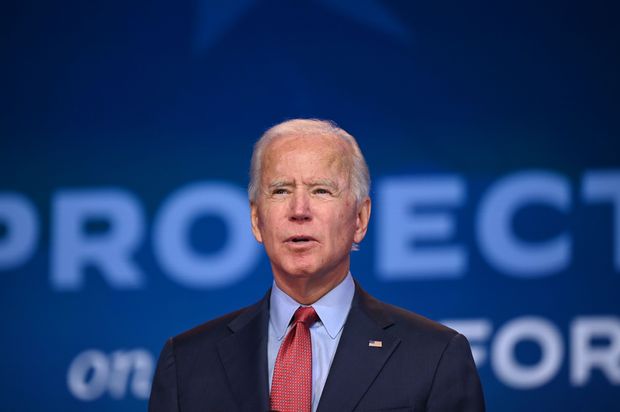

Democratic presidential candidate Joe Biden speaks just days ahead of Tuesday’s election.

Jim Watson/Agence France-Presse/Getty Images

A win for Joe Biden in the presidential election is likely to be beneficial for European stocks, strategists say, with a number of sectors set to stand out.

The Democratic nominee and former vice president has long held a lead in the polls over President Donald Trump, although Trump was also behind in the polls going into the 2016 vote.

Strategists have begun outlining how various outcomes may impact European equities, with particular focus on what Biden’s policies might mean, as a Trump win would likely maintain the status quo.

Biden boost for Europe

Barclays strategists, led by Emmanuel Cau, said a Biden win and a Democratic sweep could be seen as more beneficial to Europe than a second Trump term.

“This is due to potentially reduced trade uncertainty, stronger U.S.-Europe ties and major fiscal stimulus, which all seem more likely under a Democratic administration,” they said. It would also boost the reflation trade and help the rotation to Rest of the World equities and value stocks, they added.

UBS strategists noted that changes in the election odds in Biden’s favor have had a positive impact on European stocks in recent weeks, more so than in Asia and the U.S. — further evidence that such an outcome could help the continent’s equities.

Read: Biden win could spur deal making rush ahead of tax hikes

Three main areas of Democratic policy, in particular, will have an impact on European equities, the Barclays team said. Biden’s proposal to increase the corporate tax rate from 21% to 28% would be more negative for U.S. than European earnings, they noted.

The UBS team broadly agreed and said: “In absolute terms after a dire 2020, European corporates may have a stronger bounce back in earnings than their U.S. peers in 2021, with the current consensus estimates pointing to the highest premium in 17 years.”

However, European stocks exposed to the U.S. that benefited from the corporate tax cut in 2017, which includes plumbing giant Ferguson FERG, -0.79% and automobile maker Fiat Chrysler, may see a haircut to their earnings, Barclays strategists warned.

Biden’s $2 trillion green energy and infrastructure plan could directly benefit some European companies, including those in construction, clean energy, and technology, Barclays strategists added. Such a spending package could accelerate the continuing shift among investors to environmental, social, and governance assets. “Europe, which is ahead of the U.S. in terms of transition toward ESG assets should thus directly benefit from the inflows into the broader theme,” they said, noting that exchange-traded funds in the clean-energy space have seen high inflows in recent weeks.

Read: Europe is now closing its doors, but its recovery has been running ahead of the U.S.

Thirdly, closer economic cooperation under a Biden administration could bring fewer tariffs, supporting emerging markets and China-exposed stocks.

“If Trump secures a second term, U.S. equity outperformance should carry on and the reflation trade falter with yield curves flattening, while continued regulatory relaxation could help sectors like tech, health care and energy,” they added.

Ultimately, they said elections typically have little impact on market performance long term, expecting equities to “resume their uptrend once the dust settles.”

Stocks set to benefit

When it comes to individual stocks, the UBS equity strategy team analyzed the sectors set to benefit from a Biden presidency and then looked at European companies within those sectors that are most exposed to the U.S.

The bank’s U.S. team identified autos, utilities, real estate, construction, and financials as being positively exposed to a Biden win, based on sensitivity to changes in election odds, fiscal stimulus, tax impact, exposure to China, and tariffs, as well as recent performance.

Read: These are the ETFs to help you prepare for a Biden presidency

The European construction sector has a strong exposure to the U.S. market, the team said, highlighting four names in particular: CRH CRH, +1.34% — the most exposed, with 22% of revenues linked to U.S. infrastructure expenditure — followed by Buzzi Unicem BZU, +3.39% with 19%, Heidelberg Cement HEI, +0.98%, and LafargeHolcim LHN, +1.20%.

When it comes to autos, they identified Fiat Chrysler FCA, -0.20%, Michelin ML, +2.20% and Daimler DAI, +0.39%. “In addition, our analysts highlight Volkswagen VOW, -1.03% as a key stock, despite somewhat lower U.S. exposure it is a beneficiary of the EV [electric vehicle] theme which should gain traction under a Democrat administration,” they said. In the other sectors — financials, utilities, and real estate — European companies have very low exposure to the U.S., they added.

Barclays analyst Lydia Rainforth said Finland-based Neste NESTE, +0.26% was the most exposed European energy name to the election result, given its sales of renewable diesel into the U.S. biofuels market. “The published Biden climate plan highlights ‘doubling down’ on the liquid fuels of the future and, as such, we see a potential Democratic win as likely firming up additional demand for renewable diesel over the medium term,” she said.