The market has undoubtedly been cruel throughout 2022, putting dents in many portfolios. While there have been bright spots, such as energy, the majority of stocks have tumbled all year long.

We have found ourselves in a highly-unique economic situation after coming out of a once-in-a-lifetime pandemic, to say the least. Inflation has soared to levels not seen in decades, and the Fed has pivoted to a hawkish nature, raising borrowing rates to alleviate the problem.

As the Fed says, it’s an attempt to achieve a soft landing for the U.S. economy. While most know that this task will be mighty difficult to achieve, the Fed remains confident in its plan.

Tech stocks have been some of the biggest victims of the bear market. With the Fed increasing borrowing rates, the market has priced in the impact on high-flying tech companies’ future cash flows. Additionally, tech companies typically borrow at a higher rate than others to fuel growth.

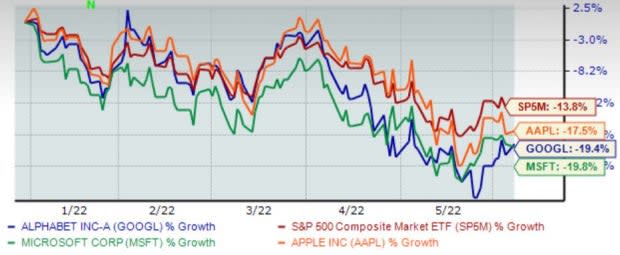

However, the bears can’t stay around forever. Three highly-coveted companies – Apple AAPL, Microsoft MSFT, and Alphabet GOOGL – are three stocks that will undoubtedly lead the rebound within tech. The year-to-date chart below shows the share performance of all three companies while blending in the S&P 500 for a benchmark.

Image Source: Zacks Investment Research

Let’s get into why it’s very beneficial to add to these positions during periods of weakness, such as 2022.

Building A Bigger Position

Let’s face it – it’s nearly impossible to time the market just right. The saying “buy low, sell high” is hardly beneficial; if investors could consistently and accurately forecast these levels, the market would be entirely unbalanced.

Of course, there is the “buy the dip” approach, which is inherently risky. Many people buy at the dip, yet it keeps dipping – that’s never fun. One of the best ways to build a more prominent position for your long-term winners is the simple approach of dollar-cost averaging.

Dollar-cost averaging is a strategy in which investors split up their initial buys in periodic timeframes, reducing the impact of volatility on the overall purchase. It allows you the flexibility to “buy the dip” and add on to those winners whenever they come into uptrends.

This is a great way to limit overall risk, as no investor wants to see an initial position become an unfavorable entry point due to market conditions.

Apple

Apple AAPL shares have fallen quite extensively in 2022. However, the five-year chart below shows that shares are trading near October 2021 levels and have bounced beautifully.

Image Source: Zacks Investment Research

Additionally, Apple’s forward P/E ratio has come all the way down to 23.8X, nearly half of 2020 highs of 41.5X. The value represents a rich buying opportunity relative to where AAPL shares have traded over the last several years.

Image Source: Zacks Investment Research

Bottom-line estimates remain strong, with the $6.11 EPS estimate for FY22 displaying a sizable 9% increase year-over-year. Additionally, earnings are expected to grow an additional 8.7% in FY23.

Image Source: Zacks Investment Research

Microsoft

Microsoft MSFT has been another victim of the tech-rout, with shares losing nearly 20% of their value year-to-date. However, the five-year chart below shows that shares have bounced wonderfully off summer 2021 levels.

Image Source: Zacks Investment Research

Pivoting to valuation, Microsoft’s 29.0X forward earnings multiple may appear a bit pricey at first. Still, the value is nowhere near 2021 highs of 37.5X and is just a tick above its median of 28.3X over the last five years.

Image Source: Zacks Investment Research

Earnings estimates for MSFT display notable bottom line strength. For FY22, the $9.30 EPS estimate reflects a sizable 17% expansion in earnings year-over-year, and for FY23, earnings are forecasted to grow by an additional double-digit 14%.

Image Source: Zacks Investment Research

Alphabet

Alphabet GOOGL shares have fallen quite extensively throughout 2022, though an upcoming stock split is a catalyst that can help send shares back in the right direction. Additionally, Alphabet shares have bounced beautifully off April 2021 levels.

Image Source: Zacks Investment Research

Perhaps the most attractive name of all three in terms of valuation, Alphabet sports a 20.5X forward earnings multiple. The value is well below the median of 27.2X over the last five years and is nowhere near 2020 highs of 39.1X.

Image Source: Zacks Investment Research

The earnings picture is slightly concerning for FY22, as the $111.86 EPS estimate reflects a marginal 0.3% decrease in earnings year-over-year. However, for FY23, the earnings picture shifts back to positive – the $131.77 EPS estimate displays a sizable 18% growth in the bottom line year-over-year.

Image Source: Zacks Investment Research

Bottom Line

While these mega-cap giants have undoubtedly had poor share performances throughout 2022, zooming out on the charts paints a much more positive picture. We can see that all three companies’ shares have respected previous trading levels.

Additionally, valuation metrics are at levels not seen in some time, marking a rich buying opportunity for a few of the top companies in the world.

Investors need to continue building more prominent positions within these companies, and using dollar-cost-averaging is an excellent way to achieve this.

The bears will eventually run out of powder, and the rebound will be massive.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research