Check out these two enticing yields for income investors.

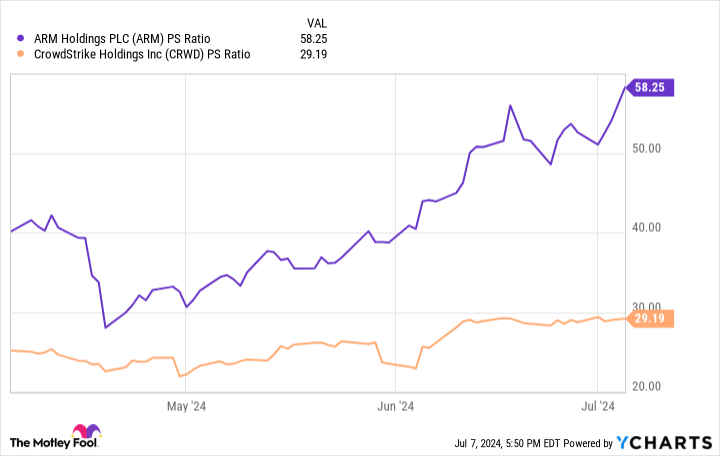

Growth stocks are all the rage on Wall Street right now, with stocks like Nvidia and Microsoft driving the markets toward record highs. They aren’t alone. Growth stocks like CrowdStrike and Arm Holdings also trade at nosebleed valuations. Stocks trading near or over 30 times sales should give investors pause.

ARM PS Ratio data by YCharts.

The rush into growth stocks leaves many high-quality dividend stocks overlooked. After all, who wants to buy dividend stocks when they can get a risk-free 5% return due to today’s high interest rates? Not many.

However, market observers anticipate that the Federal Reserve will begin lowering interest rates as soon as inflation wanes. This could cause the pendulum to swing the other way. Here are two dividend stocks to consider buying now.

Vici Properties

Real estate investment trust (REIT) stocks often struggle when interest rates rise. As I noted above, dividends are less attractive when the risk-free rate is elevated. However, that won’t last forever. Some REITs have more attractive yields than bonds and CDs. They also have rising dividends, while fixed-income vehicles do not.

Vici Properties (VICI -0.68%) is a unique REIT that fits these criteria. Vici owns iconic trophy properties on the Las Vegas Strip, in 25 other U.S. states, and in one province in Canada. These one-of-a-kind properties include Caesars Palace, Mandalay Bay, The Venetian, MGM Grand, and many others in Las Vegas, as well as places like Chelsea Piers in New York and the Hard Rock Casino in Cincinnati.

Vici’s unique properties provide it with much less vacancy risk than other REITs, as it’s not feasible for its tenants to just move down the street. Vici collected 100% of the rent even during the height of COVID-19. It has raised the dividend each year since its inception and currently yields 6%, well above its average.

Now looks like a great time to snag this dividend grower before everyone else does.

VICI Dividend Yield data by YCharts.

Starbucks

Starbucks (SBUX -2.44%) has significant challenges. Its China growth strategy is bogged down by geopolitical tensions. Its U.S. sales are crippled by slowing consumer spending and people working remotely. And it has serious competition from local boutique coffee roasters. These headwinds crushed the stock, which may make it one of the best times for long-term investors to jump in. After all, few stocks trade at a discount when everything is great.

In the second quarter of its fiscal 2024, Starbucks posted $8.6 billion in sales, a 2% decline over the prior year. Comparable sales declined 4% worldwide. However, even in a difficult environment, the company is profitable. Starbucks reported $1.1 billion in operating income and $2.9 billion in cash from operations. Rewards members number 33 million, which tells me the company isn’t going anywhere anytime soon.

The disappointing Q2 FY24 results sent the stock tumbling while the dividend yield soared to its highest level in the company’s history.

SBUX Dividend Yield data by YCharts.

Starbucks has raised its dividend each year since its introduction in 2010. Given the profitability and cash flow, this is likely to continue. The record yield likely means that the recent bad news is already priced into the stock, and long-term investors should consider buying it now to take advantage.

Dividend stocks offer several advantages, such as a steady income stream, rising payments, and lower volatility. Income-oriented investors should consider adding Vici and Starbucks to their portfolios.

Bradley Guichard has positions in Arm Holdings, CrowdStrike, Nvidia, Starbucks, and Vici Properties. The Motley Fool has positions in and recommends CrowdStrike, Microsoft, Nvidia, Starbucks, and Vici Properties. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.