The December 2022 inflation numbers are out, and the results were better than expected. The Consumer Price Index (CPI) was 6.5% for the month of December 2022. This was the lowest level since October 2021, and lower than the prior month’s figure of 7.1%. This latest figure was also substantially lower than the 9.1% high in June 2022.

This is fantastic news for stocks, as it shows the tough interest rate stance by the Federal Reserve is working. If we zoom out, you may remember the economy was booming in 2020 and it only started to go bad as inflation rose. To combat this, the Fed began to raise interest rates sharply, which caused an economic slowdown.

While Fed chairman Jerome Powell is unlikely to ease interest rates soon due to fears that higher inflation could come back, lower inflation suggests we may see a decrease in further rate hikes. I suspect at least by the end of 2023, he might begin to lower interest rates, once we know inflation is fully dealt with and close to the Fed’s 3% target (the Fed has stated that 3% is the new 2% in terms of its target interest rate).

Thus, this article will take a look at two of my favorite stocks that I foresee as being likely to benefit from the improving inflation environment; let’s dive in.

1. Amazon

Amazon (NASDAQ:AMZN) is the largest e-commerce company in the U.S. – in fact, over 56% of all U.S. e-commerce sales occur on its platform. The company is also the market leader in cloud infrastructure as a service, with its rapidly growing AWS segment.

