These companies are positioned to protect the growing digital world.

The world is becoming increasingly digitally connected. Smartphones make cross-globe communication possible with a few taps, companies embracing employees working from home means more information is shared via remote networks, and cloud services are a major part of everyday operations for many major companies.

These developments help connect the world and increase efficiency, but the downside is increased cyberattack opportunities. The lasting effects of cyberattacks shouldn’t be taken lightly, either. The most obvious cost is the money a company spends recovering from a breach or enhancing its security measures, but there’s also the reputational damage that can come from customers losing confidence in a company’s ability to keep their private information safe.

The good news is that these increased cyberthreats have made the cybersecurity industry virtually indispensable, and the industry’s growth potential is immense. For investors looking to get in on the bustling industry, the following three companies are well worth considering.

1. Cisco Systems

While most cybersecurity companies are software-based, Cisco Systems (CSCO 0.13%) plays a different role by providing critical hardware.

Cisco is admittedly trying to shift away from relying on hardware to focus more on software, but its hardware still plays an important role in cybersecurity. The company creates threat detection devices, secure access services, and network security appliances, all of which defend against cyberthreats.

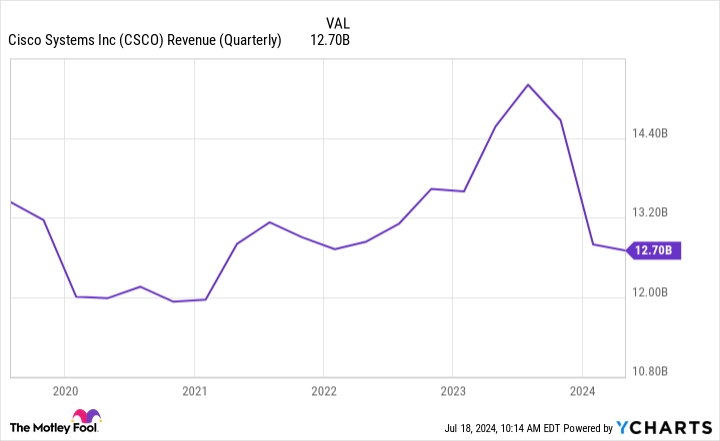

The company’s revenue has taken a hit as customers have been keeping their existing hardware in use longer, but the transition to focus more on software and subscriptions should help with this issue down the road. In Cisco’s latest quarter, subscription revenue of $6.9 billion accounted for 54% of total revenue and its ARR was up 22% year over year.

CSCO Revenue (Quarterly) data by YCharts

Cisco’s $28 billion acquisition this year of Splunk, a software company specializing in data analytics and cybersecurity, is an encouraging sign of the company’s direction. It says the acquisition should put it in a position to be a key part of the AI revolution by protecting critical infrastructure.

2. Alphabet

Alphabet (GOOG -3.72%) (GOOGL -3.53%) is widely known for the Google search and advertising business, but it also provides cybersecurity solutions.

A large part of why I chose Alphabet for this list is because of the talks it was reportedly in to buy cybersecurity start-up Wiz for around $23 billion (which would have been its largest acquisition ever). Wiz provides cloud-based cybersecurity solutions powered by AI, and the deal would’ve been a key move in Alphabet boosting its Google Cloud security offerings.

Wiz has since reportedly rejected Alphabet’s offer, but the move shows that Alphabet is serious about boosting its cybersecurity offerings and isn’t afraid to spend big to make it happen.

The cloud computing industry is rapidly growing, but Google Cloud lags behind Amazon Web Services (AWS) and Microsoft Azure. Although Google Cloud has had impressive growth (revenue was up 28% year over year last quarter), its market share is just 11%.

As Alphabet seeks to proactively enhance its cybersecurity capabilities, Google Cloud will become a much more attractive product for companies that need airtight security solutions. It won’t happen overnight, but the cloud business is still relatively early in its potential. If Alphabet wants to close the gap, prioritizing its cybersecurity offerings is a great way to pick up momentum and become a serious player in the cybersecurity space.

3. CrowdStrike (hear me out)

CrowdStrike (CRWD -1.28%) has been the subject of much scrutiny after causing arguably the worst global IT outage ever. The outage last week, which CrowdStrike said happened during a software update, rattled many industries, and many companies are still dealing with the effects.

This caused the stock to plunge, losing around a quarter of its value in just a few days. Still, the company’s long-term prospects remain strong. Before the outage incident, investors had taken a liking to CrowdStrike, with the stock up more than 130% in the past 12 months before the recent sell-off. It’s now up “only” around 80% in that time, which is still impressive.

CrowdStrike has attracted the business of many top companies globally. It’s the cloud security provider for 62 companies in the Fortune 100, showing its ability to attract and retain major enterprises (which come with large checkbooks). The recent blunder may be a black cloud over CrowdStrike, but it’s hard to see companies jumping ship as the incident wasn’t caused by a successful cyberattack or anything that would call into question CrowdStrike’s cybersecurity effectiveness.

At the end of the first quarter of its 2025 fiscal year (ended April 30), CrowdStrike noted that 65% of its customers use five or more modules, 44% use six or more and 28% use seven or more. Meanwhile, the number that use eight or more modules had increased 95% year over year.

CrowdStrike has also been putting up encouraging financials along with its impressive customer adoption. The company ended its latest quarter with $3.64 billion in annual recurring revenue (ARR), up 33% year over year, and its operating income (profit from its core operating) grew 72% year over year to $199 million. Add in its impressive free-cash-flow growth, and CrowdStrike is showing strong financial health.

CRWD Revenue (Quarterly) data by YCharts

CrowdStrike predicts the total addressable market (TAM) for AI-native security platforms will increase from $100 billion this year to $225 billion by 2028. Whether it reaches this point remains to be seen — and investors will want to keep an eye on fallout from the IT outage — but there’s no denying the market for CrowdStrike is growing, and it is in a great position to capitalize on the expansion.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in CrowdStrike and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Cisco Systems, CrowdStrike, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.