Threadneedle Strategies Founder Ann Berry analyzes JP Morgan CEO Jamie Dimon’s comments on market and consumer outlooks, tech dominance in 2023, AI trends, economic data, and the weight of energy markets.

Video Transcript

[AUDIO LOGO]

SEANA SMITH: JPMorgan CEO Jamie Dimon releasing his annual letter to shareholders today, saying about the Silicon Valley Bank collapse, quote, “The current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come.” Here to discuss what that means for the markets going forward, we want to bring in Ann Berry, Threadneedle Strategies Founder.

Ann, it’s great to have you back on set. So let’s start with that first statement there from Jamie Dimon, lots of concern about what maybe that could mean for the markets. Is more turmoil maybe ahead?

ANN BERRY: Certainly, he softened what he’d said before about a recession coming. But there are a couple of really interesting things that he said here. So number one is from the banking crisis, these credit conditions tightening, bad for consumers. Secondly, he really spends a lot of time talking about how he thinks mortgages are going to become harder to come by in general from banks and how that’s bad for Americans. So that was a really big focus of this letter.

DAVID BRIGGS: What will be the impact if that, in fact, plays out?

ANN BERRY: Well, it’s interesting. So we saw in the February data– and I think we talked about it together– we saw a bit of a bounce back in terms of housing sales, maybe housing is becoming more affordable. But if mortgages just aren’t available because it’s too expensive for banks to issue them, underwrite them, and service them, that’s very bad news for the cost of living.

DAVID BRIGGS: Is that something the Fed wants to see, dare I say that? He needs to see some damage in the housing sector. Is that good news for Jerome Powell?

ANN BERRY: I don’t think it’s good news in the aggregate because one of the big issues, right, there’s the kind– there’s a sort of immediate term, what are we going to do with demand, is it too strong? But there’s another issue, which is in terms of social mobility, in terms of whether it’s possible for different demographics to get on the housing ladder. That’s been a core part of the American dream since the dawn of the country. And if it’s no longer available, there are big– bigger issues.

SEANA SMITH: And, Ann, when we talk about the state of so many consumers right now, the consumer has really been resilient up until we started seeing some cracks in this latest round of earnings reports. But Jamie also talked about what is being spent right now, and he expects to see the spent– expects consumers to spend the bulk of their remaining excess savings. When we talk about the economic impact of that going forward, is that something that we should be concerned about?

ANN BERRY: Absolutely something that we should worry about. The consumer has been buoying up the last two years of resilience– I wouldn’t even call it growth– resilience here in the US. The fact that it’s going to be drawn down, their savings going away right as we saw data today coming out saying that the number of job openings is the lowest it has been since February prior to the pandemic. So it’s– the labor market starting to get a little bit softer while those savings going away is not a great combination.

DAVID BRIGGS: You talked about credit conditions tightening. What about the impact on bank earnings for this quarter?

ANN BERRY: Yeah, I’m actually very concerned about bank earnings for some banks for this quarter. I think we’re going to see and hear, in stereo, the regional banks getting pressure. At the same time, we’ll see the big banks actually continuing to do quite well. And if you read Jamie Dimon’s letter, he says, I’m almost surprised at how well we did in 2022, right, at JPMorgan. I think we’re going to see those winners and losers emerging.

DAVID BRIGGS: But he said, “It’s absurd the notion that this meltdown was good for big banks.” Is that right?

ANN BERRY: Absolutely right. Confidence weakening in the US banking system, period, helps absolutely nobody. And I would just say this, sort of off the record. But I was at dinner at JPMorgan last week. And the teams at JPMorgan were very clearly told do not go out there crowing about the fact that we are probably going to gain market share. Do not aggressively go after other banks’ customers. Take the inbound calls, but they are prohibited from being aggressive.

SEANA SMITH: And clearly, that was why so many of the larger banks acted so quickly in trying to stabilize some of the volatility that we were seeing within the regional banks. What about the leadership that we’ve seen since the start of the year? Certainly has been all about the outperformance of tech, all about the outperformance of communication services. Is that a shift in investor sentiment, or is that something that you see fading here during this current quarter?

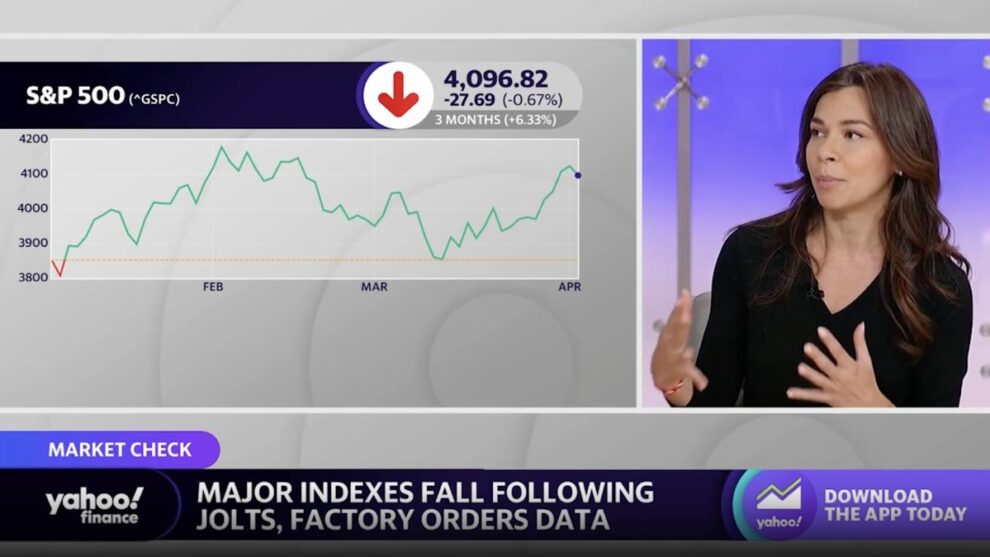

ANN BERRY: Yeah, I’m completely at a loss to understand why we’ve seen tech bounce back in the way that it has. It’s a complete mystery to me. It’s also a mystery why the S&P is still above 4,000 in the environment that we’re in. I do think we’re seeing a flight back to quality.

