Once a few more investors connect a few more dots, these stocks may soar.

Are you looking for some new high-growth stocks to add to your portfolio? You could start with the most obvious option at the moment: artificial intelligence (AI) players.

Describing AI as a once-in-a-generation investment opportunity doesn’t seem like hyperbole anymore. Even without knowing exactly what the AI industry will look like just five years from now, it’s quite clear at this point that it’s going to live up to the hype. The chief challenge now is simply figuring out which companies are best positioned to benefit.

That brings me to three artificial intelligence stocks that aren’t yet fully valued in light of their potential. Arguably, each of these three tickers could explode higher once more investors connect the dots.

1. Palantir Technologies

You’ve most likely heard of OpenAI’s ChatGPT, and you may have noticed that software giant Microsoft (MSFT -3.38%) has melded its Bing search engine with an AI-powered conversational assistant called Copilot. You may have even tinkered with this tool, or with Alphabet‘s (GOOG -2.17%) (GOOGL -2.15%) comparable chatbot, Gemini (formerly called Bard). There’s no denying these tools are fun to play with, in addition to being legitimately helpful to many who use them.

From a monetization perspective though, these platforms don’t appear to have a great deal of commercial appeal. ChatGPT and Copilot, however, don’t represent the best use cases for artificial intelligence technology. AI platforms purpose-built for business are proving far more marketable.

Enter Palantir Technologies (PLTR 3.77%).

As a consumer, you will not have used its service. Companies like General Mills, the CBS television network, and Aramark are some of its newest clients, though, joining a growing number of enterprises using Palantir’s offerings to help them do something constructive with the mountains of digitized data they’ve been gathering for years. The company’s software is also being used by the U.S. military and intelligence agencies, energy company ExxonMobil, and drugmaker Sanofi, just to name a few. There has simply not been a data-analysis option powerful enough to pay for … until now.

Palantir Technologies has only scratched the surface of its potential, though. Analysts expect its top line to grow to the tune of 21% this year and then repeat the feat next year. CEO Alex Karp’s only complaint is that the company can’t keep up with demand.

Shares are performing well, by the way. They’re up more than 50% for the past year, and higher by more than 130% for the past couple of years.

There’s reason to expect Palantir stock could catapult higher, however, given the company’s profitability as well as the fact that it’s already a market leader in its niche. Technology market research outfits Gartner and Forrester Research both consistently rank it as one of the top names of the AI data-analysis space, comparing it to much bigger players like Microsoft and Alphabet.

2. Super Micro Computer

Most everyone understands Nvidia‘s (NVDA -3.77%) hardware sits at the heart of most artificial intelligence data centers. Analysts with Mizuho Securities suggest it controls about 90% of the AI-processor market.

Those graphics processing units (GPUs) and similar powerful processors are only one piece of the technological puzzle which is an AI data center. Artificial intelligence servers are actually massive banks of individual computers that must be built around a processor and then tethered together on a giant rack (or racks). Some company has to manufacture these computers and then assemble the towers they become a part of.

That’s what Super Micro Computer (SMCI -1.40%) does. Whether a customer prefers Nvidia’s tech or Intel‘s, and whether that client wants to use Amazon‘s cloud computing service or Microsoft’s, Super Micro Computer can deliver.

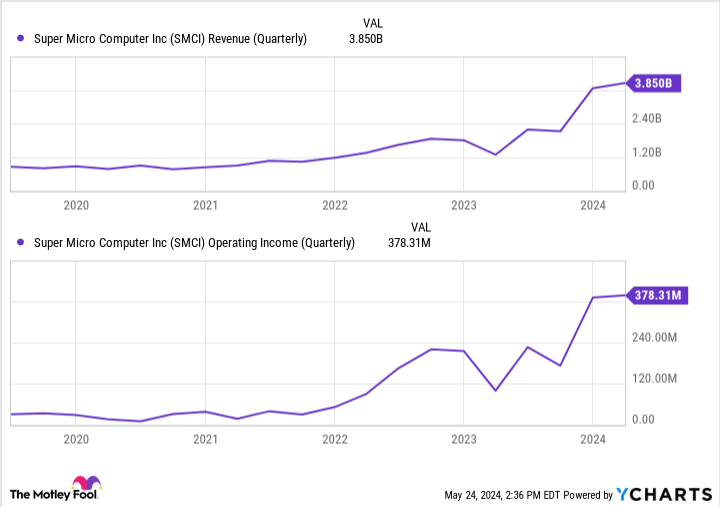

And it’s been delivering like crazy. Last quarter’s top line was up an incredible 200% year over year, extending a well-established growth trend that’s expected to last well into the future. Analysts are calling for revenue growth of 60% in its next fiscal year.

SMCI Revenue (Quarterly) data by YCharts.

That’s just the beginning. Precedence Research forecasts that the AI infrastructure market will grow at an annualized pace of more than 27% through 2033 as more and more organizations rush to build the AI platforms they’re increasingly realizing they’ll need if they want to remain competitive.

Super Micro Computer’s stock price has drifted sideways after peeling back from March’s peak. It’s most likely just taking a breather though, ahead of its next leg higher.

3. Alphabet

Last but not least, add Alphabet to your list of AI stocks that could go parabolic in the foreseeable future.

It’s a well-respected tech name, but some might find it tough to see the Google parent as an AI play. Although its Gemini/Bard chatbot is a clever use of AI tech, there aren’t a great deal of practical commercial applications for it. Besides, the company’s core business is advertising. Adding an AI profit center to the mix could be quite an undertaking.

Alphabet is taking the task on, however, and is better positioned to make it worth the effort than you might think.

See, Alphabet isn’t aimlessly building an AI business from scratch just for the sake of seeing what happens. It’s using artificial intelligence as a means of making its existing advertising business even better. Just last week, the company announced it will soon allow advertisers to use AI-generated ads, for instance. The company also says ads will soon begin appearing within its new AI Overviews, which are a separate category of search results for anyone using the Google search engine. Of course, more meaningful data about Google’s users helps advertisers as well as Alphabet.

What could really sustain and even accelerate the stock’s current advance, however, is renewed optimism from the analyst community. Bank of America analyst Justin Post recently reiterated his buy rating on Alphabet stock, citing the latest advancements in its AI advertising tech. Goldman Sachs analyst Eric Sheridan said the same.

Both recognize that advertising is and will remain Alphabet’s big breadwinner into the distant future. Its foray into artificial intelligence is complementary to this business, though, without conflicting with it. Investors may be underestimating the degree of revenue growth that’s in store here.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Bank of America, Goldman Sachs Group, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends Gartner and Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.