As the U.S. stock market navigates a challenging start to October, with major indices like the Dow Jones Industrial Average and S&P 500 experiencing declines amid rising oil prices and geopolitical tensions, investors are keeping a close eye on economic indicators such as job reports and interest rate adjustments by the Federal Reserve. In this environment of uncertainty, growth companies with high insider ownership can be particularly appealing due to their potential for alignment between management and shareholder interests, which may offer resilience in volatile markets.

Top 10 Growth Companies With High Insider Ownership In The United States

|

Name |

Insider Ownership |

Earnings Growth |

|

GigaCloud Technology (NasdaqGM:GCT) |

25.7% |

24.3% |

|

Atour Lifestyle Holdings (NasdaqGS:ATAT) |

26% |

23.2% |

|

Victory Capital Holdings (NasdaqGS:VCTR) |

10.2% |

32.3% |

|

Atlas Energy Solutions (NYSE:AESI) |

29.1% |

42.1% |

|

Super Micro Computer (NasdaqGS:SMCI) |

2.6% |

28.0% |

|

Hims & Hers Health (NYSE:HIMS) |

13.8% |

41.3% |

|

EHang Holdings (NasdaqGM:EH) |

32.8% |

81.4% |

|

Credo Technology Group Holding (NasdaqGS:CRDO) |

14.0% |

95% |

|

BBB Foods (NYSE:TBBB) |

22.9% |

51.2% |

|

Carlyle Group (NasdaqGS:CG) |

29.5% |

22% |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

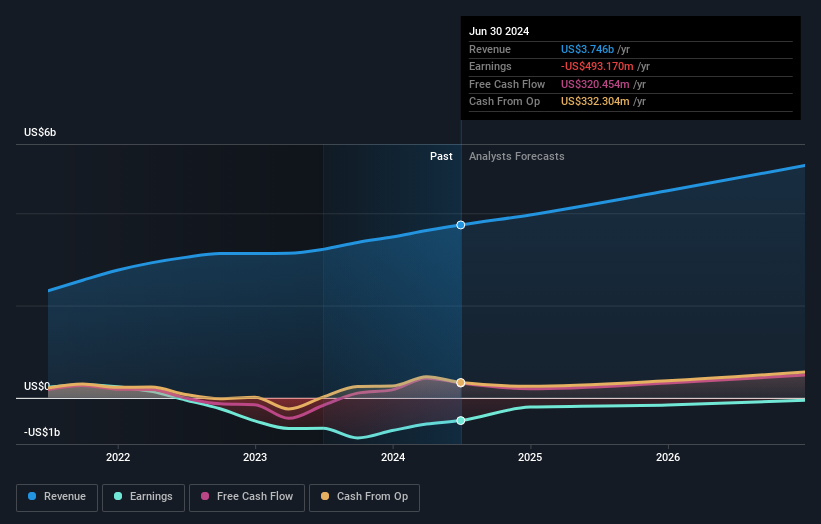

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $10.76 billion.

Operations: The company’s revenue is derived from two main segments: Devices, generating $551.17 million, and Platform, contributing $3.19 billion.

Insider Ownership: 12.4%

Revenue Growth Forecast: 11% p.a.

Roku is experiencing growth, with revenue projected to increase by 11% annually, surpassing the US market average. The company is expected to become profitable within three years. Recent developments include a new credit agreement for up to $300 million and expansion into Bengaluru, enhancing its innovation capabilities. However, challenges remain with ongoing patent litigation over HEVC technology and past shareholder dilution. Despite these issues, Roku’s strategic expansions suggest a focus on long-term growth potential.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Houlihan Lokey, Inc. is an investment banking company offering merger and acquisition, capital market, financial restructuring, and financial and valuation advisory services both in the United States and internationally, with a market cap of approximately $11.10 billion.

Operations: The company’s revenue segments include Corporate Finance at $1.21 billion, Financial Restructuring at $516.04 million, and Financial and Valuation Advisory at $287.95 million.

Insider Ownership: 23.8%

Revenue Growth Forecast: 11.4% p.a.

Houlihan Lokey’s earnings grew by 25.7% last year, with future annual earnings growth forecasted at 15.3%, slightly outpacing the US market. Revenue is expected to grow at 11.4% annually, faster than the market average of 8.7%. Recent strategic hires in its Technology and FinTech groups aim to bolster its M&A advisory services globally, particularly in technology sectors like software and FinTech, enhancing its growth prospects despite an unstable dividend history.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sable Offshore Corp. is involved in oil and gas exploration and development activities in the United States, with a market cap of $1.91 billion.

Operations: Sable Offshore Corp.’s revenue is generated from its oil and gas exploration and development activities within the United States.

Insider Ownership: 22.4%

Revenue Growth Forecast: 44.4% p.a.

Sable Offshore Corp. is expected to achieve profitability within three years, with projected revenue growth of 44.4% annually, surpassing the US market average. Despite recent shareholder dilution and a volatile share price, the stock trades significantly below its estimated fair value and was recently added to the S&P Global BMI Index. The company raised approximately US$150 million through a private placement, although it reported substantial net losses for recent quarters.

Seize The Opportunity

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:ROKU NYSE:HLI and NYSE:SOC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]