These three tickers have lagged the rest of the technology sector’s stocks of late. The market’s mistake is your opportunity.

If you keep your finger on the pulse of the market, then you likely know that most technology stocks — including most software stocks — are now at record highs. Indeed, the rallies that got them there appear to have accelerated just within the past few weeks, pricing them out of reach for most investors.

Not every software stock though. For a range of reasons, a handful of them are lagging despite their obvious potential upside.

Don’t spend too much time overthinking it. Just capitalize on this temporary weakness by stepping in before they “catch up” with their peers by going parabolic. Here’s a look at your best three bets right now.

1. Datadog

There’s a good chance you’ve never heard of Datadog (DDOG -0.21%). Although its $40 billion market cap hardly qualifies it as small cap, that’s not exactly big either. It’s also got no consumer-facing product that would leave the average individual investor familiar with the company.

Don’t let its lack of size or profile fool you. Datadog has a ton of upside, and even more given that the stock’s still down 37% from its late-2021 high and has been mostly stagnant since the beginning of this year.

In simplest terms, Datadog offers observability products to enterprises managing large networks of servers, apps, and cloud-computing platforms. In other words, its software allows information technology (IT) professionals to see and optimize the flow of digital data within a complex network of computers. Technology market research outfit Gartner rates the company’s observability software as one of this year’s best, second only to Dynatrace in terms of completeness and execution. Datadog’s platform is particularly helpful on the cybersecurity front, giving IT teams a means of detecting and responding to cyberthreats in real time.

And the numbers speak for themselves. Revenue is on pace to improve nearly 24% year over year and then grow another 22% next year. Next year’s top-line growth is also expected to rekindle earnings growth from this year’s projected profit of $1.65 per share to $1.95 per share. Look for similar top- and bottom-line growth in 2026 and very likely, beyond.

This stock isn’t cheap — perhaps the reason it’s struggled since 2022. This increasingly seems to be one of the cases, however, where the company’s fiscal trajectory means more than its stock’s valuation.

2. HubSpot

At first blush, it seems unlikely that any customer-relationship management (CRM) software company could successfully compete with industry titan Salesforce. It’s just too dominant.

The thing is, the more features, options, and services a provider brings to the table in an effort to appeal to more potential customers, the less focused, less compelling, and more expensive that platform becomes. This opens the door to would-be rivals that are willing and able to come up with something different, even if the only major difference is price.

That appears to be precisely what CRM outfit HubSpot (HUBS 1.07%) has done. Although its founding in 2006 came well after Salesforce’s 1999 launch (plus a bunch of other CRM platforms in between), numbers from market research house HG Insights indicate that Hubspot has grown to a close second to Salesforce in terms of market share, with only about 25% fewer paying customers.

Granted, Salesforce is driving more revenue than HubSpot, suggesting the former is serving bigger corporate clients and/or extracting more revenue from them. Gartner even considers Salesforce to be the more complete platform. Gartner also says, though, that HubSpot is the world’s single-best CRM name in terms of its ability to do what it says it can do for its customers.

These rankings don’t necessarily mean a whole lot to investors, of course. A stock’s potential is ultimately tethered to its underlying company’s fiscal capacity to grow. HubSpot’s got plenty of that even if its shares have underperformed since April. This year’s expected top-line growth of nearly 19% is in line with its past and projected growth. Earnings are growing even faster.

3. Microsoft

Finally, add Microsoft (MSFT 0.11%) to your list of software stocks that could go parabolic in the foreseeable future.

It’s an oldie but a goodie. The stock’s also been a strangely poor performer since July, however, failing to make the move to record highs that most of its fellow technology giants managed to make during this time.

You likely know the reason. While Microsoft appeared to have an edge in the early days of the artificial intelligence (AI) revolution, it seems to be losing it now. D.A. Davidson and Oppenheimer both recently downgraded the software giant’s stock on these competitive concerns. As Davidson analyst Gil Luria plainly explains, “Competition has largely caught up with Microsoft on the AI front, which reduces the justification for the current premium valuation.”

And the worries are legitimate, to be fair. The AI movement’s low-hanging fruit has all been picked, and most of its key players have refined their offerings to near perfection. Going forward, it’s going to be considerably tougher to remain competitive within the AI market.

These fears, however, arguably gloss over a couple of bullish truths about Microsoft. Those are (1) AI isn’t even close to being this company’s only source of revenue, and (2) if nothing else, Microsoft can still leverage its powerful brand name when pitching its products to consumers and corporations alike.

It’s also worth adding that cloud computing remains a huge part of Microsoft’s business. In this vein, data from research outfit Synergy Research Group indicates that Microsoft’s cloud business is outgrowing all others including Amazon‘s.

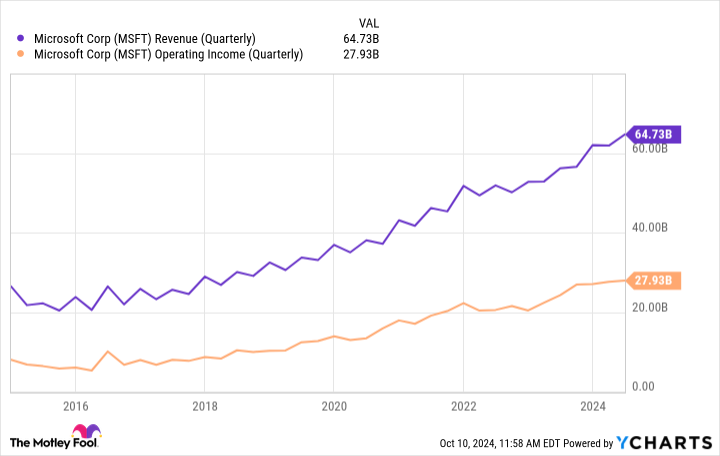

This stalwart software name’s revenue and earnings are also both consistently growing in the mid-teens and are expected to continue doing so for at least a few more years.

MSFT Revenue (Quarterly) data by YCharts.

This might drive the point home: While Microsoft stock’s been a subpar performer for a while, most analysts aren’t discouraged. More than three-fourths of them still rate shares as a strong buy, and their consensus-price target of $497.04 is nearly 20% above the stock’s present price.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Datadog, HubSpot, Microsoft, and Salesforce. The Motley Fool recommends Gartner and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.