(Bloomberg) — All it took was a few mentions of Medicare for All this spring and suddenly health-care bulls were stuck with a $300 billion loss. For investors just warming to a government that professed to put their interests first, the chill has been palpable.

Everywhere you look, policy prescriptions from an avowedly more progressive wing of the Democratic Party are threatening to undo the loving embrace Wall Street has enjoyed under Donald Trump’s presidency. Upstarts who just swept into power, and those with their eyes on 2020, want everything from a breakup of big tech to a ban on buybacks.

Forget about whether any of it passes. The mere existence of a reinvigorated progressive class is already raising temperatures.

“Most people think that they don’t have to worry about it today,” Ryan Primmer, head of investment solutions at UBS Asset Management, said in an interview. “But we can just look at what’s happened with health care as an indication that you don’t know when it’s going to come.”

Doubt people are paranoid? Consider Stephen Schwarzman’s comments Monday at the Milken Institute conference in Los Angeles. The Blackstone CEO and former Trump adviser warned that policies outlined by Democratic candidates threaten to slow the expansion, particularly a big change in taxes.

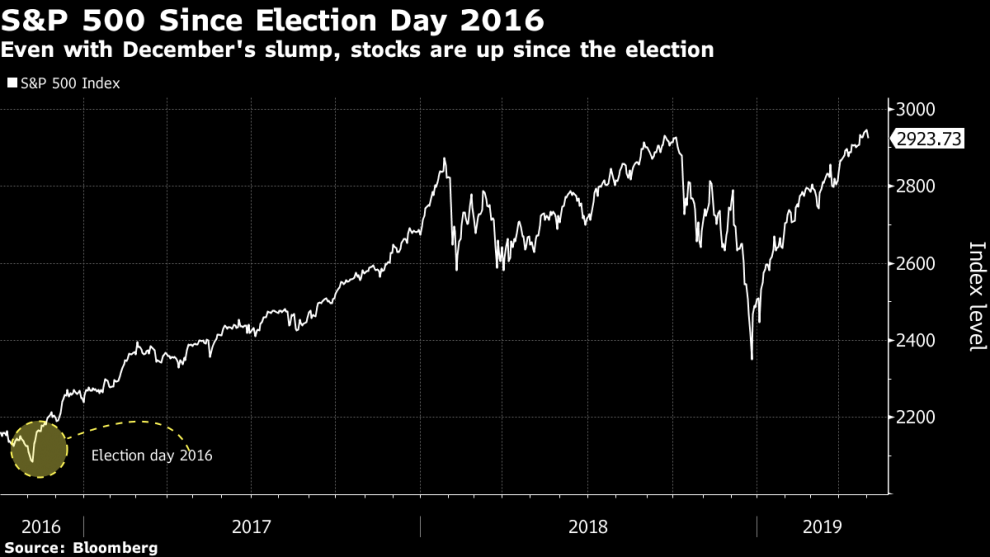

Few presidents have aligned themselves with markets as closely as Trump, who cheers records in the Dow Jones Industrial Average and browbeat Federal Reserve Chairman Jay Powell for raising rates. His sweeping overhaul of corporate taxes capped a 35 percent rally in the S&P 500. Not everything has helped, but the image of a Republican-controlled government united in the cause of stocks was one many investors had begun to savor.

Enter the opposition, its flag borne by the likes of Congresswoman Alexandria Ocasio-Cortez, whose condemnation of Amazon.com helped keep it from building a New York headquarters. Stocks may remain near record highs and few candidates frame themselves as the outright enemy of equities. But the episodes are evidence that plenty of Democratic contenders don’t view preserving profit margins as a top priority.

“That really is the polar opposite of what the Trump administration has done,” said Mark Stoeckle, CEO and senior portfolio manager of Adams Funds, which has about $2.5 billion under management.

‘Greed is going to end’

Not that the candidates are shedding any tears. A campaign aide for Senator Bernie Sanders — who is running for the Democratic nomination — touted the concerns among investors as a victory that signals growing support for his ideas like Medicare for All. The aide said it shows that investors who didn’t consider Sanders a real threat before now believe he can win.

