(Bloomberg) — For years, analysts had to guess blindly at YouTube’s size. When the official numbers finally emerged this week, they were underwhelming. Now Google must persuade Wall Street it has a viable plan to keep YouTube growing.

On Monday, Google parent Alphabet Inc. disclosed YouTube sales for the first time. At $15.1 billion last year, that was well below most analysts’ projections, even including extra subscription revenue. Needham & Co., in an October report, put it at $30 billion.

“We believe buy-side estimates for YouTube ad revenue were higher than ours,” Jason Bazinet, an analyst at Citigroup, wrote in a research note. He thought the video service generated about $19 billion in sales last year. YouTube’s figures fell 30% short of Morgan Stanley’s estimates. Google “must continue to innovate to drive engagement and monetization,“ Morgan Stanley analyst Brian Nowak wrote.

While most other stocks jumped on Tuesday, Alphabet shares dropped more than 3%, partly on disappointment with YouTube’s results.

The world’s largest online video service has been considered one of Google’s most exciting growth stories for years, giving the internet giant exposure to the buzzy trends of social media, user-generated content and TV cord-cutting.

However, YouTube has spent the past three years struggling to limit the spread of toxic videos upsetting to regulators and advertisers, which has often meant restricting commercial messages. Unlike Google search, YouTube has a more complex business model, sharing more than half its ad sales with video creators. In social media, Instagram now rivals YouTube, with $15 billion in 2019 ad revenue, according to a recent estimate from research firm EMarketer. And the Facebook Inc. service is half a decade younger than YouTube.

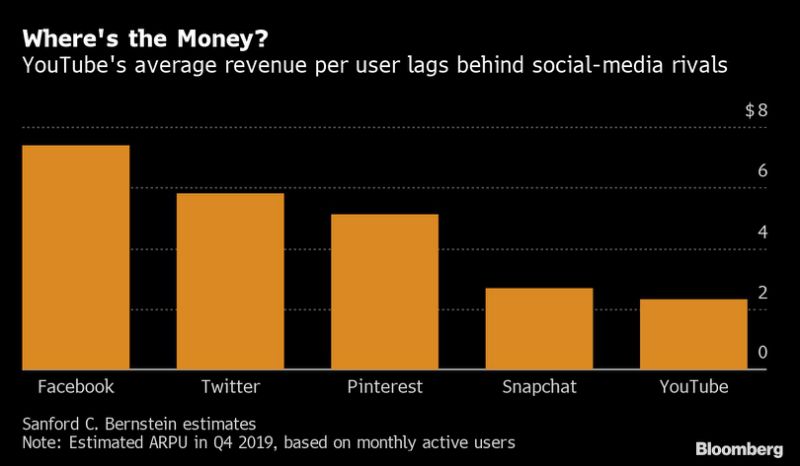

“We were too optimistic on our YouTube revenue estimates,” Mark Shmulik, an analyst at Sanford C. Bernstein, wrote in a research note Tuesday. “We must ask some tough questions – especially given that the 31% 4Q growth rate is lower than the annual revenue growth rate of 36%.”

YouTube’s average revenue per user, a closely followed metric across the internet industry, is only about a third of Facebook’s, and is also lower than other competitors, Shmulik noted.

During a conference call late Monday, some analysts asked how Google will improve YouTube’s results. Executives gave a strong hint — and it’s a departure from the current approach.

“Try searching for Puma shoes review on YouTube,” Sundar Pichai, chief executive officer of Alphabet and Google, said. He outlined a strategy to turn YouTube into an e-commerce hub where video creators hawk merchandise and advertisers entice viewers into more valuable activities than just clicking.

“People can now easily buy products in YouTube’s home feed and in search results making it possible for advertisers to reach even more audiences,” Pichai said. “With all the related content on YouTube like unboxing and beauty videos — this is a format people love and it delivers a simple in video buying experience.”

A search for “Puma shoes review” inside YouTube’s mobile app late Monday showed a swipe-able carousel of 40 ads with photos, prices and “Shop Now” buttons that linked to Puma’s website and other merchant sites.

These types of ads aim to get people to download an app, purchase a ticket or buy something else. In the past, YouTube has mostly relied on more general branding-style commercials from the traditional TV industry.

Ruth Porat, Alphabet’s chief financial officer, said the new formats are growing at a “very substantial” rate, without sharing specific numbers.

That gave some analysts hope that YouTube can still turn its giant audience into an equally huge business.

“When you see that YouTube is only a $15 billion revenue business — despite touching over 2 billion users globally each month that collectively watch over a billion minutes daily — you realize just how large the long-term opportunity is,” said Richard Greenfield, an analyst at Lightshed Partners.

Wall Street has been so starved of real statistics to crunch from Google over the years, that many analysts were simply happy to have any new numbers at all.

“Delighted they disclosed for the first time!” Needham analyst Laura Martin wrote in an email.

(Updates with ARPU estimates in eighth paragraph.)

–With assistance from Lucas Shaw, Sarah Frier and Gerrit De Vynck.

To contact the reporter on this story: Mark Bergen in San Francisco at [email protected]

To contact the editors responsible for this story: Alistair Barr at [email protected], Molly Schuetz

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”40″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”41″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.