The S&P 500 may be at all-time highs, but plenty of stocks are still worth buying.

The S&P 500 recently notched a new all-time high, which may give investors some hesitancy to enter the market. This is understandable, as nobody wants to buy at a high. However, investors also must realize that the only way the market gets to new heights is to continuously set new closing records. While I understand wanting to buy cheaper, missing out on massive bull runs waiting for a pullback can harm returns.

Part of the reason for new all-time highs is investor excitement in artificial intelligence (AI). The big tech firms all have many irons in the AI fire and are a big reason for the index’s new record high. Despite the S&P 500 being at a high, these three AI stocks I’ve pinpointed have the potential to increase even more.

1. Alphabet

Alphabet (GOOG 0.23%) (GOOGL 0.23%) is the parent company of Google, YouTube, and many other brands. While the company’s primary business is advertising, it also offers other businesses like cloud computing and a growing AI toolkit.

Although it stumbled out of the gate when companies like OpenAI released ChatGPT to the public in late 2022, it’s doing much better now. Recently, Alphabet rolled out a generative AI feature to its Google search engine that summarizes the topics you search for. While this isn’t necessarily a new moneymaker for Alphabet, it solidifies itself as a top option against other search engines that have integrated generative AI.

Alphabet is also succeeding as a business, with revenue growing 156% year over year in the first quarter and earnings per share (EPS) rising from $1.17 to $1.89. Alphabet also initiated a small dividend to pay investors with its excess cash flow while adding an additional $70 billion in stock repurchase authorization.

Alphabet remains a top buy in the S&P 500 due to its strong growth and shareholder-friendly capital return programs. With the stock only trading at 23.4 times forward earnings compared to the S&P 500’s 21.5, it only trades at a slight premium to the broader index, which indicates the stock isn’t overpriced at its current levels.

2. Meta Platforms

Meta Platforms (META -0.05%) and Alphabet are similar businesses that rely mostly on advertising revenue to keep the lights on. They’re also similarly priced compared to the market, with Meta trading at 24 times forward earnings.

Meta’s advertising revenue comes from its social media platforms: Facebook, Instagram, Threads, Messenger, and WhatsApp. These sites have been cash cows for Meta, and their strength shined in Q1. In Q1, Meta’s revenue rose 27% year over year, with EPS more than doubling to $4.71. Those strong results solidify Meta’s social media platforms as a place the consumer wants to be. As a result, advertisers also go there due to the large number of people who use them.

Although its Reality Labs division, the segment that makes virtual reality headsets and other exploratory technologies, doesn’t make any profits, it does have exciting products like the smart glasses it collaborated with Ray-Ban to make. This is one of the first products to put generative AI in the hands of consumers in a practical way outside of an internet browser and could be a product that leads to something far more mainstream.

Meta is succeeding in its primary business, but with other AI products in the works, it has a ton of upside.

3. Taiwan Semiconductor

Last is Taiwan Semiconductor (TSM -1.25%), a company that makes all things AI possible. Taiwan Semiconductor is a contract chip manufacturer that makes the semiconductors that go into hardware used to make AI models.

Taiwan Semiconductor’s customer base ranges from Nvidia to Qualcomm to Apple, and it has earned that business by consistently having best-in-class technology. Right now, that’s 3nm (nanometer) chips, but management stated on its Q1 conference call that its 2nm design (available in 2025) is already seeing far more demand from its customer base.

Management also believes its AI chips will be a significant source of growth in the coming years. It expects its AI-related business to grow at a 50% compound annual growth rate for five years, reaching 20% of its total revenue by 2028. This performance will help fuel management’s broader 15% to 20% overall compound annual revenue growth projection — a strong projection from a sizable company.

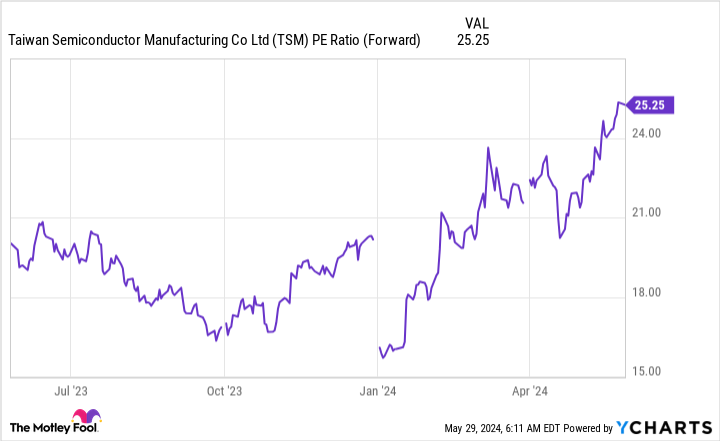

Taiwan Semiconductor is the most expensive stock of the trio at 25 times earnings, but its importance in the rollout of high technology cannot be understated, which is why it has performed so well this year.

TSM PE Ratio (Forward) data by YCharts

Without Taiwan Semiconductor, none of the AI technologies we experience today would be possible. As a result, it’s a fantastic stock to buy and hold on to for years to come.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Meta Platforms, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.