This article first appeared on Simply Wall St News.

Netflix’s (NASDAQ: NFLX) year so far is hard to describe by anything less than disastrous. Although the broad market is weak, the stock cratered 40%.

Even though there are still no signs of bottoming, insiders, as well as activists, are starting to step in.

See our latest analysis for Netflix

Ackman Steps In

After the massive sell-off by the end of January, Pershing Square Capital CEO Bill Ackman announced a 3.1 million shares position in Netflix. With an average price of US$390, the investment was worth US$1.2b.

He stated that the sell-off presents an opportunity to acquire a best-in-the-class business at a favorable valuation. Yet, looking into our latest data, we can see that the stock still trades at a P/E ratio over 30 and a P/S ratio of 5.4.

However, the market trusts the contrarian instincts of Mr.Ackman, especially after he made US$2.6b in the 2020 turmoil and an additional US$1b in the 2021 hedge against inflation.

Hastings Makes a Big Bet

The Co-Founder, Wilmot Hastings, made the most significant insider purchase in the last 12 months. That single transaction was for US$20m worth of shares at US$393 each. That means that even when the share price was higher than US$362 (the recent price), an insider wanted to purchase shares. While their view may have changed since the purchase was made, this suggests they have had confidence in the company’s future. In our view, the price an insider pays for shares is significant.

Generally speaking, it catches our eye when an insider has purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price.

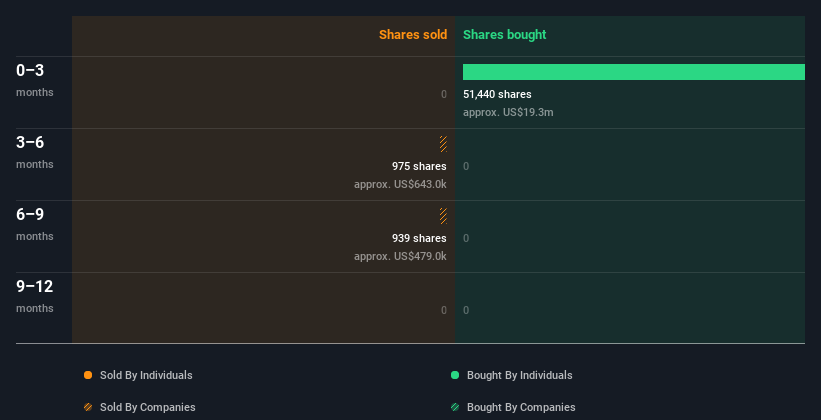

The chart below shows insider transactions (companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Netflix is not the only stock that insiders are buying. For those who like to find winning investments, this free list of growing companies with recent insider purchasing could be just the ticket.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely that insiders will be incentivized to build the company for the long term. Netflix insiders own about US$2.1b worth of shares (which is 1.3% of the company). It is good to see this level of insider ownership because it increases the chances that management is thinking about the best interests of shareholders.

Conclusion

Pershing Square Capital Management has around US$13b of assets under management. Thus, taking a US$1.2b stake in Netflix is significant. Bill Ackman likely sees value in the stock, but it wouldn’t be surprising to see him influencing management’s decisions.

Although Co-CEO’s insider purchase of US$20m looks great, it is insignificant compared to his existing stake of US$1.9b. We’d rather see independent directors who don’t own any shares use this sell-off to acquire some at this valuation.

While we like knowing what’s going on with the insider’s ownership and transactions, we also consider what risks are facing a stock before making any investment decision. Be aware that Netflix is showing 3 warning signs in our investment analysis, and 2 of those are concerning…

But note: Netflix may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.