Yahoo Finance tech reporter Dan Howley outlines Activision Blizzard’s second-quarter earnings report, looking at the status of the game company’s acquisition deal with Microsoft.

Video Transcript

SEANA SMITH: Activision Blizzard out with its earnings results. Dan Howley has that for us. Dan.

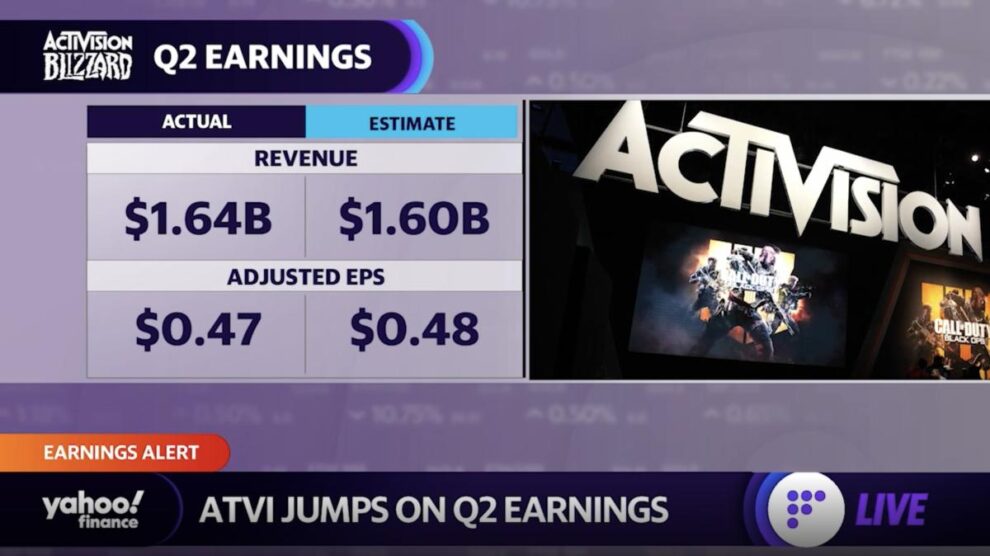

DAN HOWLEY: That’s right. We have a beat on the top line for Activision Blizzard. They came in at bookings with $1.64 billion. That’s versus the expectations of $1.59 billion. Now, they did miss slightly on earnings per share. That came in at $0.47 versus expectations of $0.48. Now, the bookings for this quarter were actually down 14% year over year. And that’s a result of that kind of industrywide slowdown we’re starting to see as the COVID hangover hits the gaming industry.

People are interacting with games less, jumping online less, and therefore spending less on these kinds of titles. That said, Activision Blizzard does have a strong lineup coming later this year, including a new version of “Call of Duty,” a new version of the free to play “Call of Duty Warzone,” as well as a new version of “Overwatch.” So that could help buoy it into the holiday season.

SEANA SMITH: Yeah, good. And, Dan, I think lots of focus on this earnings call. At least a couple of questions are going to be about Microsoft’s $69 billion deal to buy Activision. A couple of notes out recently saying that it will likely get approved. Any more color on that, I think, is what TheStreet is going to be looking for. Again, shares after hours up just a bit, up about 1%, Dave.

DAVE BRIGGS: Why do you– what do you make of the fact that there really hasn’t been much of an arbitrage play betting that that deal will go through? It’s still about 17% below what Microsoft agreed to pay in that massive purchase. And no one’s really betting on the stock that it will go through, which is strange. I don’t know what your takeaway is from that. I hate to put you on the spot, but many people thought people would pour in. I think Warren Buffett made a slight bet on the arbitrage.

SEANA SMITH: No, I think that’s a really good point. And we’re going to have an analyst coming on. He has a hold rating on the stock, 86 price dollar target. And he thinks– he’s relatively optimistic, I believe. We’re going to double check with him that that’s still the case.

DAVE BRIGGS: Yeah, he is, yeah.

SEANA SMITH: But in the most recent note, that it’s going to go through. So I don’t know what the disconnect there is.

DAVE BRIGGS: But why aren’t investors, right?

SEANA SMITH: I know. I know. I think there’s some hesitation. I think a lot of it goes back to the apprehension from the Biden administration on some of these similar type of deals, I don’t know, just in terms of–

DAVE BRIGGS: Oh, it’s definitely a pattern.

SEANA SMITH: –competition in the space. And maybe that is still being priced in here. Rachelle, what do you think?

RACHELLE AKUFFO: I mean, investors are clearly still bullish on this. The stock is up about 20% year to date. So even though we are seeing this slowdown in gaming we’re seeing, especially when it comes to PC gaming, still a lot of room for growth. As we were talking about things like the esports market, still room to grow in the gaming market perhaps outside of the US market. But Activision, at least for now, year to date, the stock up there at 20%, as you can see, and still in mildly positive territory after releasing that earnings data there, up about 3/4 of a percent.