So almost irrespective of which sector it is, whether it’s big tech, whether it’s industrials, strong balance sheets, good free cash flow, we’re seeing a lot of movement there. But I think some of the broader rebound, particularly in some of these NASDAQ names, remains– frankly, I don’t understand why some of the growth names are bouncing back.

DAVID BRIGGS: Is too much made of it because Apple, Nvidia, and Microsoft essentially 90% of the gains. Are we making too much of essentially three companies leading the entire sector?

ANN BERRY: I think in terms of those mind share– look, Apple– if we want to talk about the bellwether stock for consumer sentiment, right, if consumers are going to not have as much savings and employment is not going to be as robust as it was, Apple is going to be feeling that at some point, right? Nvidia’s a slightly different play. But I do worry about the Nvidia story. Right now, it’s all AI, all the time. And the fact that that story is hanging on that one piece is just very, very concerning to me.

SEANA SMITH: What do you make about all this hype surrounding AI because it almost seemed like every single technology company who even mentioned tech– who have even mentioned AI, we saw their stock take off. Is that something that’s going to stick here, or is that just a trend?

ANN BERRY: Do you know what’s really fascinating, it was actually– I was working this weekend. And I was meeting with a founder who’s out raising money right now, not a public company, but a very experienced CEO. And his board had said to him, can you put AI into the pitch, into the pitch deck? And he turned around and said, if I do that, I lose credibility, right?

We’ve gone so far the other way now on the pendulum of AI being everywhere. It’s sort of everything, everywhere, all at once, right, to misquote the movie title. We’ve got to pare it back because I just do think– we saw this with the metaverse, right? We saw this when it came to blockchain. Those two buzzwords went everywhere, and the wheat and the chaff needs to be sorted out.

DAVID BRIGGS: This is a counter-take than I expected. Even the president weighing in on AI just moments ago, “It can help disease and climate change.” He does say there are potential risks.

But Bill Gates himself said this will impact essentially every single industry on the planet. Goldman Sachs impact 300 million workers around the world. Why do you think we need to pump the brakes? And I know you mentioned the metaverse. Don’t you think this is in every quantifiable way different?

ANN BERRY: I don’t think we should pump the brakes in terms of anticipating the impact that AI is going to have. I think should be very clear about defining what it is. So if I think about companies out there talking about artificial intelligence broadly, some of them simply mean they’ve got quite smart algorithms that are taking data inputs, and they’re not actually generating anything. They’re just using a lot of computational power to do lots of calculations quickly.

That’s different from the kind of AI like ChatGPT that everyone’s been excited about, which is generative. So I think elements of AI in its different levels of sophistication will touch everything. But in terms of rallies and stock prices where the companies and the management teams are not defining what exactly they mean by it, that’s where I get nervous and think you can start seeing bubble territory.

SEANA SMITH: So, Ann, we’ve talked about the leadership there in AI, at least up till now some questions about that going forward. What do you like, though, in terms of positioning right now if it’s not tech, if it’s not communication services, and outside of the banks?

ANN BERRY: I’m incredibly, incredibly boring. I think cash is queen. I keep saying cash is queen. Right now, it’s queen. But I do think it’ll change at some point. So I’m looking out for Q2 earnings.

I think they’re going to be weaker-than-expected. And if it is weaker-than-expected, I’m going to start legging back into consumer staples, where there’s really strong cash flow, start legging back in perhaps to financials, where I do think there could be some rebound post-recession.

DAVID BRIGGS: It’s the time of year some look out for an April surprise, could have, in some ways, been the OPEC production cuts, doesn’t look to be as massive and Earth-changing shift. What could that be for you?

ANN BERRY: In terms of the– a bit surprising?

DAVID BRIGGS: Yes.

SEANA SMITH: The one that I’m still looking at is what happens geopolitically, what happens in Ukraine, does that situation look like it’s nudging towards being resolved? And then a derivative of that is what continues to happen with the US-China relations. That headline comes in and out, depending on what’s going on like a day– like today, but it’s so fundamental. And Jamie Dimon talks about this, by the way. He’s pretty clear that Ukraine and the implications for geopolitical stability is his number one concern.

DAVID BRIGGS: And what could impact– real quick– the US-China relations? Could TikTok have any implication on that, or are we talking something major geopolitically, like Taiwan?

ANN BERRY: I think it’s both. But I think TikTok is sort of a lead indicator of that, right? This whole idea that the US wants to continue to lean in to protect its intellectual property and to continue to protect consumer data, that’s a theme that has been spanning several administrations now. And it’s just getting louder and louder. And I think an outright TikTok ban, if it gets to that point, is a real shot across the bowels of a different level.

SEANA SMITH: It certainly would be.