Amazon stock is due to rise again over the next year.

Before buying a stock, I always like to see what Wall Street analysts say about it. While this isn’t the final yes or no on my checklist, I do it to ensure I haven’t missed anything.

Wall Street analysts offer one-year price targets for a stock, and for those following Amazon (AMZN 0.04%), their average target is $224, indicating 20% upside from today’s price. Furthermore, 45 of those 47 analysts say that Amazon is a buy, while the other two say it is a hold.

I agree with the majority: I think it’s a fantastic stock to buy right now.

Amazon’s service divisions are the real reason to invest in the stock

Most people know Amazon because of its e-commerce store, which has nearly anything you could want. However, that’s probably the worst reason to own the business. It’s a low-margin segment and growing slowly (sales rose 5% year over year in the second quarter).

Instead, the more attractive reasons to invest are its service divisions. The three that are most important to Amazon are its third-party seller services, advertising services, and Amazon Web Services.

Its third-party seller services segment has become a crucial part of Amazon’s business. It is its second-largest revenue segment, providing a nice profit boost without much risk. Because Amazon has built out a large warehouse footprint and logistics network to deliver goods from seller to buyer, it makes sense that it offers this service to third-party sellers that want to be on the Amazon network. This helps the company because it doesn’t have to maintain the product inventory; it’s the responsibility of the third-party sellers.

Advertising is a rising star for Amazon. It is currently the fastest-growing segment (revenue rose 20% in the second quarter), and it’s not done yet. Management says that while it has seen strong growth, it believes these are still the early innings of what is possible in video advertising. Ads also provide a huge profit boost for its commerce business, part of the reason profit margins have risen in recent years.

Lastly, Amazon Web Services (AWS), the company’s cloud computing wing, is currently the largest cloud provider by market share. While AWS had a weak 2023, this year has been fantastic as new AI workloads have come online. This has caused growth to accelerate in three straight quarters, and I’m willing to bet it will notch a fourth consecutive quarter when it reports on its third quarter later this month. AWS is also a huge profit contributor, making up 64% of operating profits despite only 18% of revenue.

Amazon is doing great as a business, and its fastest-growing segments also happen to be its most profitable ones, which is why margins have seen a strong improvement.

Amazon’s stock is pricey right now

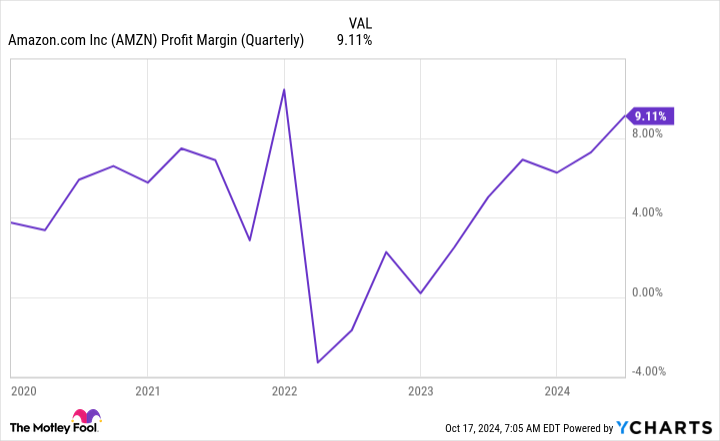

Since its profit margins dipped in 2022 due to overspending, Amazon’s efficiency has dramatically improved in recent quarters.

AMZN profit margin (quarterly); data by YCharts.

Investors will continue to watch this trend to ensure its profit margin moves higher, but Amazon’s key goal will be to sustain these elevated margins. This is also why the valuation looks pricey, as its trailing price-to-earnings ratio (P/E) is expensive.

AMZN PE ratio; data by YCharts.

However, when 2025 earnings are used, it looks much more reasonable (although still pricey). Amazon has many tailwinds, and the growth of its three most important business segments is crucial. If it can maintain this high growth and continue to expand profits, it will be a successful investment for years to come and easily surpass Wall Street’s one-year average price target of $224.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.