<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="- By Alberto Abaterusso

” data-reactid=”11″>- By Alberto Abaterusso

These two large technology companies announced quarterly results after the closing bell on Thursday.

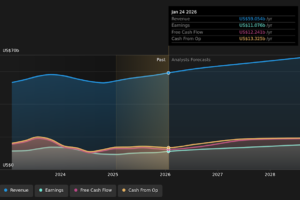

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="NVIDIA Corp. (NVDA) jumped 1.97% to $163.34 per share in after-hours trading on Thursday after beating consensus estimates on non-GAAP earnings for the first quarter of fiscal 2020 by 7 cents, posting 88 cents per share or 57% down from the prior-year quarter. GAAP earnings were 64 cents per share or 68% lower year-over-year, topping consensus estimates by 7 cents.” data-reactid=”13″>NVIDIA Corp. (NVDA) jumped 1.97% to $163.34 per share in after-hours trading on Thursday after beating consensus estimates on non-GAAP earnings for the first quarter of fiscal 2020 by 7 cents, posting 88 cents per share or 57% down from the prior-year quarter. GAAP earnings were 64 cents per share or 68% lower year-over-year, topping consensus estimates by 7 cents.

Revenue was $2.22 billion, down 30.8%, beating market expectations by $20 million.

The Santa Clara, California-based global visual computing company also recorded a decline of 570 basis points in non-GAAP gross margin to 59%, a 16.2% increase in non-GAAP operating expenses to $753 million and a 55.4% tumble in the free cash flow to $592 million.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For the second quarter of fiscal 2020, NVIDIA guided for revenue between $2.5 billion and $2.6 billion versus estimates of $2.54 billion. The company also expects a non-GAAP gross margin of 59.5% and non-GAAP operating expenses of $765 million.” data-reactid=”22″>For the second quarter of fiscal 2020, NVIDIA guided for revenue between $2.5 billion and $2.6 billion versus estimates of $2.54 billion. The company also expects a non-GAAP gross margin of 59.5% and non-GAAP operating expenses of $765 million.

The stock was $160.2 per share at close on Thursday for a market capitalization of $97.47 billion. NVIDIA Corp. climbed 20% so far this year, in line with the Nasdaq. The closing price on Thursday was 28.7% above the 52-week low of $124.46 and 82.7% from the 52-week high of $292.76.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Shares of Applied Materials Inc. (AMAT) soared 6.1% to $44.20 in after-hours trading on Thursday after beating consensus estimates on non-GAAP earnings for the second quarter of fiscal 2019 by 4 cents, posting 70 cents per share, which was down 41% year-over-year.” data-reactid=”31″>Shares of Applied Materials Inc. (AMAT) soared 6.1% to $44.20 in after-hours trading on Thursday after beating consensus estimates on non-GAAP earnings for the second quarter of fiscal 2019 by 4 cents, posting 70 cents per share, which was down 41% year-over-year.

GAAP earnings were also 70 cents per share, topping consensus estimates by 5 cents.

Revenue decreased 22.7% to $3.54 billion, beating expectations by $60 million.

The Semiconductor Systems segment fell 24.7% to $2.184 billion, the Applied Global Services segment increased 4.1% to $984 million and the Display and Adjacent Markets segment tumbled 51.6% to $348 million.

The Santa Clara, California-based provider of equipment, services and software to the semiconductor industry also posted a 240 basis-point decrease in non-GAAP adjusted gross margin to 43.5% and 690 basis-point decrease in non-GAAP operating margin to 22.4%.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Applied Materials expects to report revenue of $3.375 billion to $3.675 billion and non-GAAP earnings per share of 67 to 75 cents for the second quarter of fiscal 2019. Analysts predict non-GAAP earnings of 69 cents per share on revenue of $3.51 billion.” data-reactid=”36″>Applied Materials expects to report revenue of $3.375 billion to $3.675 billion and non-GAAP earnings per share of 67 to 75 cents for the second quarter of fiscal 2019. Analysts predict non-GAAP earnings of 69 cents per share on revenue of $3.51 billion.

Shares of Applied Materials closed at $41.7 on Thursday for a market capitalization of $39.55 billion. The stock has risen 27% year to date, surpassing the Nasdaq by 7%. The closing price on Thursday was 44.8% above the 52-week low of $28.79 and 27.6% below the 52-week high of $53.23.

Disclosure: I have no positions in any security mentioned.

Read more here:

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Turquoise Hill Resources Issues 1st-Quarter Results” data-reactid=”47″>Turquoise Hill Resources Issues 1st-Quarter Results

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Retailers Fall on US Sales Ex-Auto Results ” data-reactid=”48″>Retailers Fall on US Sales Ex-Auto Results

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="3 High-Performing Large-Cap Stocks” data-reactid=”49″>3 High-Performing Large-Cap Stocks

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="This article first appeared on GuruFocus.

” data-reactid=”51″>This article first appeared on GuruFocus.