Cryptocurrencies have suffered lately owing to the broader market selloff earlier this month, triggered by fears of a recession. However, fears have alleviated over the past two weeks, following the release of a spate of positive economic data that showed the U.S. economy is still holding strong.

On Aug 21, Bitcoin (BTC) rebounded from its earlier lows and was trading above $60,770 after the release of the minutes of the Federal Reserve’s Federal Open Market Committee (FOMC) meeting that hinted at the first rate cut in September.

This is likely to give Bitcoin a boost, as lower interest rates generally benefit growth-oriented assets, such as technology stocks, consumer discretionary goods, and cryptocurrencies.

Given this situation, Bitcoin-oriented stocks like NVIDIA Corporation NVDA, Interactive Brokers Group, Inc. IBKR, Robinhood Markets, Inc. HOOD and Block, Inc. SQ are likely to benefit once the crypto rally resumes.

Rate Cuts to Help Crypto Market

The minutes of the FOMC’s July meeting revealed that the Federal Reserve is gearing up to start its easing cycle with a likely 25-basis point rate cut in September. The likely rate cut stems from the Federal Reserve’s confidence that the U.S. economy continues to be resilient and inflation is declining significantly to reach its 2% target.

Lower interest rates typically decrease the opportunity cost of holding assets that don’t generate yields, like Bitcoin and other cryptocurrencies. In an environment with lower interest rates, investors are more likely to pursue assets that offer higher potential returns, even if they carry more risk.

This shift makes cryptocurrencies, known for their historical volatility and potential for significant returns, more appealing to a wider range of investors.

Bitcoin on Track to Rebound

Bitcoin had a strong run in the first half of this year after a solid 2023. Bitcoin hit a record high of $73,750 on March 14.

This year’s rally gained momentum after the Securities and Exchange Commission approved 11 spot Bitcoin exchange-traded funds (ETFs) in January. The approval aims at providing both individual investors and large institutions with a regulated and accessible platform to invest in Bitcoin.

However, the rally lost steam in April, and even the Bitcoin halving event failed to boost the price. The halving event, which cuts the reward for mining new blocks in half to limit the total Bitcoin supply to 21 million, usually sparks demand and pushes prices higher. Despite this, Bitcoin experienced a sharp decline.

The rally picked up again in July but suddenly came to a halt earlier this month, with its price dropping to below $55,000. Bitcoin’s price may remain rangebound for a while but the anticipated rate cut in September is likely to give Bitcoin and the overall cryptocurrency market a boost.

Crypto Stocks to Watch

We have narrowed our search to four crypto-oriented stocks that have strong potential for 2024. Each of our picks carries either a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA Corporation

NVIDIA Corporation is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, NVDA’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

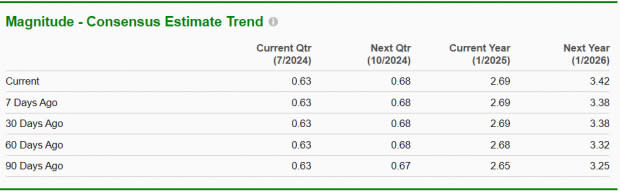

NVIDIA has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last 60 days. NVDA presently has a Zacks Rank #2.

Image Source: Zacks Investment Research

Interactive Brokers Group, Inc.

Interactive Brokers Group, Inc. is a global automated electronic broker. IBKR executes, processes and trades in cryptocurrencies. IBKR’s commodities futures trading desk also offers customers a chance to trade cryptocurrency futures.

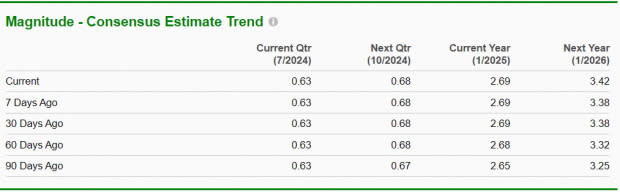

Interactive Brokers Group has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.9% over the last 60 days. IBKR currently sports a Zacks Rank #1.

Image Source: Zacks Investment Research

Robinhood Markets, Inc.

Robinhood Markets, Inc. operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin and other cryptocurrencies using its Robinhood Crypto platform.

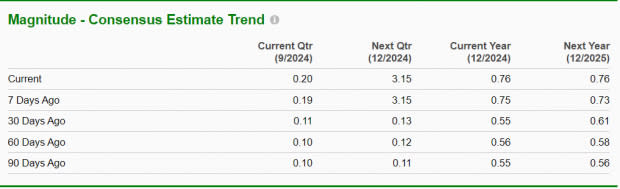

Robinhood Markets’ expected earnings growth rate for the current year is more than 100%. The Zacks Consensus Estimate for current-year earnings has improved 35.7% over the last 60 days. Robinhood Markets currently sports a Zacks Rank #1.

Image Source: Zacks Investment Research

Block, Inc.

Block, Inc. is an online digital and mobile payment platform for consumers and merchants and is the parent company of Square and Cash App. The users of Cash App can buy, sell, send and receive Bitcoin. In addition, SQ’s decentralized tbd platform allows developers to build decentralized finance applications to run on programmable blockchains. SQ is also one of the largest Bitcoin investors.

Block’s expected earnings growth rate for the current year is 99%. The Zacks Consensus Estimate for current-year earnings has improved 9.1% over the last 60 days. SQ presently has a Zacks Rank #3.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.