Senator Elizabeth Warren’s campaign didn’t return messages seeking comment on the impact of her proposals on the stock market. But both candidates have focused on highlighting the disparity between upper-income Americans enjoying an economic boom and poorer ones who aren’t invested in stocks and have seen real wages flatline.

Warren and Sanders have called for sharply raising taxes on wealthy people and corporations — often calling them out by name — to finance an expansion of the safety net. “Do you happen to know — anybody here happen to know how much Amazon paid in taxes last year?” Sanders said at a CNN town hall last week. “Zero. All right? Owned by the wealthiest guy in America. That is an absurd tax system, a regressive tax system.”

Warren recently warned that major technology firms are hurting entrepreneurs. “The area around these giants are referred to by venture capitalists, investors, as the dead zone because it means you try to start up a business, you just run the risk that Amazon steps in front of you or Google steps in front of you or they buy you out before you have a chance to get started,” she said last week at the same series of CNN town halls.

The health-care rout intensified when UnitedHealth Group Inc. waded into the debate over Medicare for All. The proposal to expand Medicare, which covers about 60 million mostly elderly Americans, would “surely have a severe impact on the economy and jobs, all without fundamentally increasing access to care,” the company’s CEO said on a recent call with analysts, igniting a sell-off.

Democrats remain divided over government’s role in health care and markets have started weighing the severity of the threat. Sanders proposes replacing private health insurance providers with a government-run plan that covers primary care, going so far as to tweet that UnitedHealth’s “greed is going to end.”

Breakup of Monopolies

Other election themes bear watching, say bulls. They include stiffer regulation and the breakup of large companies, something Warren is advocating. Her proposal could see the dissolution of tech megacaps like Amazon.com Inc., Alphabet Inc.’s Google and Facebook Inc., which she’s called monopolies that harm innovation and small business.

“Today’s big tech companies have too much power — too much power over our economy, our society, and our democracy,” Warren wrote in a recent blog post. “They’ve bulldozed competition, used our private information for profit, and tilted the playing field against everyone else.”

Warren’s motion hasn’t done much to the tech sector. Shares of Facebook barely budged following her announcement — ditto for Amazon and Alphabet. But critics say the proposal has the potential to be disruptive in a market that these firms all but dominate.

“You might see Facebook and Google and Amazon try to be broken up. That’s always a risk,” Gary Bradshaw, a portfolio manager at Hodges Capital Management in Dallas, said by phone. “There’s always been this political jargon and fighting and hell raising, so to speak, over the years.”

Sanders is calling for the dismantling of megabanks, which he says are so large they pose dangers to taxpayers and hurt the middle class. “We will no longer tolerate the greed of Wall Street, corporate America and the billionaire class,” reads a statement on his website.

The House Financial Services Committee has already held hearings about accountability, where Democrats questioned the heads of the nation’s biggest banks about consumer issues, the stability of the banking system and compensation. Representative Maxine Waters, chair of the committee, said that, behind the scenes, she told the executives: “Please do not overwhelm us with requests for deregulation.”

Breaking Buybacks

Corporate governance is also emerging as an election issue, with top Democrats focusing on buybacks. Sanders, along with Senate Minority Leader Chuck Schumer, proposed restrictions for companies repurchasing their shares unless they first increase workers’ pay and benefits.

“When more than 80 percent of corporate profits are going to stock buybacks and dividends, something is really wrong in the state of corporate America and the state of our economy,” Schumer said recently.

That has put some Wall Street firms on the defensive. A ban on buybacks — which, by some estimates, topped $800 billion last year — would spur stock volatility and the bull market would lose one of its staunches allies, hurting growth in per-share earnings, according to strategists at Goldman Sachs.

To be sure, the political cycle is just starting to heat up and there are about 550 days until the 2020 election.

“There’s a lot of work to be done between now and November 2020,” Tom Essaye, a former Merrill Lynch trader who founded “The Sevens Report” newsletter, said in an interview. “As a reference point, at this point four years ago, I don’t even think Donald Trump was in the race. A lot can change.”

–With assistance from Sahil Kapur.

To contact the reporters on this story: Vildana Hajric in New York at [email protected];Sarah Ponczek in New York at [email protected]

To contact the editors responsible for this story: Jeremy Herron at [email protected], Chris Nagi

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”79″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.