Scouting for stocks can be exhausting at times, especially with such an extensive list of options out there. However, one common metric investors love to put focus on is free cash flow.

Still, what is free cash flow?

Free cash flow is the total cash a company holds onto after paying for operating costs and capital expenditures.

It speaks volumes about a company’s financial health, but in what way?

A healthy free cash flow provides more growth opportunities, a higher potential for share buybacks, stable dividend payouts, and the ability to wipe out any debt with ease.

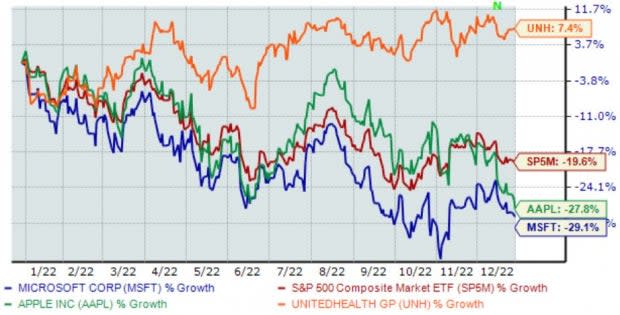

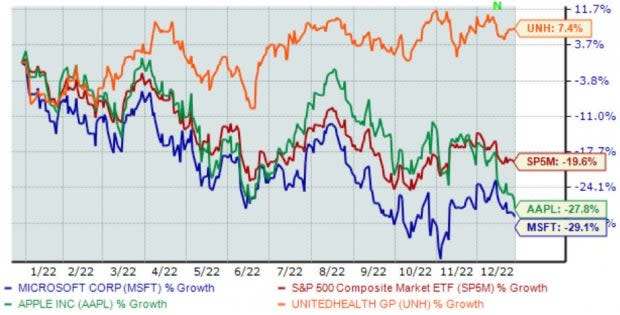

Three companies – Apple AAPL, Microsoft MSFT, and UnitedHealth Group Inc. UNH – all generate substantial cash. Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at how each one stacks up.

Apple

We’ve all become highly familiar with Apple, the technology heavyweight that has revolutionized the mobile phone landscape with its flagship iPhone.

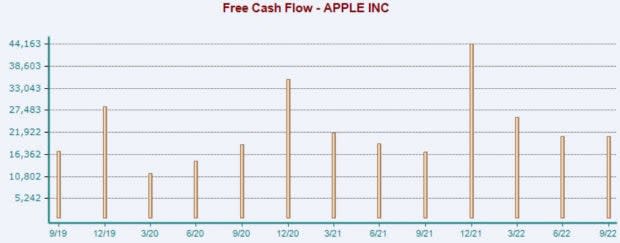

Apple generated a mighty $20.8 billion in free cash flow throughout its latest quarter, good enough for a 22.7% Y/Y increase.

Image Source: Zacks Investment Research

Apple has posted better-than-expected results despite facing a harsh business environment, exceeding top and bottom line estimates in four consecutive quarters.

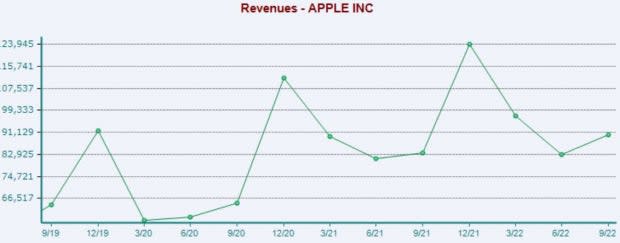

In its latest release, AAPL exceeded the Zacks Consensus EPS Estimate by more than 2% and reported revenue 1.9% above expectations. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Microsoft

Another investor favorite, Microsoft, is a mega-cap titan that’s one of the largest broad-based technology providers in the world.

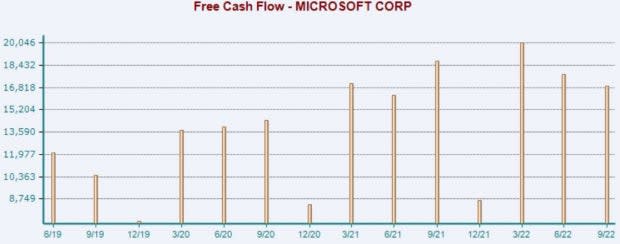

The company posted free cash flow of a steep $16.9 billion in its latest quarterly release, indicating a minor pullback Y/Y.

Image Source: Zacks Investment Research

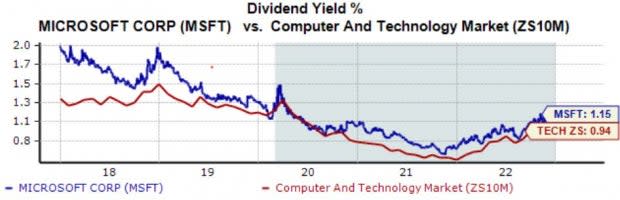

For those seeking income paired with exposure to tech, MSFT has that covered; the company’s annual dividend currently yields roughly 1.2%, nicely above its Zacks Computer and Technology sector average.

Further, Microsoft has upped its payout five times over the last five years, translating to a nearly 10% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

UnitedHealth Group, Inc.

UnitedHealth provides a wide range of healthcare products and services, including health maintenance organizations (HMOs), point of service plans (POS), preferred provider organizations (PPOs), and managed fee-for-service programs.

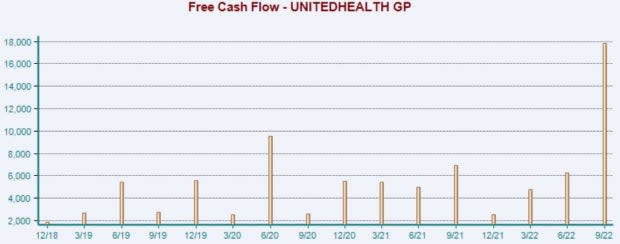

UnitedHealth generated a whopping $17.8 billion of free cash flow during its latest quarter, reflecting a steep 150% Y/Y change and an even larger 180% sequential increase.

Image Source: Zacks Investment Research

Like MSFT, UnitedHealth rewards its shareholders; UNH’s annual dividend yield stands at 1.2%, a few ticks below its Zacks Medical sector average of 1.4%. Still, the company’s 17.5% five-year annualized dividend growth rate picks up the slack immensely.

Image Source: Zacks Investment Research

Bottom Line

Generally, companies that display free cash flow strength are well-established and carry highly-successful business operations, undoubtedly perks that any investor looks for.

And all three companies above – Apple AAPL, Microsoft MSFT, and UnitedHealth Group Inc. UNH – generate rock-solid levels of free cash flow.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Add Comment