Financials and inflation

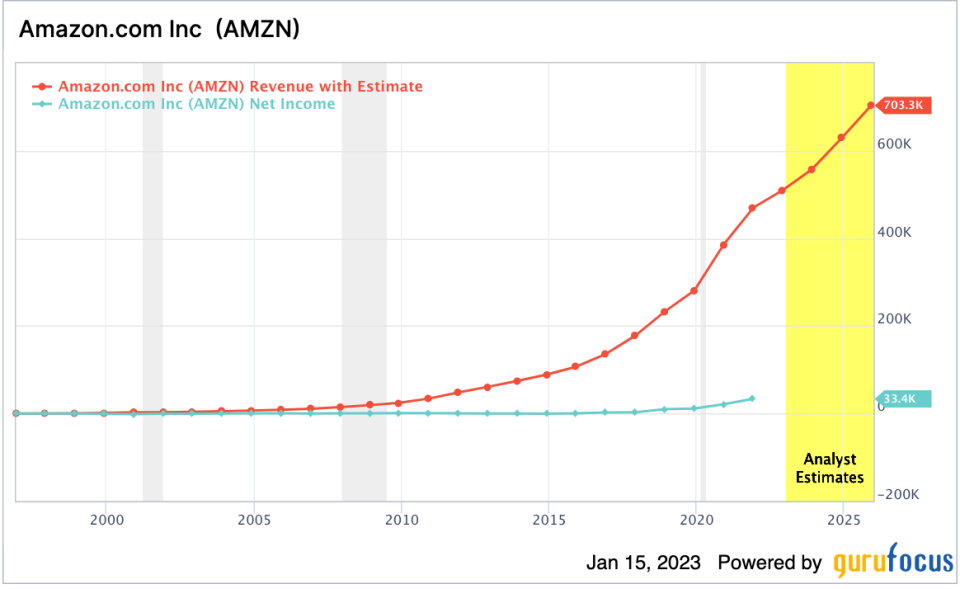

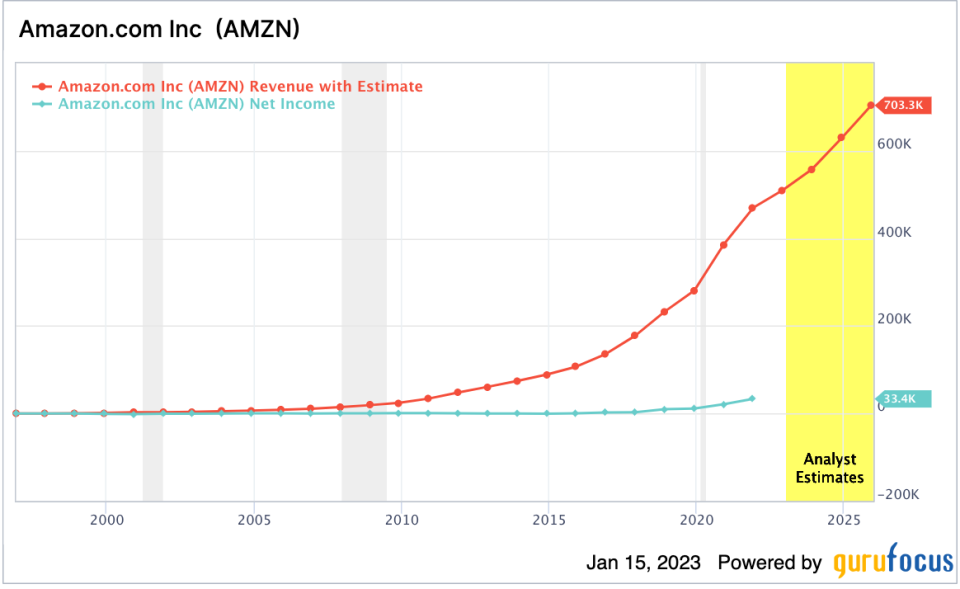

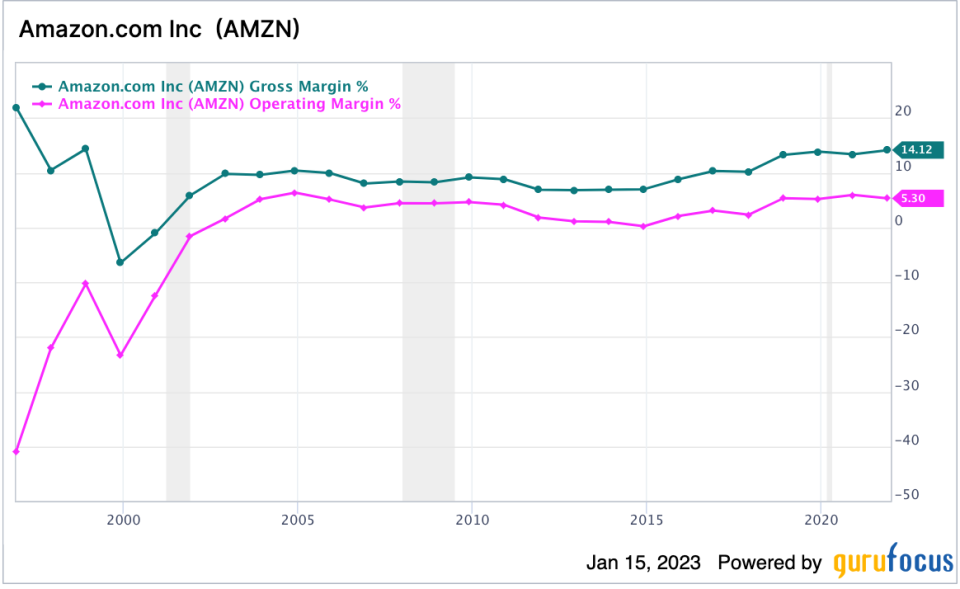

Amazon is poised to benefit from lower inflation rates as its large logistics network operates with tight margins. In the third quarter of 2022, its net income was sliced in half year-over-year $4.9 billion to $2.5 billion. This was mainly driven by a 17% increase in operating expenses, which rose to a staggering $124.6 billion. Its direct fulfillment costs were $20.6 billion, which increased by 11% year-over-year. This was caused by a sharp increase in oil prices, freight costs and even labor. A positive is that lower inflation rates were driven mainly by a fall in energy inflation, which was the main source of Amazon’s cost inflation.

