Nvidia’s stock turned many investors into millionaires.

Nvidia (NVDA 1.99%) is on one of the greatest runs investors have seen over the past few years. However, its dominance has been going on for much longer than that. Nvidia and its market-leading GPUs (graphics processing units) have given investors nearly unparalleled performance over the past decade. You’re likely a millionaire if you invested a fairly reasonable amount of money in its stock a decade ago and never sold.

I think investors can also find a few key takeaways from Nvidia stock, as its situation may not be as unique as you think.

Nvidia’s run was interrupted a few times

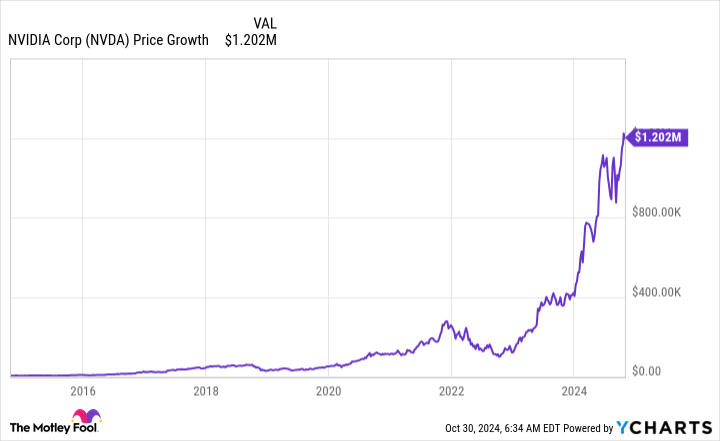

If you had invested just $4,000 in Nvidia stock a decade ago, this is how much your initial investment would be worth right now:

That’s an unbelievable run in just a decade and may leave many investors kicking themselves that they didn’t make the choice 10 years ago to buy the stock. However, that’s the wrong way to look at it. While Nvidia is unique, stocks that go on unbelievable runs are not. You can usually find a few companies that do it each decade, making these stocks rare.

The hardest thing to do is to identify them and hold on throughout all the ups and downs.

Starting with the downs, it wasn’t all a smooth ride up for Nvidia investors. Over the past decade, Nvidia went through two periods where it lost over half of its value. The chart below shows the percentage off of its last high, which helps illustrate the depths of various drawdowns.

Most recently, in late 2022, investors had to deal with a 66% decline that decimated all of the returns since 2020.

So, one factor investors must keep in mind if they are going to capitalize on these long-term winners is that there will likely be huge drawdowns that make it seem like the only answer is to sell. However, investors need to ask themselves if the current issue will cause the stock to remain down five years from now. If the answer is yes, it may be time to consider selling. If it is no, then you’ll need to ignore what the rest of the market is doing and be patient.

This isn’t easy, but it’s the only way to hold a stock long enough to see $4,000 transform into $1 million.

Unfortunately, buying and holding is pretty easy compared to identifying companies with this kind of potential.

Finding companies with mass market upside is key

When looking for companies with massive upside, the biggest thing I look for is mass market appeal. Essentially, does this company have a product that could affect nearly everyone in the world?

This mindset would have captured huge winners like Amazon and Alphabet, as the masses use their products and have shifted how people act.

Unfortunately, Nvidia slipped under this radar screen. Because its primary product is the GPU, which was originally designed for processing gaming graphics, investors would have been forgiven if they didn’t see the bigger picture. GPUs are incredible pieces of hardware that can process multiple calculations in parallel, which makes them useful in data centers for tasks like engineering simulations or artificial intelligence (AI) model training. The latter is what caused Nvidia’s latest run, and it’s a trend that many investors knew would eventually occur.

So, with Nvidia producing a product that could eventually have a mass market impact, it could have been pinpointed as a stock with a huge upside. I’m not saying it would have been obvious a decade ago, but there were signs.

Investors can use these screens to look for companies that have the potential to impact how humans live and do business. If you find one, the best thing to do is to hold it through the ups and downs. Five years from now, what is dragging it down today may not matter.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool has a disclosure policy.