keep the technology sector on the leading edge of the stock market

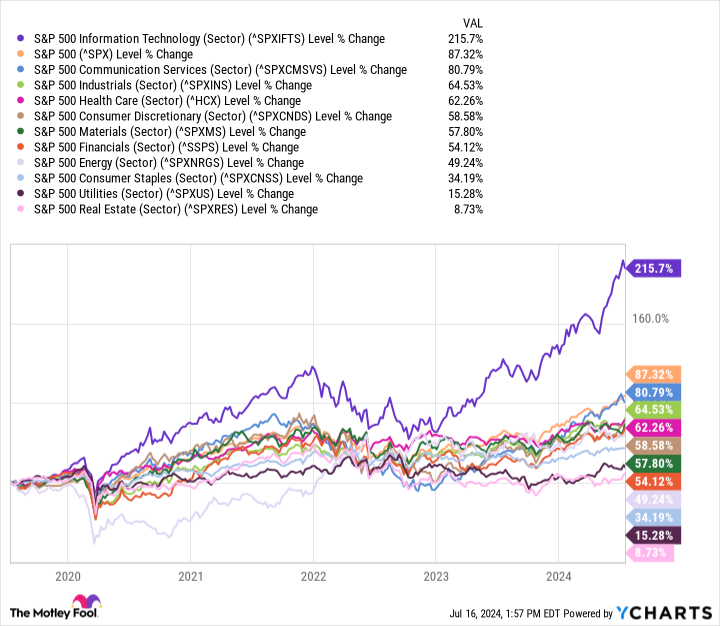

The S&P 500 is divided into 11 stock market sectors by the Global Industry Classification Standard (GICS). Among those, information technology generated the best returns over the last five, 10, 15, and 20 years due to investment themes like cloud computing, cybersecurity, digital commerce, mobile devices, and streaming media.

The chart below illustrates how profoundly the information technology sector outperformed the S&P 500 during the past five years. It was the only sector to beat the benchmark index, and it more than doubled its gains.

Going forward, artificial intelligence (AI) is the next major investment theme that could keep powering the information technology sector ahead of the broader market. Indeed, Grand View Research says AI spending across hardware, software, and services could compound by 37% annually through 2030. That means the Vanguard Information Technology ETF has a good shot at outperforming the S&P 500 in the coming years.

The Vanguard Information Technology ETF provides exposure to the stock market’s best-performing sector

The Vanguard Information Technology ETF measures the performance of 320 stocks in the information technology sector. Its constituents fall into three broad categories: (1) internet services and infrastructure companies, (2) technology consulting, hardware, and equipment providers, and (3) semiconductor and semiconductor equipment manufacturers.

The five largest holdings in the Vanguard ETF are listed by weight below.

- Microsoft: 16.7%

- Apple: 16.1%

- Nvidia: 14.6%

- Broadcom: 4.7%

- Advanced Micro Devices: 1.7%

Importantly, those five companies should be major beneficiaries as businesses and consumers pour money into AI goods and services in the coming years.

- Morgan Stanley believes Microsoft is the company best positioned to monetize generative AI across cloud infrastructure and enterprise software.

- Wedbush Securities thinks Apple will emerge as the gatekeeper of the consumer AI revolution following its launch of Apple Intelligence later this year.

- Forrester Research recently wrote that Nvidia graphics processing units (GPUs) set the pace for AI infrastructure, so much so that “without Nvidia GPUs, modern AI wouldn’t be possible.”

- Bank of America recently selected Broadcom as its top AI stock due to the company’s leadership in networking chips and custom silicon.

- Piper Sandler recently selected Advanced Micro Devices as a top pick due to its strength in data center server chips used for AI workloads.

The last item of consequence is the expense ratio. The Vanguard Information Technology ETF bears a reasonable expense ratio of 0.10%, meaning the annual fees will total $1 on every $1,000 invested in the fund. Similar investment products have an average expense ratio of 0.98%, according to Vanguard.

Here’s the bottom line: This Vanguard ETF lets investors spread money across hundreds of technology stocks that have collectively outperformed the S&P 500 on a consistent basis. Of course, the highly concentrated nature of the fund means it can be quite volatile at times. But patient investors comfortable with volatility should consider buying a position today given that AI spending could keep the Vanguard ETF ahead of the S&P 500 for years to come.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Bank of America, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.