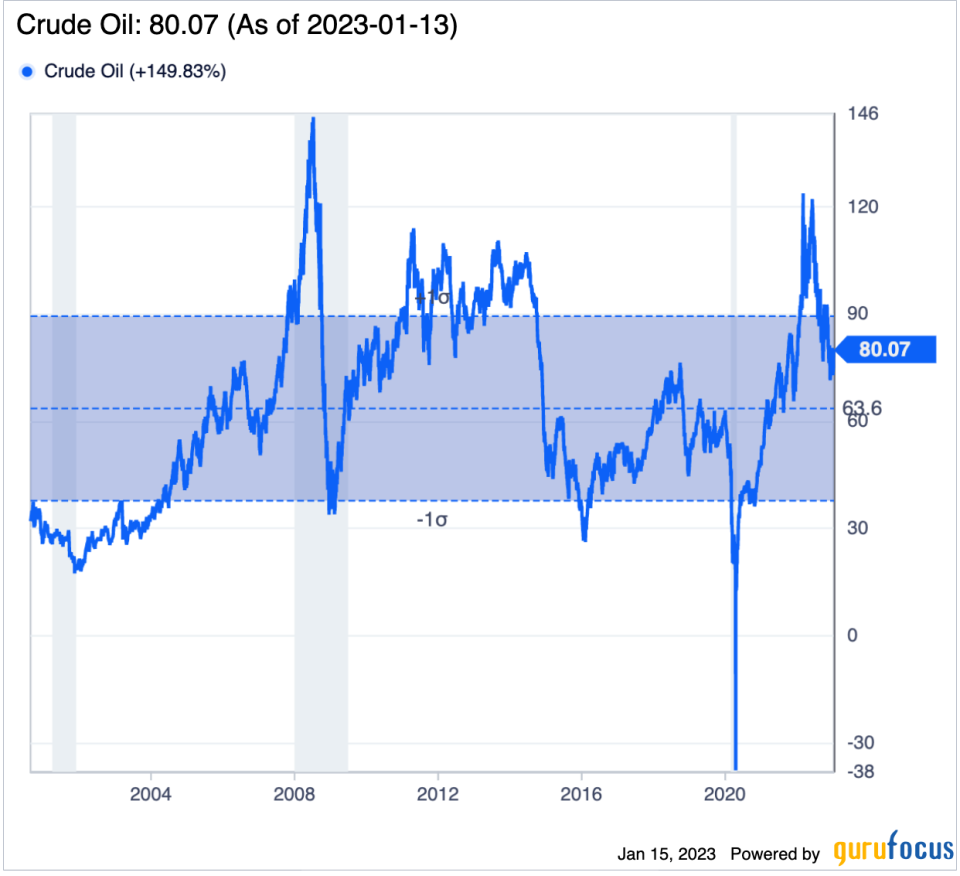

The WTI Oil index indicates oil prices were over $120 per barrel in May 2022, but this has fallen to $80 per barrel more recently, which is a positive sign. Oil is now at a similar price to 2014, but is still above its pre-pandemic level of $55 per barrel. As Amazon operates at a tremendous scale with 30,000 delivery vehicles, its margins are steeply impacted by rising oil costs.

Amazon has tried to outsource a portion of its most uneconomical routes through its Delivery Service Partner (DSP) program, which enables anyone to start their own Amazon delivery business. However, this program is still in its early stages and is fraught with challenges. A positive is lower oil prices should help DSP owners to generate more profits, which will increase retention and the likelihood of the program benefits.

As inflation falls, this is also likely to improve Amazons labor costs. Amazon employs over 1.4 million people. Keeping these costs reasonable is a challenge. The company has been criticized for its poor working conditions, which reportedly pressurize workers with unrealistic targets and minimal breaks.

In the third quarter of 2022, Amazon reported revenue of $127.1 billion, which increased by 15% year-over-year. However, this figure came in below analyst estimates by $370 million. This was mainly impacted by a strong U.S. dollar, which impacted foreign exchange rates. Overall, I believe most markets tend to be cyclical, thus I expect this metric to reverse long-term. Part of the sell-off in the Euro has been driven by the Russia-Ukraine war.

Amazons cloud business is expected to be a continued growth driver of the companys success. AWS reported sales of $20.5 billion in the third quarter, which increased by a rapid 28% year-over-year, despite a tough economic backdrop. Its operating income also rose by $5.4 billion, or 11% year-over-year.

