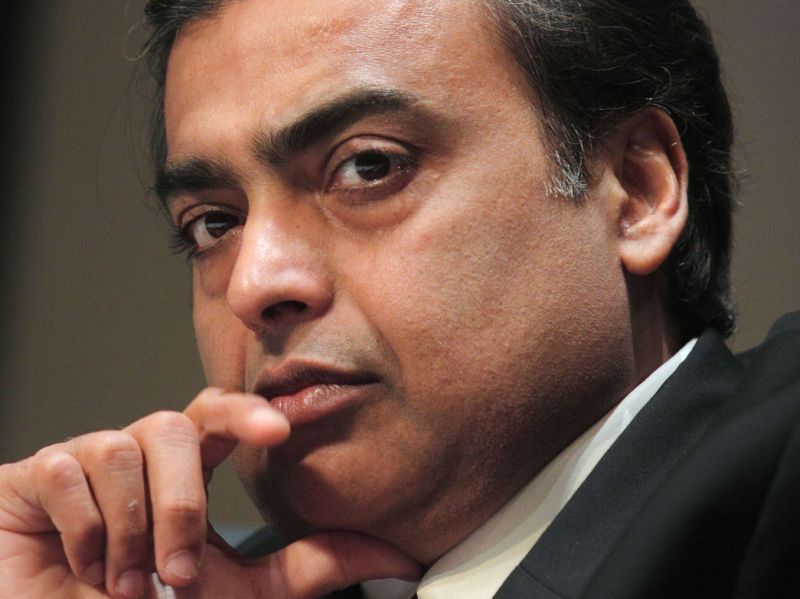

(Bloomberg) — After raising more than $20 billion for his digital venture in three months, billionaire Mukesh Ambani is readying his retail unit for global partners, as his oil-to-petrochemicals conglomerate turns to India’s billion-plus consumers for growth.

Asia’s richest man and the chairman of Reliance Industries Ltd. told shareholders Wednesday that Reliance Retail Ltd. is getting inquiries from investors and may start bringing some on board in the coming months. The legacy petrochemicals business is also getting attention from potential investors even though a proposed stake sale to Aramco isn’t proceeding as planned, he said.

“We’ve received strong interest from strategic and financial investors in Reliance Retail,” Ambani told the 300,000-plus people who logged into the virtual conference from 41 countries. “We will induct global partners and investors in Reliance Retail in the next few quarters.”

The 63-year-old tycoon has identified technology and retail as future growth areas in a pivot away from the energy businesses he inherited from his father who died in 2002. Retail is the next frontier for Ambani, who just finished selling almost 33% of his digital venture over the past three months to a slew of investors including Silicon Valley giants Facebook Inc. and Google, valuing Jio Platforms Ltd. at $58 billion.

Reliance Retail, which runs supermarkets, India’s largest consumer electronics chain store, a cash and carry wholesaler, fast-fashion outlets and an online grocery store called JioMart, reported 1.63 trillion rupees ($22 billion) in revenue in the year through March 2020. The unit operates almost 12,000 stores in nearly 7,000 towns.

Although Ambani laid out a vision for a technology future for Reliance Industries at the shareholders meeting, shares of the conglomerate slumped. The tycoon confirmed that a planned sale of stake in Reliance’s oil-and-chemicals division to Saudi Arabian Oil Co. for an estimated $15 billion hadn’t progressed as planned, disappointing investors.

Frenzied Fundraising

The stock fell 3.8% Wednesday, the biggest loss since May 14, paring gains from a rally spurred by the frenzied fundraising by Jio. The shares are still more than double their value when they reached a low on March 23.

But most of Ambani’s focus during his 93-minute presentation to shareholders was on technology. He, along with his children Isha and Akash Ambani, unveiled a slew of services, including a fifth-generation wireless network as early as next year and a mega video-streaming platform that will bring Netflix, Disney+ Hotstar, Amazon Prime and dozens of other TV channels under one umbrella.

“I believe that the time has come for a truly global digital product and services company to emerge from India, and to be counted among the best in the world,” he said.

Jio Platforms, unveiled last year, is now at the center of his ambitions to tap a billion Indians increasingly embracing mobile devices and data plans to shop online. Jio is eyeing an opportunity to shake up retail, content streaming, digital payments, education and health care.

Giant Rivals

Those plans would put Jio in direct competition with e-commerce giant such as Amazon.com Inc. and Walmart Inc.’s local operations. Alphabet Inc.’s Google is the latest to join Jio as an investor, with Wednesday’s announcement of a $4.5 billion investment for a 7.7% stake.

“Each of the new hyper growth engines have high customer acceptance opportunity with scale, and will be multiple times current valuation, making the traditional oil and gas business a less than 20% contributor to valuation going forward,” said Chakri Lokapriya, chief investment officer at TCG Asset Management in Mumbai.

Here are some of the plans laid out by Ambani:

Google and Jio are partnering to build an Operating System that could power a cheap 4G/5G smartphone.JioMart, the online shopping portal, and WhatsApp will be working closely to create growth opportunities for millions of Indian small merchants and enable customers seamlessly transact with mom-and-pop storesJio Glass to bring teachers and students together in 3D virtual rooms and conduct holographic classes through our Jio Mixed Reality cloud in real-timeBroadband for enterprises and small businesses; Narrowband Internet-of-Things (NBIoT)

Jio, which started out as a wireless carrier as its first building block back in 2016, will roll out its 5G network once airwaves are available, according to Ambani. Unlike other carriers, Jio will be using a technology developed locally for 5G, Ambani said, leaving it immune to political disputes linked to Chinese equipment vendors that global telecommunications companies are embroiled in.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”62″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”63″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment