The market is full of AI stocks that don’t have nearly the price tag of Nvidia.

Nvidia has been the best artificial intelligence (AI) stock to own for the past year and a half. But investors are starting to profit from their huge gains and realize that some of the lofty projections will be difficult to reach.

As a result, some might be looking elsewhere for top-tier AI investments. I have three that I think are worthy competitors that could outperform Nvidia.

1. Taiwan Semiconductor

Taiwan Semiconductor Manufacturing (TSM 0.90%) is the world’s largest contract chipmaker. If a high-tech device has a chip in it, chances are it originated from TSMC, as it’s known for short.

TSMC believes that AI-related chips will be a huge growth avenue. Management projects a 50% compound annual growth rate (CAGR) for these chips through 2027, by which time this emerging segment will make up more than 20% of its overall business. That’s massive growth for a significant part of its business, making the company a fantastic AI stock pick.

Management also believes its total revenue will have a CAGR between 15% and 20% over the next few years, which is strong for a company as large as TSMC.

For just 25 times forward earnings, you can own one of the most dominant chip manufacturers available, one that will be a huge part of nearly every new innovation.

2. Meta Platforms

Meta Platforms (META 0.28%) is probably better known by the social media companies it owns: Facebook, Instagram, Threads, WhatsApp, and Messenger. Nearly all of Meta’s revenue comes from advertising on these platforms, allowing it to fund its AI research.

Its generative AI model, Llama, is one of the best available and is currently being integrated throughout the company’s various platforms, whether you are aware of it or not. Facebook has already launched generative AI features that allow advertisements to be tweaked depending on who is viewing them, which should make ads more effective.

Meta’s AI platform has many other uses, like integrating it with some of its augmented reality hardware.

Management has the cash cow of its ad business to fund research that practically no other company (except Alphabet) can match. Yet, the stock trades for just 24 times forward earnings.

Meta is a no-brainer buy right now. You get its established dominant ad business, as well as the upside of its AI offerings.

3. Alphabet

Alphabet is in a similar position as Meta. Its ad platform funds its AI research, but it must play catch-up to the undisputed generative AI model: ChatGPT. The latest iterations of Alphabet’s Gemini model have been fantastic and outperformed ChatGPT in several key tests.

The company has a large cloud computing business, Google Cloud. Much of the business world was already moving toward cloud computing, but the push for AI integration has only accelerated this movement. Companies now need access to vast amounts of computing power to train their AI models, and renting it from a provider like Google Cloud is a great idea.

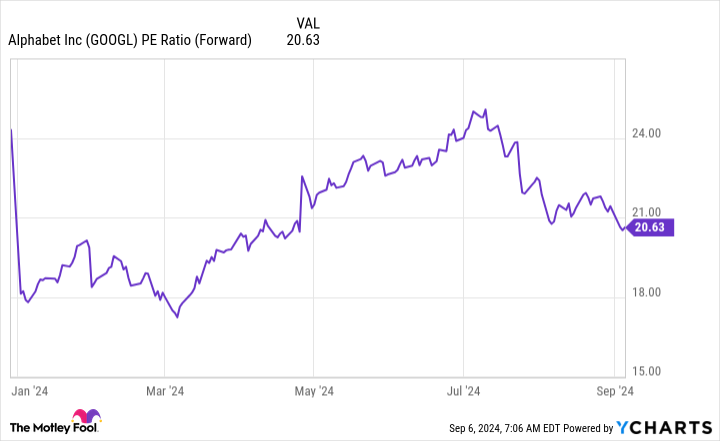

Despite its dominance in these key areas, Alphabet’s stock is pretty cheap.

GOOGL PE ratio (forward) data by YCharts; PE = price to earnings.

Alphabet is cheaper than the broader market, with a forward price-to-earnings ratio (P/E) of 21, compared to the S&P 500‘s 23. I don’t think Alphabet is a below-average business, though, which makes it a fantastic buy, especially considering its AI tailwinds.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Meta Platforms, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.