Valuation

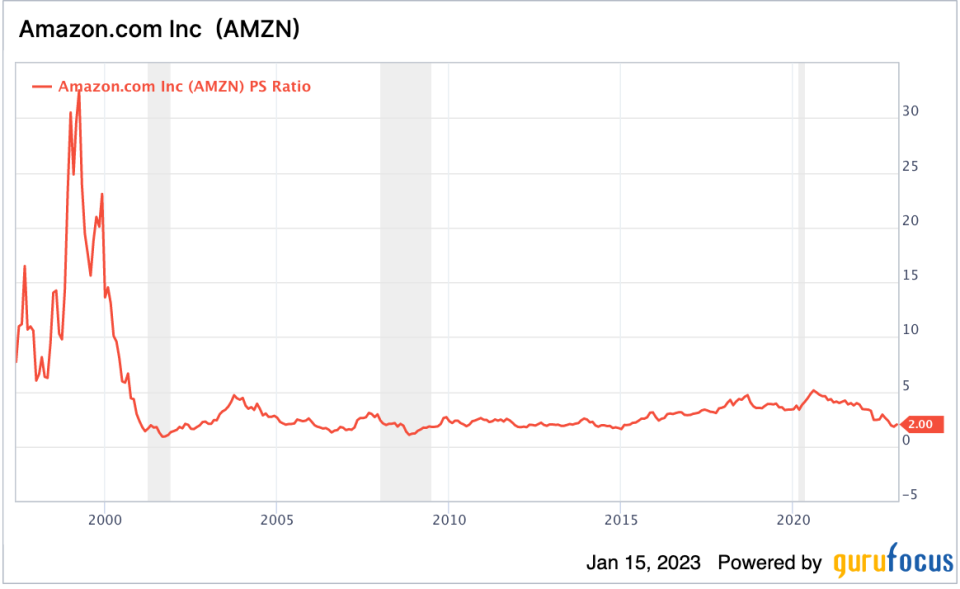

Amazon trades at a price-sales ratio of 1.99, which is ~46% cheaper than its five-year average.

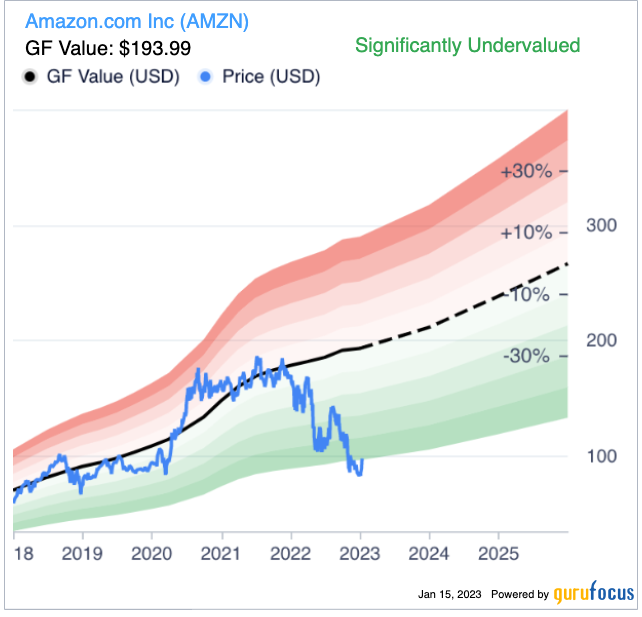

The GF Value chart indicates a fair value of $193 per share, making the stock significantly undervalued at the time of writing.

Investors such as Al Gore (Trades, Portfolio), Stanley Druckenmiller (Trades, Portfolio) and Catherine Wood (Trades, Portfolio) were buying shares of Amazon in the third quarter of 2022, during which shares traded for an average price of $126, based on their 13F reports.

Investors should be aware that 13F reports do not provide a complete picture of a gurus holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarters end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

