Hookipa Pharma Inc., a biotech that’s using arenavirus-based platforms to develop treatments targeting infectious diseases and cancers, priced its initial public offering on the low end of its range late Wednesday.

The company said it will sell 6 million shares at $14 each, after previously saying it would offer 6.7 million shares priced at $14 to $16 each. Hookipa HOOK, +0.00% raised $84 million, and is expected to debut on the Nasdaq exchange Thursday under the ticker symbol “HOOK.”

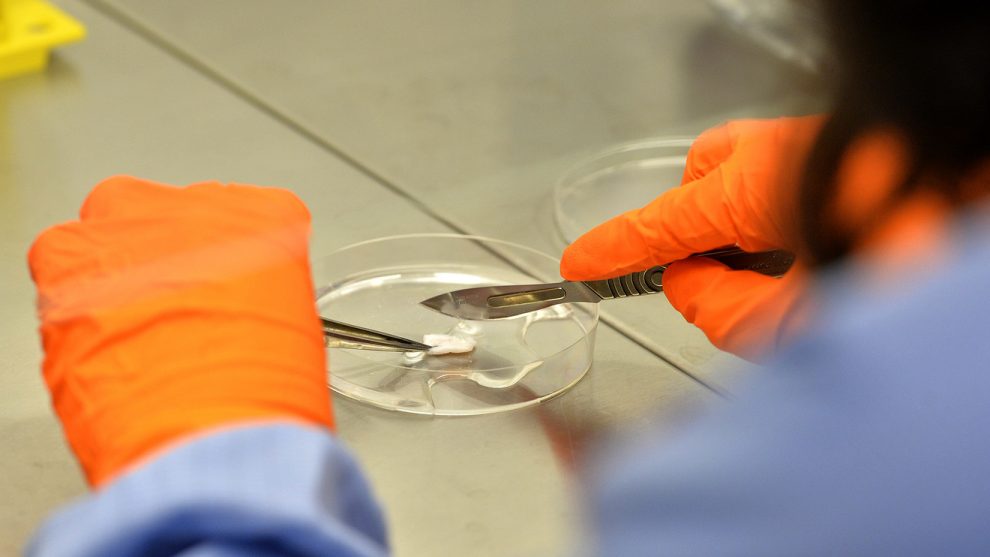

Only one of Hookipa’s six pipeline drugs is in the clinical stage of development. It’s a therapy called HB-101, meant to treat cytomegalovirus (CMV), a common virus that is generally clinically benign in healthy people but can cause serious issues in people who are immunocompromised. HB-101 uses Hookipa’s VaxWave technology, an arenavirus that can induce a strong immune response against infectious disease but does not replicate. The other five pipeline drugs, all in preclinical stages of development, target hepatitis B, human immunodeficiency virus (HIV), cancers caused by human papilloma virus (HPV) and prostate cancer. The oncologic therapies use the company’s TheraT technology, which is based on the arenavirus but is supposed to produce an even more powerful immune response.

Related: IPO market comes back with a bang as Pinterest launches at a discount

Also: Opinion: With Lyft offering, the IPO casino is now open

Like many biotech prospectuses, Hookipa’s S-1 is filled with language about the speculative nature of biotech and the fact that the company has operated at a loss since its inception. “We are not profitable and have incurred losses in each period since our inception in 2011,” Hookipa wrote, noting it reported net losses of $12.7 million and $16.7 million in the years ended 2017 and 2018, respectively. The company added that it expects to continue to incur significant losses for the foreseeable future, another statement commonly found in biotech prospectuses.

Bank of America Merrill Lynch, SVB Leerink and RBC Capital Markets are joint bookrunners on the deal with Kempen acting as co-manager.

Here are five things to know about the company as it readies its IPO.

Hookipa doesn’t have sufficient personnel to properly check the company’s accounting

Hookipa disclosed in its prospectus that it does not have enough people to do proper checks and balances on its numbers.

“Prior to this offering, we have been a private company with limited accounting personnel and other resources with which to address our internal control over financial reporting,” the company wrote in its prospectus, adding that it “did not maintain a sufficient complement of resources with an appropriate level of accounting knowledge, experience, and training, which would allow for appropriate monitoring, presentation and disclosure, and internal control over financial reporting.”

“Specifically, we have not designed and implemented a sufficient level of formal accounting policies and procedures. Additionally, the limited personnel resulted in our inability to consistently establish appropriate authorities and responsibilities in pursuit of our financial reporting objectives, as demonstrated by, amongst other things, our insufficient segregation of duties in their finance and accounting functions,” Hookipa wrote.

A situation like this opens up the opportunity for accounting mistakes and, in the worst case, fraud.

There are some holes in Hookipa’s insurance coverage

Hookipa does not carry biological or hazardous waste insurance, and its property, casualty and general liability insurance policies specifically exclude coverage for damages arising from biological or hazardous waste exposure or contamination, according to the company’s prospectus.

“Accordingly, in the event of contamination or injury, we could be held liable for damages or be penalized with fines in an amount exceeding our resources, and our clinical trials or regulatory approvals could be suspended,” the company wrote.

The company does carry general liability, employment practices liability, property, umbrella, and directors’ and officers’ insurance, but noted that “operating as a public company will make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified people to serve on our board of directors, our board committees or as executive officers.”

Pharmaceutical giant Gilead is a drug development partner

In June, Gilead Sciences Inc. GILD, -2.00% obtained exclusive rights to Hookipa’s TheraT and VaxWave technologies for HBV and HIV in a deal where the drug maker agreed to fund all related research and development activities and Hookipa would be eligible to receive tiered royalties on net sales.

Under the terms of the agreement, Hookipa received $10 million from Gilead up front and will be eligible to receive milestone payments up to a total of more than $400 million.

Read: Wall Street is buzzing about Gilead’s rheumatoid arthritis drug. Here’s why

A significant chunk of Hoopika’s research and development operations are located in Austria, and the Austrian government has helped bankroll some of Hookipa’s programs

Hoopika was originally incorporated in Austria in 2011. In February 2017, the company reorganized and became a U.S. company. Hookipa wrote in its prospectus that it has “significant” research and development operations in Austria and sources third-party manufacturing, consulting and other services in the European Union.

The company has also contracted “numerous” funding agreements, including below-market loans and grants, with an agency of the Austrian government to partially finance its research and development programs, according to the prospectus. That includes “personnel costs, material costs, third-party services, travel expenses and research and development infrastructure use,” the company said. As such, Hookipa needs to get approval for any significant changes it makes in the cost structure of any research and development programs the government funds.

Hookipa is entering a crowded space

In CMV research, Hookipa faces significant competition from companies such as Helocyte, Inc., VBI Vaccines, Inc. VBIV, -1.44% Moderna, Inc. MRNA, -1.18% SL VaxiGen, Inc., Merck & Co. MRK, -4.69% GlaxoSmithKline GSK, -0.72% and Pfizer, Inc. PFE, -2.54% all of whom have approved drugs or drugs in the pipeline for CMV management, including vaccines, in some cases.

For HPV-associated cancers, there’s competition from Gilead’s Kite Pharma, which is developing an early-stage CAR-T therapy with the National Cancer Institute, and Advaxis, Inc. ADXS, -4.35% which is working on a Phase 3 immunotherapy to treat cervical cancer. ISA Pharmaceuticals B.V. is working with Regeneron Pharmaceuticals, Inc. REGN, -6.72% to develop a combination immunotherapy consisting of ISA’s ISA101b and Regeneron’s cemiplimab, and BioNtech AG is developing a personalized cancer vaccine.