Is now the right time to invest in a top AI player? Let’s explore the risks and rewards of buying this market darling in the fall of 2024.

It’s no secret that Nvidia (NVDA 2.75%) is making a mint in the artificial intelligence (AI) market. Its AI accelerator chips are the pick of the litter for high-end AI-training systems, and those systems are in high demand these days.

Nvidia’s stock is a very direct bet on a long-running AI boom. It’s not necessarily a slam-dunk winner, and investors should keep a couple of big risks in mind before buying these shares. But there is a world where Nvidia comes up aces and continues to outperform the stock market.

So let’s take a quick look at Nvidia’s investment risks and what it would take to keep the market-beating party going.

Nvidia doesn’t have a monopoly on AI accelerator chips

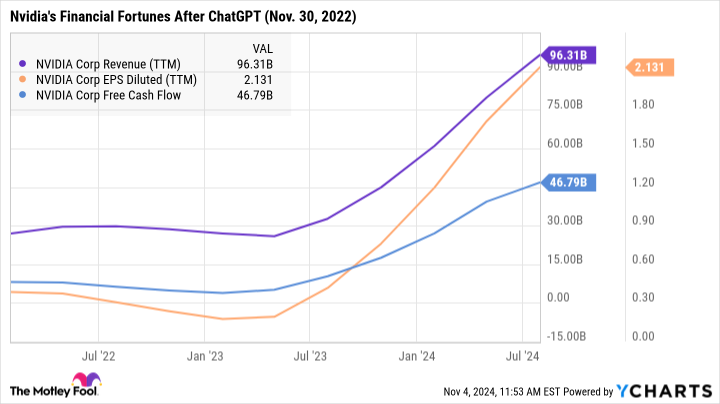

It’s true that Nvidia got the jump on the competition. OpenAI‘s first public version of ChatGPT was trained on more than 10,000 Nvidia V100 accelerators. Later versions of the same large language model (LLM) training setup will use many more units of newer, more powerful, and more expensive accelerator chips. Nvidia’s financial charts show a sharp inflection point (aka “hockey-stick” moment) when it started to fill orders inspired by the ChatGPT release:

NVDA Revenue (TTM) data by YCharts

But there are actually many alternatives on the chip market. Advanced Micro Devices (AMD 0.75%) and Intel (INTC 3.40%) have their Instinct and Gaudi processors, respectively. Cloud computing giants such as Alphabet (GOOG 0.66%) (GOOGL 0.57%) and Amazon (AMZN 1.75%) are ordering Nvidia chips by the truckload — but have also developed their own AI accelerators in an effort to cut costs and meet specific performance targets. Even OpenAI is working on a custom chip design in partnership with Broadcom (AVGO 2.18%).

Every chip design comes with a different balance of performance, price, power and cooling requirements, and unique features. Intel even brings its own manufacturing facilities to the game, dodging the potential bottleneck of every fabless designer jockeying for time on the usual manufacturing lines.

Nvidia is on top so far, but who’s to say what chip designer might win the next generation’s most lucrative design contracts? If the answer isn’t Nvidia, its investors could be in for a sharp price correction.

Nvidia’s stock isn’t cheap after rising 928% in two years

You see, Nvidia’s stock has skyrocketed in the ChatGPT era. The stock has gained 928% in two years and 216% in the last 52 weeks. With a $3.4 trillion market cap, Nvidia’s stock trades at the lofty valuation ratio of 74 times free cash flows or 36 times sales.

This is the typical market performance of a young, hungry growth stock with big dreams and a small market cap. The company will have to deliver tremendous sales growth and profits for years to come in order to earn this gigantic market value. Any misstep along the way could lead to a sudden price drop — either right away or when investors have taken their time digesting the long-term implications of negative news.

Many potential downsides are out of Nvidia’s control

Despite its massive market cap and soaring sales, Nvidia doesn’t run the world.

Economic downturns could take the wind out of the AI boom’s sails. Nvidia’s chosen design priorities might be less popular than some other chipmaker’s AI products in a later (and more lucrative) product generation. Regulators in key markets like China and the U.S. may set up firewalls against international trade, undermining Nvidia’s business prospects. Natural disasters have the power to disrupt Nvidia’s supply chains. International conflicts can have the same effect, while also challenging the global economy.

Nvidia doesn’t have direct control over these issues. There is no such thing as a risk-free investment, no matter how well-positioned the company might be and how flawless the management team’s business plan is. Unexpected events can always throw a spanner in the works, and that’s bad news for high-flying market darlings.

Why you might want to buy Nvidia stock today anyhow

But Nvidia is a market darling for good reason.

The chart above showed you how revenue, earnings, and free cash flow results are soaring in the generative AI boom. The valuation ratios are high, but sharply lower than their peaks in the summer of 2023 — the business results are keeping pace with the investor enthusiasm.

And you should certainly mind the competition risk, but Nvidia is still the silverback gorilla to beat in the AI hardware market. Challengers have a lot of work to do, both in the chip-design labs and the marketing department.

I mean, Nvidia is stealing Intel’s spot in the Dow Jones Industrial Average (^DJI 0.94%) market index, reflecting a sea change in the semiconductor industry. And the incoming cash profits won’t sit idle in some bank account. Nvidia’s product development budgets are suddenly among the world’s most generous, giving the company many new tools for defending its dominant market position.

Balancing AI optimism with risk-conscious caution

So I understand why Nvidia is a popular investment idea at today’s rich prices and despite many business risks. The company’s footprint on the AI market is inspiring, and those beefy cash profits should help Nvidia perform in the long run.

And the stock has been very good to my own portfolio. I took some profits in February, but left more than half of my position untouched. I’m not buying Nvidia stock at these prices, which look a bit too generous in the context of the risks noted earlier. But I’m happy to hold the remaining shares and see how the AI market plays out over the next few years. A small Nvidia position is almost mandatory for growth investors in 2024.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet, Amazon, Intel, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, and Nvidia. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.