Superior solutions and a deep-seated, irrefutable long-term need make these three names overlooked winners.

Identifying good stocks to own for the foreseeable future is one thing. Finding stocks with enormous growth potential to buy and hold for a full decade is another. It isn’t enough to offer a superior product or service. It must also operate in an industry that’s sure to grow — a lot — for the long haul.

With that as the backdrop, here’s a rundown of three monster stocks to consider adding to your portfolio now and holding for several years. None of them are household names. As you’ll see, however, each offers plenty of game-changing promise.

1. AST SpaceMobile

In its infancy, broadband internet connectivity required physical connections like a phone line or cable TV cord. Then the wireless leap was made, turning your mobile phone into a connected device using antennas attached to cellphone towers.

Now these connections can be made from outer space. AST SpaceMobile (ASTS 14.96%) is not only making it possible, but relatively easy as well as reasonably affordable. At first blush, it seems like a solution to a problem that doesn’t exist. There’s enough mobile infrastructure peppered across the United States for seemingly everyone to remain connected.

Look beyond the U.S., though. AST SpaceMobile reports that of the planet’s 7.9 billion people, 3.7 billion of them face a significant gap in access to broadband (if they have access at all), while another 5.3 billion cellular subscribers occasionally lose connectivity due to terrain or travel. And, as recent hurricanes Helene and Milton reminded us, land-based connections aren’t immune to being knocked out.

AST SpaceMobile is still a start-up, with all the usual hallmarks of a young company. Those are minimal revenue paired with sizable losses. Indeed, the company’s top line was just a little less than $1 million during the second quarter of this year, yet it spent nearly $64 million on operating expenses like R&D and equipment construction — a fairly typical quarter so far.

The trajectory of its business is the key here, however. A year ago, the company wasn’t generating any revenue at all, and it didn’t actually launch its first commercial satellites until September of this year (in partnership with AT&T). And, it was only a few days ago that these so-called Bluebirds deployed the solar panels that will power them.

Once they’re fully activated though, they’ll each be able to deliver the same voice, data, text, and video services you currently enjoy with your more traditional mobile connectivity. They’ll just be making it happen from orbit.

As you can imagine, once this tech is tested and proven, look for it to explode. Market research outfit Global Market Insights believes the worldwide satellite-based 5G connectivity market is set to grow at an average annual pace of 50% through 2032.

2. Lam Research

When investors think of semiconductor stocks, names like Nvidia and Qualcomm tend to come to mind. And rightfully so. After all, these are some of the world’s biggest chipmakers.

There’s a whole universe of semiconductor opportunity, however, hiding behind the scenes. These are the companies that make the equipment used by the chip foundries to manufacture their computer components. Lam Research (LRCX -2.44%) is one of these key equipment suppliers.

In simplest terms, Lam Research offers a range of wafer (microchip) manufacturing technologies like cryogenic etching, stripping and cleaning solutions, and mass metrology to ensure all of a chipmaker’s production is uniform in size and shape… all of which are critical to the silicon-making industry. As the world uses more and more tech, it needs more and more equipment to manufacture these technological solutions.

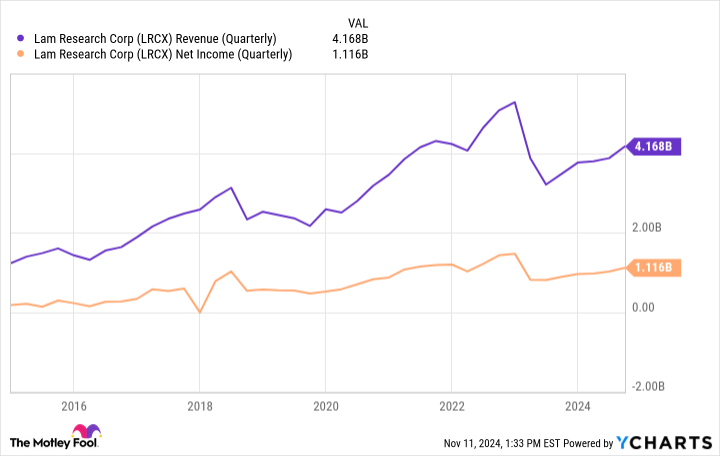

This doesn’t mean Lam Research is immune to the occasional industry-wide headwind that other industry players like Intel or the aforementioned Nvidia occasionally bump into. In the bigger picture, however, the chipmaking industry’s demand for Lam’s tech doesn’t wane for long — if it weakens at all. Lam Research is also not only profitable, but it’s reliably profitable, and increasingly so.

LRCX Revenue (Quarterly) data by YCharts

Now, on the off-chance you’ve been keeping tabs on this company’s stock of late, then you know it’s been a fairly poor performer since July. You should also know, however, that the analyst community isn’t discouraged. Most of them rate Lam as a strong buy, with a 12-month consensus price target of $95.09. That’s 25% above the stock’s present price — not a bad start to a 10-year trade.

3. Wolfspeed

Last but not least, add Wolfspeed (WOLF -3.47%) to your list of monster stocks to hold for the next 10 years.

Wolfspeed is a developer of high-performance silicon carbide. So what? Whereas most computers, consumer electronics, and even electrically powered machinery require silicon components, this basic silicon is increasingly limiting by not being more electrically conductive, and not being tolerant of the sort of heat modern-day electronics and electrically powered equipment can produce. Silicon carbide (silica combined with carbon) solves these limitations by making electronic components that are far more heat-resistant, and more efficient conductors.

And its potential applications are as deep as they are wide. From solar panel power inverters to HVAC systems to energy-intensive data centers to agricultural machinery (and more), silicon carbide improves the functionality of all of them.

Perhaps the most promising usage of this material, however, is on the battery-powered electric vehicle front. Silicon carbide not only makes sense as a means of making EVs more power efficient, it can even be used as an alternative to the lithium used in most electric vehicle batteries at this time. The cost of such batteries just needs to be curbed first. That will happen in time, though.

Silicon carbide is still a somewhat unfamiliar solution to most industries that have been designed around better-established and more-proven material options. That’s a big reason that Wolfspeed’s revenue of $194.7 million for its recently ended fiscal quarter fell short of estimates. Top-line estimates for the quarter now underway also came up short of expectations, underscoring the EV market’s headwind. Shares rekindled a long-standing downtrend as a result, and now sit more than 90% below their late-2021 peak.

Think bigger picture, though. That pullback is an opportunity to plug into a market that consulting outfit McKinsey says is set to grow at an annualized pace of 26% through 2030. Given the company’s strong patent portfolio and existing leading market share, it’s poised to capture at least its fair share of this growth.