Investors can cover a lot of ground with just two investments worth buying and holding onto long-term.

Everybody loves the thought of hitting it big in the stock market on a company they believe in. There’s something rewarding about having your “I knew it could happen” feelings justified with results. However, it doesn’t take finding the next big thing to generate wealth in the stock market; broad exchange-traded funds (ETFs) can do the trick.

ETFs may not be as exciting as hot-name stocks, but they can often be just as rewarding over time. Investors looking to add ETFs to their portfolio should consider the following two options. These are both broad ETFs that cover a large range of sectors and company size.

1. Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO 1.32%) mirrors the S&P 500, the most important index in the U.S. stock market. Tracking the 500 largest U.S. companies on the market, the S&P 500 is widely considered as a way to gauge the health of the U.S. economy.

I generally recommend this ETF regardless of time. Like any stock, it has its ups and downs, but betting on the long-term growth of the U.S. economy has proven to be a smart move, and that’s essentially what an investment in this ETF represents.

This ETF isn’t as diversified as in previous years because big tech valuations have exploded recently (it’s market cap-weighted), but it still contains top companies from all major sectors of the U.S. economy:

- Communication Services: 9.3%

- Consumer Discretionary: 10%

- Consumer Staples: 5.8%

- Energy: 3.6%

- Financials: 12.4%

- Health Care: 11.7%

- Industrials: 8.1%

- Information Technology: 32.5%

- Materials: 2.2%

- Real Estate: 2.1%

- Utilities: 2.3%

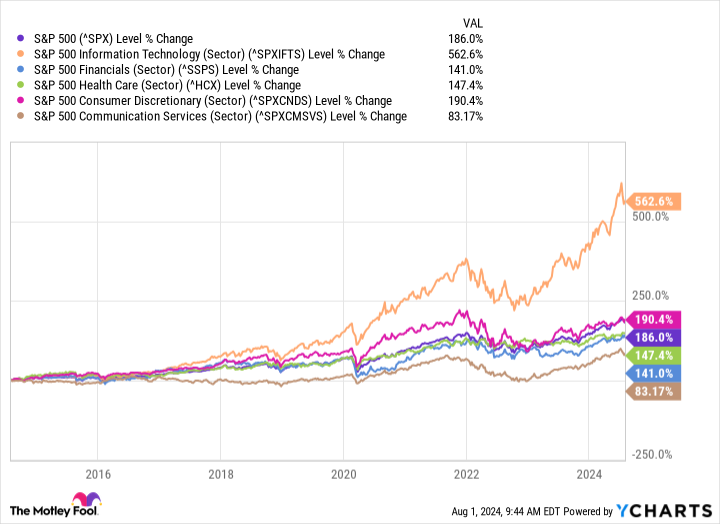

With almost a third of the ETF in the tech sector, investors benefit from broad coverage while also leaning on what is easily the stock market’s most rewarding sector in recent times. Here’s how the top five sectors represented in the ETF have performed in the past decade:

There’s no way to predict how a stock will perform in the future, but this ETF is in good hands with the companies it has leading the charge.

Investors can also count on keeping much of their gains to themselves because the ETF’s expense ratio is a low 0.03%. Working out to $0.30 per $1,000 invested annually, it’s one of the cheapest ETFs you’ll find on the market.

2. The Vanguard Russell 2000 ETF

The Vanguard Russell 2000 ETF (VTWO 1.38%) is on the other side of the spectrum from the Vanguard S&P 500 ETF. While the S&P 500 deals with the 500 largest U.S. companies, the Russell 2000 tracks 2,000 of the smallest companies on the market.

For perspective, the largest company in the ETF has a market cap of just over $12 billion, which is less than Microsoft‘s profits from its latest quarter.

Small-cap stocks are generally a risk-reward trade-off. Their small size often makes them more volatile, but being small also gives them many growth opportunities. You probably don’t want this ETF to be a large part of your portfolio because of its higher risks, but it can be a great choice to complement an S&P 500 ETF.

The Russell 2000 has underperformed the S&P 500 so far this year, but it surged over 10% in July, while the S&P 500 had its worst July returns in a decade. That’s an encouraging sign of what could come with a small-cap bull run. It has to be a team effort, though, as the ETF contains over 2,000 stocks, and the largest holding is only 0.41% of it (Microsoft is over 7% of the S&P 500):

- Insmed: 0.41%

- FTAI Aviation: 0.41%

- Abercrombie & Fitch: 0.36%

- Fabrinet: 0.35%

- Sprouts Farmers Market: 0.33%

This ETF is also more diversified when it comes to sectors. The largest five sectors are industrials (18.8%), healthcare (17.1%), financials (16.2%), consumer discretionary (11.9%), and technology (11.5%). Since small-cap stocks are more volatile in nature, this diversification is especially helpful for stability.

Part of having a well-diversified stock portfolio is investing in companies of different sizes, and this ETF checks off the small-cap box in one investment. Instead of relying on a few companies, you can trust in the overall growth of small-cap stocks.

Stefon Walters has positions in Microsoft and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Microsoft and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.