Artificial intelligence could add $15 trillion in economic value to the global economy.

The artificial intelligence (AI) hype has been on overdrive for the past 18 months. While AI has been around for years, recent advances in the technology mean AI is still very much in its infancy in terms of investment potential.

Investors should expect plenty more changes over the coming years with some companies moving up into the limelight while others fizzle out, unable to keep pace with competition. That leaves many investors interested in this sector wondering how to pinpoint the winning AI stocks that will remain winners long-term.

Exchange-traded funds (ETFs), which are buckets of individual stocks that trade under one ticker symbol, could be the answer. The diversification they offer means you don’t have to pick specific winners, which benefits investors looking to capture the upside of artificial intelligence (AI).

Here are two AI-related ETFs that you can comfortably buy and hold for decades.

A broad gem with a proven track record

The Invesco QQQ Trust (QQQ -0.09%) doesn’t market itself as an AI-dedicated fund, but its “DNA” could make it the most dependable AI ETF money can buy. It tracks the Nasdaq-100. This index is technology-heavy; about 60% of its stocks come from the tech sector. The rest are primarily healthcare and consumer discretionary stocks.

More importantly, the ETF’s top holdings are already big-time players in AI. Names like Microsoft, Nvidia, Amazon, and Meta Platforms are in the top five, accounting for 26% of its total value. These big-tech companies are major players in AI-related fields like semiconductor chips (Nvidia), cloud computing (Microsoft and Amazon), and the metaverse (Meta Platforms). That’s excellent AI exposure from companies that are already fundamentally rock-solid.

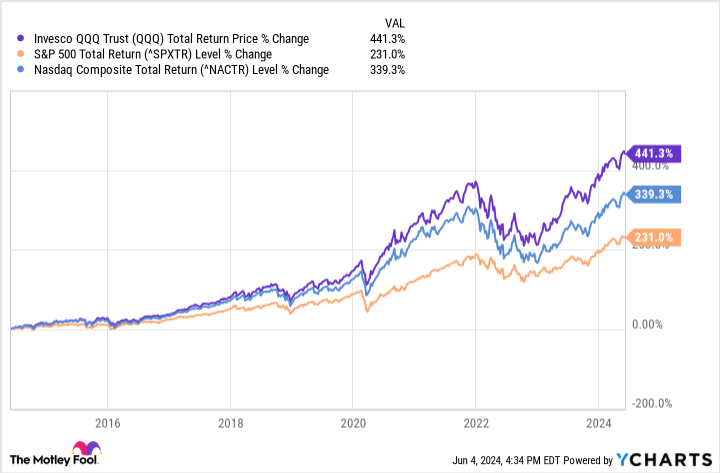

The fund has already shown strong results; the Invesco QQQ easily outperformed the S&P 500 and the Nasdaq Composite over the past decade:

QQQ Total Return Price data by YCharts

There’s no guarantee that its outperformance will continue indefinitely, but betting on the biggest technology companies in the world has worked out well. Since these same companies are already at the forefront of the AI industry, it seems like a good idea to continue riding those horses for long-term growth.

A more concentrated AI fund with a high potential upside

Investors who are feeling a bit more adventurous might find an ETF that is specifically dedicated to AI appealing. The Roundhill Generative AI & Technology ETF (CHAT -0.59%), launched in May 2023, aims to provide long-term outperformance by focusing heavily on generative AI and its growth potential. The big difference between this ETF and the Invesco QQQ is that it doesn’t track an index. The fund managers of the Roundhill Generative AI & Technology ETF actively buy and sell positions regularly.

The potential benefit of an actively managed fund is that smart investment decisions can pay off with massive returns. Right now, the fund managers are bullish on Nvidia (the ETF’s most significant position, at over 14%) and Microsoft (its second largest, at more than 10%). The fund currently has 50 holdings. The risk is that bad decisions by those managers can sap investors’ returns.

So far, the Roundhill Generative AI & Technology ETF has performed well, outperforming the S&P 500 and the Nasdaq Composite since its inception:

CHAT Total Return Price data by YCharts.

Actively managed ETFs often charge higher fees than passively managed funds. The expense ratio for this one is 0.75%, significantly higher than the Invesco QQQ’s 0.2%. That fee effectively puts this ETF on par with the Nasdaq Composite in terms of performance (so far). Still, the high fee won’t matter as much if the investment returns are high enough for long enough.

Ultimately, either of these funds could benefit long-term investors. According to a forecast from PwC, the global economic impact of AI could be more than $15 trillion annually by 2030. In that scenario, investors who put money into the trend will likely make out very well, regardless of which of these funds they own.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.