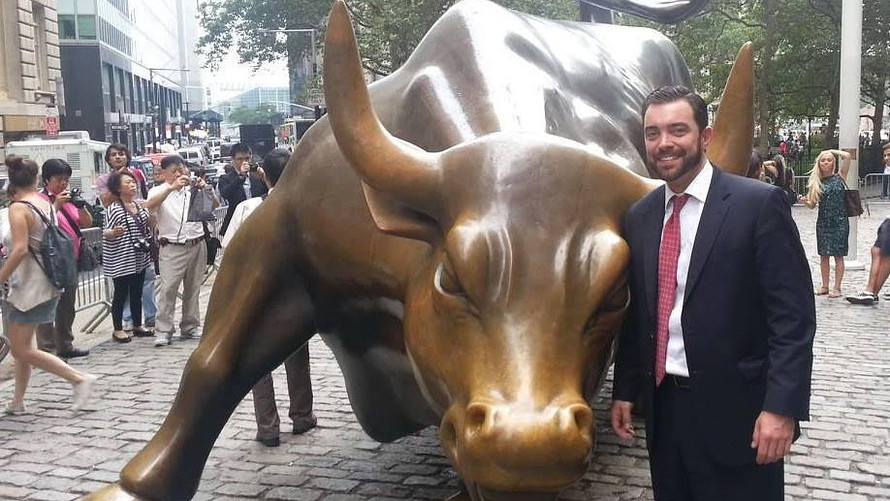

Vance Barse is a San Diego, California-based financial advisor who runs a company called “Your Dedicated Fiduciary.”

The financial advice industry is often seen as bifurcated between broker-dealers, who execute trades for clients on a commission basis, and Registered Investment Advisors, who provide wider sets of financial advice for a fee, and who have a fiduciary duty to their clients.

But Barse, whose company serves 55 households around the country, is neither. He is an Investment Adviser Representative. And he is also an Accredited Investment Fiduciary, a designation that demonstrates he’s met certain criteria to act as a fiduciary for clients — that is, in their best interest.

Clear as mud, right? For anyone who thinks the business of buying financial advice ought to be easier to understand, industry observers aren’t very hopeful. Consumers are on their own and regulators aren’t likely to be much help, many think. That notion is especially evident now, as financial services professionals get used to a new industry rule taking effect June 30.

Regulation Best Interest, which was developed as a successor to the Fiduciary Rule proposed by the Obama administration’s Department of Labor, has an innocuous name. But industry observers say it’s confusing, scattershot, and designed to protect industry, not investors.

“The standard doesn’t do enough to strengthen the regulatory obligations of broker-dealers or investment advisors,” said Barbara Roper, director of investor protection for the Consumer Federation of America. “It doesn’t do enough to assist investors in making informed choices between broker-dealers and investment advisers. Everything it set out to do, it has failed. And that is precisely because the (Securities and Exchange Commission) chose to prioritize not disrupting the broker-dealer business model over protecting investors.”

Related: What is asset allocation?

As Barse’s business shows, the line between broker-dealers and advisers is becoming more blurry with time.

“Brokers have evolved into advisors of sorts,” Roper told MarketWatch. “No-one pays for brokerage services to have someone conduct the transaction. You can do that now with the click of a mouse.”

Research shows that most retail investors “don’t understand the differences between broker and advisor, they don’t have the financial sophistication to make their own decisions, that they are going to rely, almost without exception, on the advice of the professionals, and they can’t begin to understand the web of toxic conflicts of interest that encourage brokers to make recommendations that are not actually in their best interest,” Roper said.

“People don’t know what they don’t know,” said Jonathan Reuter, an associate professor of finance at Boston College’s Carroll School of Management.

“The sorts of people who need financial advice tend to be lower-income, younger, and less experienced. And if you don’t understand financial markets and someone says here’s my standard contract, I don’t know that that’s going to raise red flags or give you an understanding that there are alternatives.”

One of the most concrete outcomes of Regulation Best Interest is that broker-dealers must now give clients a form that describes the services they offer and how they are paid for them, as well as any conflicts of interest or legal obligations they may have. Broker-dealers are also required, in the words of the SEC, to “identify and mitigate any conflicts of interest associated with such recommendations that create an incentive for the broker-dealer’s associated persons to place their interest or the interest of the broker-dealer ahead of the retail customer’s interest,” but Roper argues that the agency never explicitly explains what mitigation should entail.

Reuter, whose past research was one of the models for the defunct Fiduciary Rule, isn’t a fan of Regulation Best Interest, either. “It’s not saying the broker-dealers need to be held to a fiduciary standard or put clients’ interests first,” he said in an interview. “It’s saying they can’t put clients’ interest last.”

But unlike Roper, he sees it as a positive first step. Even if the disclosures seem like useless make-work, he thinks some financial firms may at least start to take to heart some of the spirit of the regulation. And if firms actually develop their own disclosure forms, rather than relying on industry-standard boilerplate, there’s potential for industry observers to collect the information they contain, monitor it, and possibly even develop a grading system for broker-dealers.

Read: Investing legend Burton Malkiel on day-trading millennials, the end of the 60/40 portfolio and more

While the implementation of the new regulation means broker-dealers are under the spotlight, it’s worth noting that many experts have qualms about registered investment advisers as well.

“It’s likely to be a better model for most people because it’s not distorted by commissions,” Reuter said. But it’s hard for many clients to assess RIA fees, he thinks. And that’s if they’re even able to get in the door: most RIAs will only work with clients who meet a certain threshold of assets.

Roper thinks the key is for investors to seek out advisers who voluntarily hold themselves to a higher standard of accreditation. Those with certifications as an Accredited Investment Fiduciary, like Vance Barse, or from the organization called CEFEX (Centre for Fiduciary Excellence) have decided to commit themselves to serving their clients in a fiduciary capacity.

For his part, even though Vance Barse is neither an RIA nor a broker-dealer, he has an affiliation with a large company, Commonwealth Financial Network, that provides the services of both spheres, so he’s gotten very familiar with Regulation BI.

Barse is hopeful it’s a baby step in the right direction. “It’s virtually impossible to eliminate all potential conflicts of interest,” he said. And he believes individual investors have a responsibility to educate themselves on what they want and what they’re getting. Still, the financial services industry has to meet them halfway, he said.

“In medicine, licensed doctors take the Hippocratic oath and I’m of the belief we should have the equivalent in financial services.”