Investors take heed: Growth stocks continue to outperform value stocks.

Which are better: growth stocks or value stocks? By the numbers, there’s a clear winner, at least in recent years. It’s growth stocks, hands down.

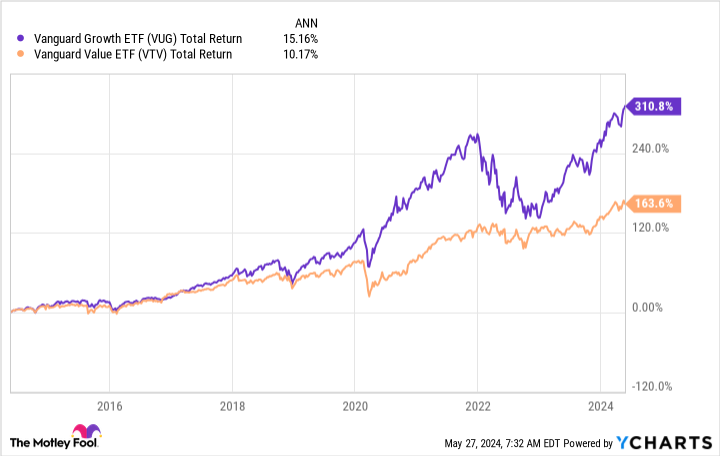

In fact, over the last 10 years, the Vanguard Growth ETF significantly outperformed the Vanguard Value ETF, with an annualized return of 15.2% to 10.2%.

VUG Total Return Level data by YCharts.

With that in mind, let’s have a look at three growth stocks I think are poised to deliver excellent returns over the long run.

Image source: Getty Images.

The Trade Desk

First up is The Trade Desk (TTD -1.82%). Shares of the company, which operates a cloud-based digital advertising platform, have more than doubled in value over the last 18 months.

The boom in the digital advertising market is to thank. Statista states that in 2023, the digital advertising market was over $600 billion. That figure is estimated to increase to above $870 billion by 2027. The evidence of this growth is all around you.

Take streaming services, for example. After resisting investor calls for an ad-based subscription tier for years, Netflix embraced one — Netflix’s ad tier now has over 40 million monthly active subscribers. Similarly, Disney+ (NYSE:DIS), Hulu, Paramount+, and Peacock now have ad tiers.

That’s excellent news for The Trade Desk, whose platform allows advertisers to direct overall ad campaigns and place ads directly on streaming services. Indeed, The Trade Desk has already announced partnerships with Disney and Netflix.

As for growth, The Trade Desk is growing revenue by 28% year over year as of its most recent quarter (the three months ending March 31, 2024). So, for growth-oriented investors, The Trade Desk is a name to keep an eye on.

Visa

Visa (V 0.91%)operates one of the world’s largest payment networks. The company leverages the scale of its network to yield enormous revenue and profits.

In its most recent quarter (the three months ending March 31, 2024), Visa generated $8.8 billion in revenue and $4.7 billion in net income. In turn, the company returned over $3.8 billion to shareholders via share buybacks and dividends.

What’s more, over the last 10 years, Visa cumulatively reduced its overall shares outstanding by about 19%, roughly 2% each year.

That’s great news for investors. As the number of shares outstanding decreases, all else being equal, the value of the remaining shares will increase, thanks to the law of supply and demand.

Finally, Visa isn’t just about shareholder returns. The company is still growing rapidly, thanks to its business model, which benefits from rising prices. Over the last decade, Visa averaged revenue growth of 11%, and analysts expect similar growth over the next two years as well.

Amazon

Last, but by no means least, is Amazon (AMZN -1.48%). After taking a significant dip in 2022, Amazon’s stock is once again riding high and near its all-time high.

One reason the company’s stock is performing well is that its operations are firing on all cylinders. In fact, the company’s immense e-commerce business is clearly running more efficiently than ever before. Consider this quote from the company’s most recent earnings call:

“In March, across our top 60 largest US metro areas, ~60% of Prime members’ orders arrived the same or next day.”

In short, Amazon’s massive investments in its fulfillment network — made during the COVID pandemic — are paying off. Customers are getting their orders faster than ever.

Moreover, with those large e-commerce infrastructure projects in the rearview mirror, the company is generating more free cash flow than ever before.

AMZN Free Cash Flow Per Share data by YCharts.

Granted, management signaled that free cash flow will likely dip later this year as the company invests heavily in upgrading its AI capabilities. However, investors shouldn’t fret — those investments are designed to bolster the market share of Amazon Web Services (AWS), the company’s cloud computing segment.

Finally, turning to growth, Amazon’s revenue continues to soar. The company generated $591 billion in revenue over the last 12 months — making it second to Walmart for the largest American companies based on revenue. Additionally, analysts expect Amazon to continue growing revenue at a double-digit pace both this year and in 2025. For investors looking for a growth stock with staying power, it’s time to consider Amazon.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon, Visa, and Walt Disney. The Motley Fool has positions in and recommends Amazon, Netflix, The Trade Desk, Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Value ETF, Visa, and Walt Disney. The Motley Fool has a disclosure policy.