This company is firing on all cylinders and gaining share in its home market.

Amazon is one of the best-performing stocks of all time. The e-commerce and technology giant is up over 1,000x since going public by taking advantage of the huge consumer shift from in-person to online shopping (among other things).

It is still a great business, but at a market capitalization of $1.9 trillion it is highly unlikely to replicate the returns of the last couple of decades. This may be disappointing for new investors who have missed the boat on most of Amazon’s gains. But what if I told you investors could own shares in the next Amazon out of East Asia?

Enter Coupang (CPNG -1.38%). The South Korean e-commerce giant is taking its home country by storm and expanding to new markets. Here’s why it could be a once-in-a-generation investment opportunity at today’s price.

The Amazon of South Korea

Founded in 2010 as a Groupon clone, Coupang pivoted to copying Amazon‘s business model but catered to the South Korean market. It has a lot of similarities to Amazon’s retail operations — a subscription membership, vertically integrated shipping, video streaming — as well as things that help it win in the small Asian country. For example, it allows customers to leave reusable return boxes outside their doors to return packages, which are picked up by Coupang drivers.

It is these types of customer value propositions that have elevated Coupang as a leading e-commerce platform in South Korea. Last quarter, it generated $7.1 billion in revenue, up 23% year over year on a foreign currency neutral basis and excluding its acquisition of Farfetch. With the growth of its third-party marketplace for other e-commerce retailers, gross profit is growing much quicker and was up 27% last quarter excluding Farfetch.

These growth rates are much faster than the entire e-commerce market in Coupang. There is around $500 billion in retail spending in South Korea each year, giving Coupang a lot of runway to grow if it can convince more customers to adopt its offering for things like food delivery and groceries.

Expansion into Taiwan?

Coupang has plenty of runway left to grow in South Korea, but this is not a giant market like the United States or China. Luckily, management is forward-thinking and has been testing different ways to expand into other Asian regions with wealthy enough consumers who can spend money on an e-commerce platform. It recently landed on Taiwan as a place for major investment.

In the region, it is setting up infrastructure to replicate the vertically integrated offering it has in South Korea and seeing strong initial growth. Revenue in Coupang’s “developing offerings” segment grew 143% year over year excluding Farfetch, with most growth coming from Taiwan. The market is small and unprofitable right now but with close to 25 million people living on the island nation, there is a big opportunity for Coupang to expand its e-commerce platform outside of Korea.

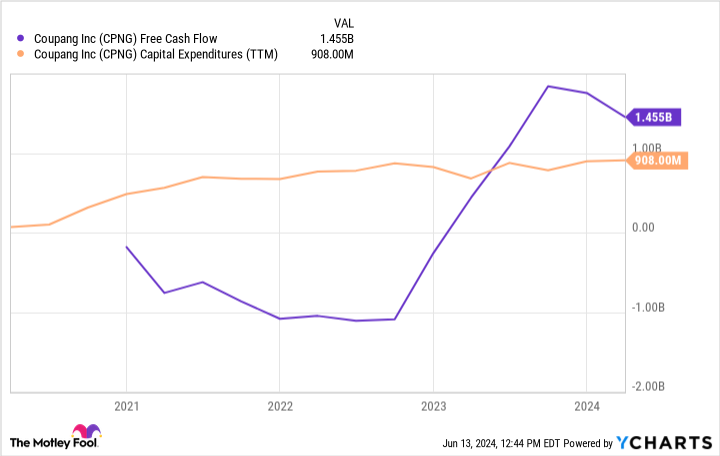

CPNG Free Cash Flow data by YCharts

The stock is cheap for patient investors

Today, Coupang trades at a market capitalization of $38 billion. Over the last 12 months, it has generated $1.45 billion in free cash flow for a trailing price-to-free-cash-flow (P/FCF) ratio of 26, which is close to the market average. However, I think the stock is set up to deliver better-than-market returns over the next five years and beyond.

First, the company’s free cash flow is depressed due to all the growth capital expenditures over the last 12 months, especially in Taiwan. It has spent close to $1 billion on new infrastructure over that time. It is also growing faster than the market average with 30%-plus gross profit growth. That level of growth will not continue forever, but I think the company is poised to grow at a double-digit rate for many years into the future.

At an earnings multiple around the market average, I think Coupang is a cheap stock for patient investors willing to hold for the long term.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon and Coupang. The Motley Fool has positions in and recommends Amazon and Coupang. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.