Artificial intelligence (AI) spending is expected to pick up the pace in 2026.

After another year of successful returns in the tech sector of the market, I have little reason to doubt that 2026 will be any different from 2025. The same trends that provided impressive returns in 2025 are still prevailing in 2026, and just because the calendar flipped a page doesn’t mean the market is done with artificial intelligence (AI).

Several companies look like excellent buys in January, and I’ve got four that top the list.

Image source: Getty Images.

1. Nvidia

Nvidia (NVDA 0.43%) has been one of the best stocks to own in the market over the past few years, and 2026 looks like it will be another successful year. The company makes graphics processing units (GPUs), and its chips are widely acknowledged as the best general-purpose chips for AI computing. This has led to outsized growth versus the competition.

Today’s Change

(-0.43%) $-0.81

Current Price

$188.03

Key Data Points

Market Cap

$4.6T

Day’s Range

$186.16 – $193.62

52wk Range

$86.62 – $212.19

Volume

5.6M

Avg Vol

185M

Gross Margin

70.05%

Dividend Yield

0.02%

Nvidia’s products are so popular that the company informed investors that it was “sold out” of cloud GPUs during Q3. Nvidia reported data center revenue of $51.2 billion during Q3, making it even more impressive that it sold out of product despite selling more than $50 billion of it during the quarter.

The supply constraint will still be present heading into 2026, making Nvidia a top pick for January.

Advertisement

2. Broadcom

One of Nvidia’s rising competitors is Broadcom (AVGO 1.21%).

Instead of making a general-purpose GPU like Nvidia, Broadcom is partnering directly with AI hyperscalers to design its own chips. These ASIC (application-specific integrated circuit) chips can outperform Nvidia’s GPUs in certain situations. They can also be acquired at a lower price point. These two advantages make Broadcom’s option incredibly popular, and this is reflected in its results.

Today’s Change

(-1.21%) $-4.20

Current Price

$343.42

Key Data Points

Market Cap

$1.6T

Day’s Range

$336.50 – $355.03

52wk Range

$138.10 – $414.61

Volume

31M

Avg Vol

28M

Gross Margin

64.71%

Dividend Yield

0.70%

During the fiscal fourth quarter of 2025 (ending Nov. 2), Broadcom’s AI semiconductor revenue rose 74% year over year to $6.5 billion. For Q1, they expect that revenue to rise to $8.2 billion, increasing its year-over-year growth rate to more than 100%.

That monster growth makes Broadcom a top stock to consider buying in January.

3. Taiwan Semiconductor

Regardless of whether you’re looking at Nvidia, Broadcom, or one of the other chip manufacturers, they all have to get the semiconductors that go into them from somewhere. Neither of these two has its own production capabilities, and a lot of the chip manufacturing work is sent to Taiwan Semiconductor (TSM +0.80%).

This makes Taiwan Semiconductor a neutral way to play the AI investment trend. While each company will be battling for a computing share in data centers, a Taiwan Semiconductor investment is a bet that data center capital expenditures will continue to rise. That’s a safe bet, making Taiwan Semiconductor a strong buy in 2026.

4. Meta Platforms

Meta Platforms (META +1.22%) took a tumble after reporting third-quarter results. While Meta’s growth was strong (its revenue increased 26% year over year), the market was fixated on one thing: capital expenditure growth.

Meta informed investors that their capital expenditure growth would be greater than the dollar growth from 2024 to 2025. Capital expenditures in 2024 were $39 billion, and were expected to be between $70 billion and $72 billion for 2025. It appears that in 2026, Meta could spend more than $100 billion on capital expenditures.

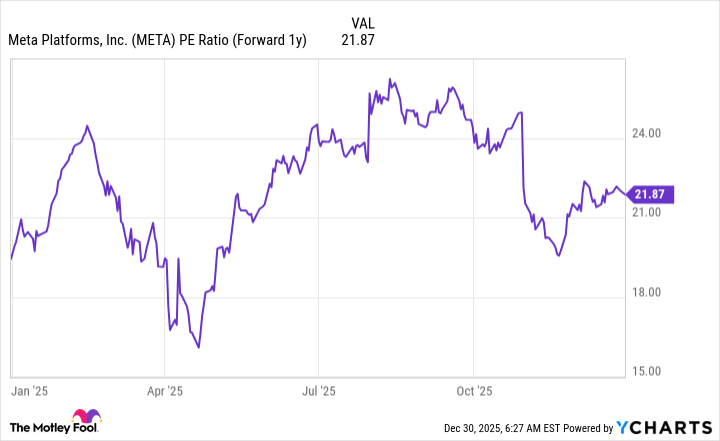

That scared a lot of investors out of the stock, but I think massive growth like this will become more common among the AI hyperscalers. Still, Meta’s stock is attractive at about 22 times forward earnings.

Meta PE Ratio (Forward 1y) data by YCharts

I think the market will come back around to Meta’s stock in the new year, making it a great option to buy now.