Although November is nearly over, plenty of stocks still look like great buys right now. Three that I’ve got my eye on are ASML (ASML 1.72%), Meta Platforms (META 1.07%), and Alphabet (GOOG 1.72%) (GOOGL 1.75%).

These three have great long-term prospects, and I believe now represents a great time to take a position.

Why now?

December is historically a strong month for stocks due to something called the “Santa Claus Rally.” This effect occurs when fund managers buy up a bunch of stocks they think will position them well for 2025. With more buyers than sellers in December, stock prices sometimes climb throughout the month. This doesn’t happen every year, but with a strong economy in hand, I’m confident it will occur this year. As a result, buying stocks in November is a smart move.

It’s also a great time to take a position in these three stocks in particular, as they’re well-positioned for 2025.

ASML

ASML makes lithography machines that are used to put electrical traces on chips. The company has a technological monopoly on these machines in the high-end space, and any company making cutting-edge chips must purchase ASML’s machines. However, it ran into a bit of a speed bump as regulations have restricted ASML from selling its machines to China and its allies. As a result, ASML reduced its revenue guidance for 2025 from 30 billion-40 billion euros to 30 billion-35 billion euros.

This caused the stock to sell off heavily, but it’s now priced at an attractive point.

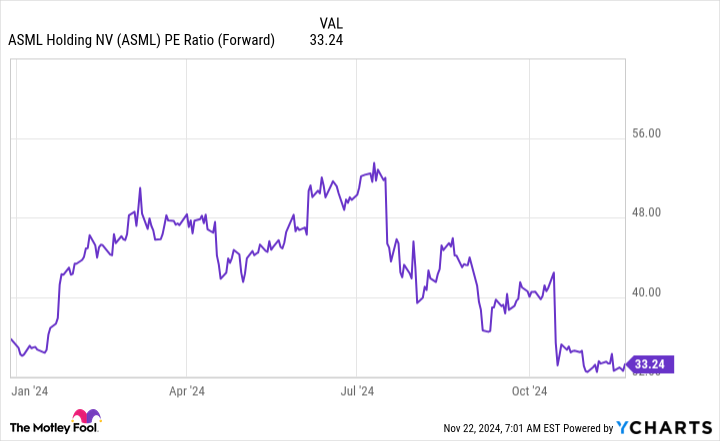

ASML PE Ratio (Forward) data by YCharts

At 33 times forward earnings, ASML isn’t necessarily a “cheap” stock, but it’s at an attractive level compared to where it has been over the past year.

ASML is well-positioned to capitalize on the AI chip boom, and this short-term weakness is a buying opportunity.

Meta Platforms

Meta Platforms is probably better known by its former name, Facebook. The shift from Facebook to Meta originally occurred because of its metaverse aspirations, but now those desires have switched over to AI.

While Meta still derives nearly all of its revenue from ads on its social media platform, its generative AI model, Llama, is starting to become popular. As a result of this demand, Meta is planning on building out even more AI computing capacity in 2025, which management says will cause “significant” capital expenditure growth.

Unlike the metaverse, there’s serious return on investment potential here, as Meta’s generative AI model could become the industry standard for areas it specializes in, like augmented reality and advertising.

Even though Meta is priced near the highest point it has traded at all year, it’s still not that expensive compared to the broader market.

META PE Ratio (Forward) data by YCharts

The S&P 500 (^GSPC 0.30%) trades for 24.6 times forward earnings, meaning Meta is valued like an average company. This valuation looks dirt-cheap to me, and Meta could be another company that sees strong buying heading into the new year.

Alphabet

Alphabet, Google’s parent company, has a very similar story to Meta. It’s an advertising giant in its various fields that has funneled some of that money into AI technology.

This takes shape in multiple forms, but the one investors notice most clearly is its cloud computing business, Google Cloud. Google Cloud provides its customers with the computing power they need to run workloads, whether they are AI or not. However, AI workloads have surged in popularity. Part of this surge came from the popularity of Alphabet’s generative AI model, Gemini. This helped revenue rise by 35% in Q3, which marked a sizable growth acceleration from Q2’s 29% growth.

Alphabet is also extremely cheap, trading at just under 21 times forward earnings.

GOOGL PE Ratio (Forward) data by YCharts

Part of this discount is due to the Department of Justice calling for a breakup of Google and the sale of Google Chrome. While this is an investment concern, we are years away from anything happening, as this case will be fought tooth and nail in court. As a result, using the short-term weakness in the stock from this news headline is a great way to get a discount on a stock that is succeeding but won’t have a real resolution for some time.

Both Alphabet and Meta trade far below the valuations of some of their peers despite posting similar or better results. As a result, these two tech giants may get some love as we head into 2025 because both are putting up incredible results and are slated to continue their dominance in 2025.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in ASML, Alphabet, and Meta Platforms. The Motley Fool has positions in and recommends ASML, Alphabet, and Meta Platforms. The Motley Fool has a disclosure policy.