Some of the world’s most dominant companies in high-growth markets, such as cloud computing and artificial intelligence, offer compelling valuations.

The economy and the stock market experience ups and downs over time. Being a long-term investor allows you to see the forest for the trees and base your investments on big-picture trends that could dictate which stocks perform the best over time.

Over the past decade, cloud computing, e-commerce, and digital advertising have been prominent growth stories. While those still have more upside, emerging industries like artificial intelligence (AI) are already paving the path to the future.

The brilliant companies leading these industries have already enriched shareholders and have the fundamentals and growth prospects to continue winning for the foreseeable future. Consider buying these three top-notch growth stocks today and holding them long-term.

1. Nvidia

AI chip company Nvidia (NVDA -2.25%) is the poster child of the AI craze that has swept the market since early 2023. The company built its business on graphics processing units (GPUs), and their strong computing power and task-specific functionality made them such a good fit for training AI models in data centers that Nvidia essentially took almost the entire market. Cloud computing companies have spent billions of dollars on Nvidia’s H100 chips to amass the computing power needed to run AI applications through the cloud.

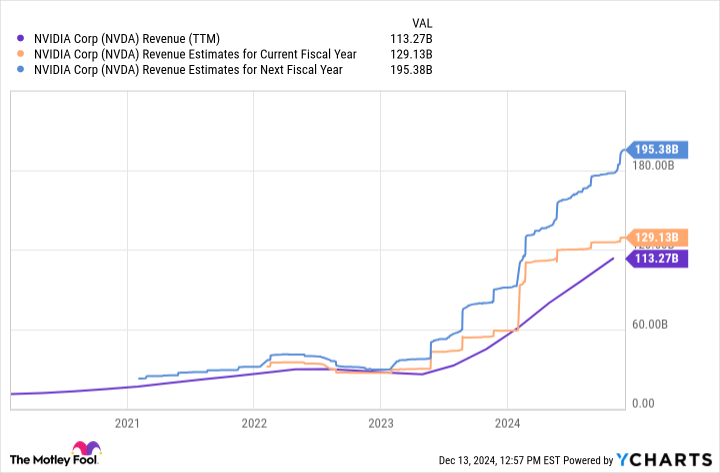

That launched Nvidia into hyper-growth mode, and its next-generation chips are poised to be just as successful. The reality is that AI requires immense computing resources, and the need grows as models become more advanced and more companies want to deploy AI applications. You can see that Nvidia’s business remains on an upward trajectory, with analysts estimating that it will generate nearly $200 billion in revenue next fiscal year:

NVDA Revenue (TTM) data by YCharts

Analysts estimate Nvidia will grow earnings by an average of 20% annually over the next three to five years. The stock trades at a forward price-to-earnings (P/E) ratio of 47, a reasonable valuation for arguably the most important company in the still-nascent AI industry. Nvidia should continue winning, so consider buying today and adding opportunistically.

2. Alphabet

Google is one of the world’s most famous brands and is so dominant in internet searches that regulators ruled it a monopoly earlier this year. That alone puts its parent company, Alphabet (GOOG -1.16%) (GOOGL -1.11%), on this list. But Alphabet is far more than a search engine; it owns the world’s most-visited video platform (YouTube), the world’s third-largest cloud (Google Cloud), and a host of interests in other technologies, like autonomous driving, quantum computing, and smartphone software.

Alphabet is fiercely competing for AI leadership with other technology rivals. It could have an edge because it owns the primary ingredients to develop and deploy AI, including a cloud business (Google Cloud), an AI model (Gemini), and a treasure trove of first-party data on which to train its AI. Alphabet has $93 billion in cash and generated $55 billion in free cash flow over the past four quarters. The company is a financial juggernaut that can outspend (or at least keep pace with) any competitor:

GOOGL Free Cash Flow data by YCharts

Given its existing businesses and AI upside, it’s hard not to love Alphabet’s investment prospects. Analysts estimate the company will grow earnings at an average annual rate of almost 18% for the next three to five years. That growth rate makes the stock a compelling value, trading at just 24 times earnings.

3. Amazon

E-commerce giant Amazon (AMZN -0.66%) went from selling books online to selling just about everything. Its ascension to control roughly 40% of all e-commerce in the United States makes it one of the most significant corporate success stories ever.

Just as impressive has been the company’s ability to pivot, starting and expanding new businesses that have risen to the top of their respective markets. Amazon’s Prime subscription gives the company direct access to over 200 million customers, helping it create additional opportunities in video streaming, grocery, and healthcare.

Amazon also operates the world’s largest cloud computing platform, which has become the primary source of the company’s profits. Customers can deploy AI applications through Amazon’s cloud platform, making it a key cog in AI for as long as it retains its market share. Amazon’s ability to pursue various markets makes it a clear-cut growth stock.

AMZN Revenue Estimates for Current Fiscal Year data by YCharts

The future looks bright, partly because Amazon’s core businesses still have plenty of life left. Consider that e-commerce (Amazon’s oldest business) accounts for less than a fifth of retail spending in America! Amazon recently launched online vehicle sales, proving it can and will target almost any consumer market.

Analysts estimate Amazon will grow earnings by an average rate of 28% over the next three to five years, making the stock a solid buy at its forward P/E of 44.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool has a disclosure policy.