Multiple growth drivers and a trillion-dollar revenue opportunity could help this company maintain its impressive growth over the next few years.

Buying and holding solid companies with stock trading at attractive valuations for a long time is one of the best ways to make money in the stock market. Adopting this strategy allows investors to capitalize on secular growth trends and disruptive technologies. This is part of why buying shares of Nvidia (NVDA 0.75%) right now could turn out to be a smart long-term move.

The company is sitting on huge addressable markets and, but some measures, appears undervalued. Of course, the stock has also more than tripled in value over the past year. That has some wondering if Nvidia stock is overvalued right now. A closer look at Nvidia’s pace of growth suggests it is more undervalued overall. Investors might regret not buying this semiconductor giant before it soars higher. Let me explain.

Here’s why Nvidia stock is undervalued

Nvidia’s trailing price-to-earnings (P/E) ratio of 70 is admittedly rich and may indicate that it is overvalued, especially when compared to the U.S. tech sector’s average P/E ratio of 44.5. But with a forward-earnings multiple of 46, there are strong indications of a big jump coming in its bottom line. That forward P/E is almost in line with the U.S. tech sector’s average.

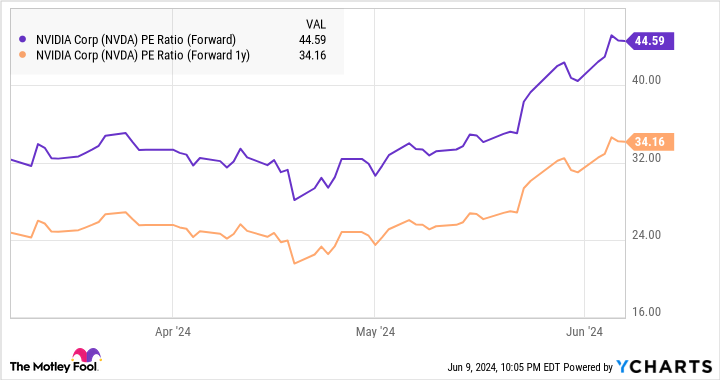

When looking beyond the next year, Nvidia’s forward P/E falls even lower.

NVDA PE Ratio (Forward) data by YCharts.

Nvidia is also quite cheap when you analyze its price-to-earnings-to-growth (PEG) ratio, a valuation metric that takes a company’s potential growth into account.

NVDA PEG Ratio data by YCharts.

The PEG ratio is calculated by dividing a company’s trailing P/E by the expected growth that it could deliver in the future. This is a forward-looking valuation metric that gives investors a better idea about how Wall Street is valuing a stock based on its future earnings growth. Investors should note that a PEG ratio of less than 1 means that a stock is undervalued. So, based on the chart above, Nvidia’s PEG ratio of just 0.09 makes it incredibly undervalued.

Buying Nvidia at this valuation looks like a no-brainer as the company sees a $1 trillion potential revenue opportunity across various markets.

The chip giant’s phenomenal growth shows no signs of slowing

Nvidia generated just under $80 billion in revenue in the trailing 12 months. Lately, the company has started growing at a phenomenal rate thanks to the terrific demand for its artificial intelligence (AI) chips.

In the first quarter of fiscal 2025, for instance, Nvidia’s revenue jumped 262% year over year to $26 billion. This solid surge was driven by a year-over-year increase of 427% in its data center revenue to $22.6 billion. Back in 2022, Nvidia pegged its revenue opportunity in the hyperscale data center and AI chip market at $300 billion.

The company generated $47.5 billion in data center revenue in the previous fiscal year. The segment’s revenue in Q1 of fiscal 2025 is evidence that it is on track to witness a big jump in this segment once again.

So, Nvidia is making solid progress on the $300 billion data center opportunity, and it won’t be surprising to see it grab a major share of this market in the future. That’s because Nvidia dominates the market for hyperscale and AI graphics cards with a share of more than 90%, which is the reason why its data center revenue is expected to grow at a stunning pace in the coming years.

Markets such as digital twins and automotive are other components of Nvidia’s potential $1 trillion revenue opportunity. For instance, Nvidia sees a $300 billion revenue opportunity in automotive chips. The good part is that the company is gaining traction in automotive, and its revenue from this segment grew 17% year over year in the previous quarter to $329 million.

There is no doubt that the automotive business is currently a small portion of Nvidia’s overall business, but a solid ecosystem of automotive customers and component suppliers could help accelerate the company’s growth in this segment.

Meanwhile, Nvidia’s Omniverse software solutions are also gaining terrific traction due to the growing adoption of digital twins, driving a 45% year-over-year jump in the company’s professional visualization-segment revenue last quarter to $427 million. Investors should not forget that Nvidia also has a massive growth opportunity available in the gaming market where it stands to gain from the growing adoption of AI-enabled personal computers (PCs).

In all, it won’t be surprising to see Nvidia becoming a much bigger company a few years from now thanks to the multitude of catalysts it is sitting on and the dominant position it enjoys in key markets such as those for AI chips. The company finished the previous fiscal year with $12.96 per share in earnings, and you can see in the following chart that its bottom line is set to surge over the next three years.

NVDA EPS Estimates for Current Fiscal Year data by YCharts.

As such, there are ample reasons for investors looking to buy a growth stock to add Nvidia to their portfolios. And now that you’ve seen how attractively valued Nvidia is right now in light of the potential growth that it is expected to deliver, buying it looks like a no-brainer as it could keep delivering healthy gains for a long time to come.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.