These companies can be staples in an investor’s portfolio, providing income and growth opportunities.

As the head of Berkshire Hathaway, Warren Buffett has become one of the world’s best-known investors. He and his team have turned Berkshire into an $875 billion behemoth, and Buffett’s net worth has skyrocketed along the way.

When you have that type of investing success, people tend to look to you for investing guidance. While Berkshire Hathaway’s financial situation vastly differs from the average person’s, there’s nothing wrong with looking at its stock holdings for inspiration.

The following three companies, in particular, can be great options to buy and hold on to for the long haul.

1. Coca-Cola

Coca-Cola (KO 0.11%) is Berkshire Hathaway’s fourth-largest holding, accounting for 6.5% of its stock portfolio. After a slump, Coca-Cola’s stock has made some progress this year and is only a few percentages below its 52-week high, which it hit on June 6.

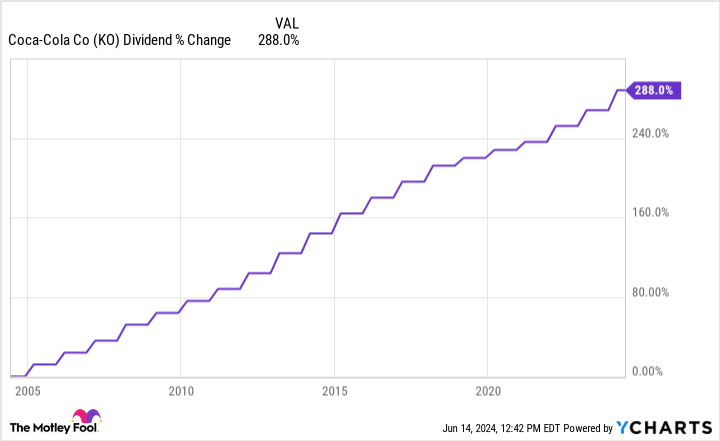

Coca-Cola’s main appeal is its dividend, which is likely a large part of why Buffett is such a fan of the company. Its annual dividend is $1.94, and the forward yield is close to 3%. Owning 400 million shares, Berkshire Hathaway can expect to earn $776 million from the beverage giant by the end of this year.

Not only does Coca-Cola have a high-yield dividend, but it’s also known for its annual dividend increases. It has upped its annual dividend for 62 straight years, making it a Dividend King. Only eight companies have longer streaks of annual increases, so investors can be confident that this streak will continue for the foreseeable future.

KO Dividend data by YCharts

Coca-Cola’s financial health is one of the more robust you’ll find. It has over $99 billion in assets compared to around $71 billion in liabilities (current and non-current) and its brand power allows it to exercise its pricing power to offset periods of stagnant volume growth.

The beverage industry is constantly evolving, and Coca-Cola isn’t afraid to spend to keep up with changing consumer preferences. Yes, its flagship Coca-Cola soda will likely continue to be its bread and butter, but via acquisitions the company has added eight brands, each producing over $1 billion in sales, such as Topo-Chico, Smartwater, and Fairlife.

Despite Coca-Cola’s historical success, it does a great job of constantly evolving and not getting complacent. That’s a company you can feel comfortable holding on to for the long haul.

2. Amazon

Buffett wasn’t interested in investing in Amazon (AMZN 0.22%) initially, but has admitted that he regrets not buying shares in the company sooner. Looking at Amazon’s gains over the past decade (up over 1,000%), it’s easy to see why.

Amazon’s e-commerce business has made it a household name and continues to be its main revenue generator (roughly 84% of total revenue in 2023). However, Amazon’s growth will likely come from its cloud segment, Amazon Web Services (AWS), and its growing advertising business.

AMZN Revenue (Quarterly) data by YCharts

AWS is the world’s leading cloud platform by market share, and new generative AI capabilities should help drive further growth. Its SageMaker and Bedrock platforms simplify building and scaling AI applications and should attract more enterprise customers looking to leverage AI for their respective businesses.

Amazon’s ad business was its fastest-growing segment in 2023. With a combination of live sports, premium content, and large scale, Amazon presents a compelling case for advertisers. It also has an advantage because it can track when customers buy relevant ad products on Amazon, giving advertisers more insight into the effectiveness of their campaigns.

Amazon has its hand in many different industries and is becoming a formidable force in each. The diversity and history of innovation puts it in a position for continued success.

3. Procter & Gamble

Procter & Gamble (PG 0.43%) (P&G) may be the poster child for defensive stocks. Whenever the economy is going through rough periods, investors lean on P&G for its reliable stability and performance.

You shouldn’t expect market-beating growth from P&G year in and year out, but its dividend is one of the surest things on the stock market. It’s paid out a dividend for 134 years and increased it for 64 straight years.

With a portfolio of brands that include household names like Tide, Pampers, Tampax, and dozens more, there’s likely no major retail store you can step into in America without encountering one of P&G’s products. It’s not just the number of brands P&G owns, either. A big part of its appeal is the fact these products sell regardless of economic conditions.

If you’re looking for a stock you can buy and hold on to forever, P&G is a great choice because of its reliable dividend, strong brand portfolio, and resilience in virtually all economic conditions.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. The Motley Fool has a disclosure policy.