2. WEX Inc.

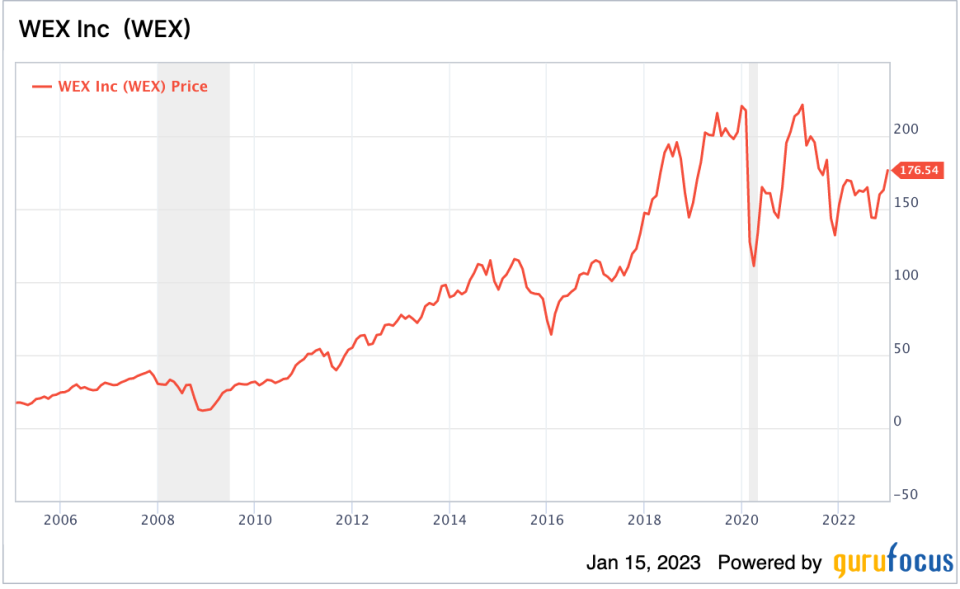

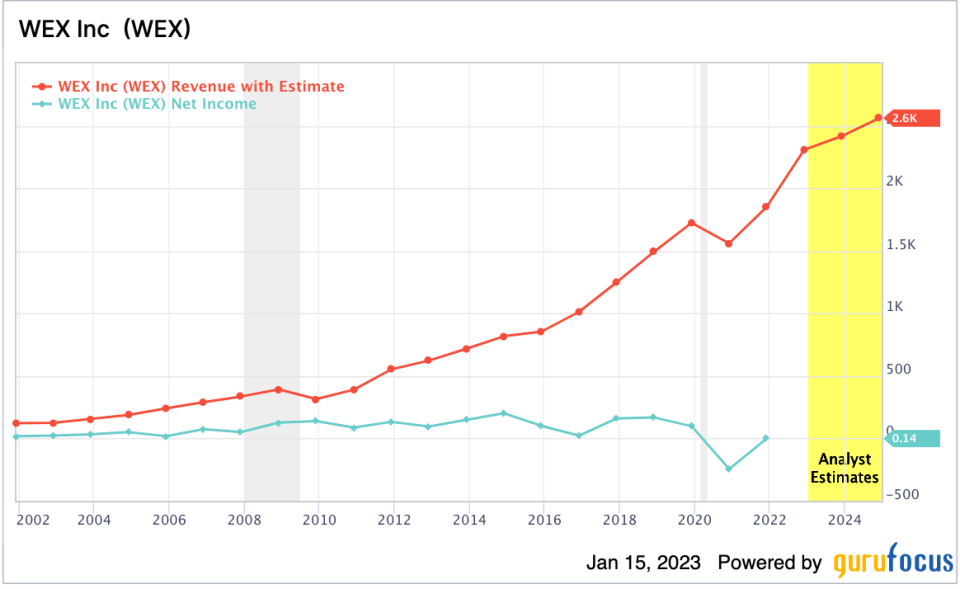

WEX Inc. (NYSE:WEX) is a fintech company that offers a fleet card and virtual card program for a range of business and government clients. As inflation is falling, along with fuel prices, I imagine the companys customers will be more interested in purchasing new solutions related to fuel card programs for trucking fleets. However, as high oil prices are still at the top of the mind, I imagine these customers will be eager to optimize fuel costs.

Financials and inflation

In the third quarter of 2022, the company reported strong revenue of $616 million, which beat analyst estimates by $28.27 million and increased by 26% year-over-year.

The company also reported strong earnings per share of $3.51, which beat analyst estimates by $0.09 on a non-GAAP basis.

WEX has a solid balance sheet with $2.18 billion in cash and short-term investments. The company does have fairly high total debt of ~$3 billion, but just $86 million of this is current debt and thus manageable. In the longer term, as interest rates start to be lowered, this should reduce debt servicing costs, which is a strong positive.

