These stocks don’t appeal only to dividend seekers.

Stocks that can survive and thrive for long periods — say, beyond 20 years — are a special breed. These companies typically display one or several of the following characteristics: innovative abilities, leadership in a major industry, a strong moat, or exciting growth potential. That’s not an exhaustive list of traits such corporations can have, but they are among the most important.

To find businesses that display them, it can be helpful to start by looking at companies that have already passed the test of time. Let’s look at two examples: Microsoft (MSFT -1.33%) and Abbott Laboratories (ABT 1.91%). Beyond the strong prospects they offer, these two well-known businesses are also excellent dividend payers worth holding on to for good.

1. Microsoft

Few companies are more popular than Microsoft. That’s an important advantage in and of itself — it means the company’s brand is well known and enjoys relatively high consumer trust.

Microsoft has become synonymous with many of the services it offers. No company gets close to its share of the computer operating system market. Microsoft’s productivity tools are the norm for millions of people and businesses, many of which rely on them for their day-to-day activities; that arguably grants Microsoft high switching costs, a potent competitive edge.

Still, Microsoft’s OS business isn’t much of a growth machine anymore. Thankfully, the company has other exciting opportunities: cloud computing and artificial intelligence (AI). Microsoft is second only to Amazon in the cloud market, though the latter has been closing in on the former.

AI is providing yet another vital boost to Microsoft’s cloud business. The company also benefits from switching costs in this field. Microsoft is a leader in every field in which it operates, whether in AI, cloud computing, computer OS, or gaming.

That’s excellent evidence that the company is incredibly innovative, an important reason it has performed well over the years.

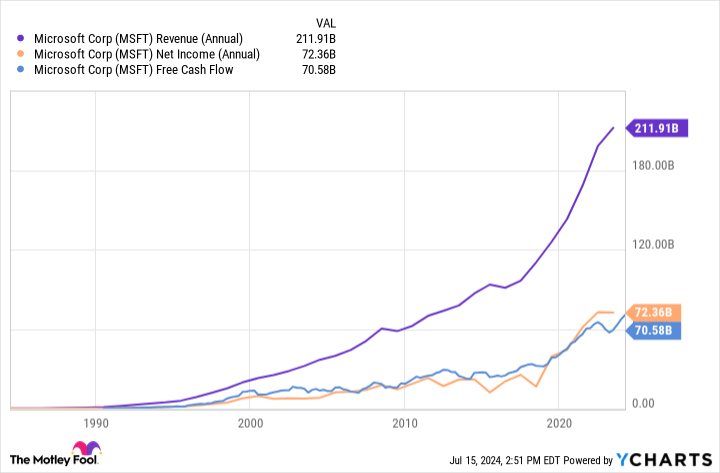

MSFT Revenue (Annual) data by YCharts

Everything points to Microsoft still delivering strong financial performances and market-beating returns in the long run. Note the company’s free cash flow: $70.58 billion.

A company’s ability to generate strong free cash flow isn’t just a sign of a robust underlying business. It also allows it to invest in more growth opportunities. Beyond those Microsoft is currently pursuing, the company will undoubtedly find more.

And here’s another piece of evidence of the company’s strong business: Microsoft boasts an AAA rating from Standard & Poor’s. That’s a higher rating than the U.S. government itself.

What about Microsoft’s dividend? The company’s yield isn’t impressive; it’s just 0.66%. However, the tech giant has increased its payouts by 168% in the past 10 years. Its cash payout ratio of 30.11% is conservative — perhaps too conservative. Microsoft has ample room for more increases.

Dividend investors can’t go wrong with Microsoft, nor can those looking for reliable corporations to invest in for good.

2. Abbott Laboratories

Developing innovative medical technologies is a surefire way to survive for a long time. In that department, there aren’t many companies with a better track record than Abbott Laboratories.

The medical device giant has a long lineup of products across its cardiovascular and diabetes care segments. Abbott Laboratories’ FreeStyle Libre franchise, a series of continuous glucose monitoring (CGM) systems that help diabetics track their blood glucose levels, has been the company’s biggest growth driver in recent years. The company highlighted that the FreeStyle Libre is now the most successful medical device in history in terms of dollar sales.

Beyond medical devices, Abbott Laboratories’ nutrition, diagnostics, and established pharmaceuticals segments grant it significant diversification. Abbott Laboratories holds patents that protect its devices from being knocked off, at least for the duration of the patent, an important competitive advantage for companies across many industries, including healthcare.

Here’s another critical moat source for Abbott Laboratories: The company has successfully navigated the highly regulated healthcare sector for a long time. It knows its way around and has developed a brand name people trust. That’s one reason Abbott Laboratories has performed exceptionally well.

ABT Revenue (Annual) data by YCharts

With the world’s aging population, the severely underpenetrated diabetes market — just 1% of adults with the disease in the world have access to CGM technology — and many other opportunities, Abbott Laboratories can still deliver superior returns.

Abbott Laboratories is also an exceptional dividend stock. It has increased its payouts for 52 consecutive years. It might not be the most exciting business, but it looks reliable enough to sustain strong returns and growing payouts for a long time.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool has positions in and recommends Abbott Laboratories, Amazon, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.