Valuation

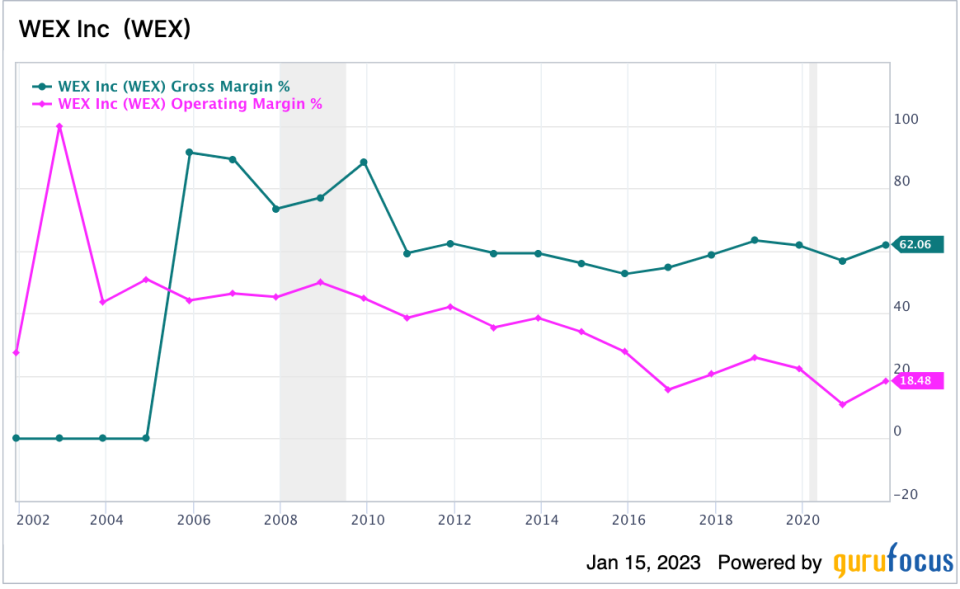

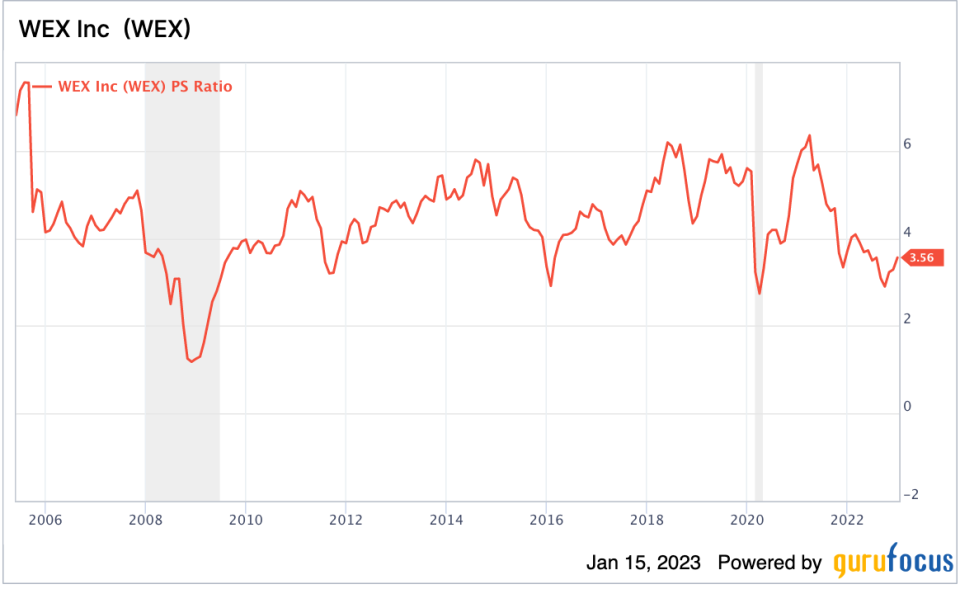

WEX trades at a non-GAAP price-earnings ratio of 13.45, which is over 39% cheaper than its five-year average. The company also trades at a price-sales ratio of 3.55, which is 26% cheaper than its five-year average.

Final thoughts

Both Amazon and WEX are great companies that are poised to benefit from the falling inflation figures. Amazon is poised to benefit from lower fulfillment center costs, and WEX is expected to benefit from the desire to reduce fuel costs but it is more of a niche play. Overall, Amazon is my favorite pick for lower inflation as the company’s low-margin e-commerce business is set to recover.

This article first appeared on GuruFocus.