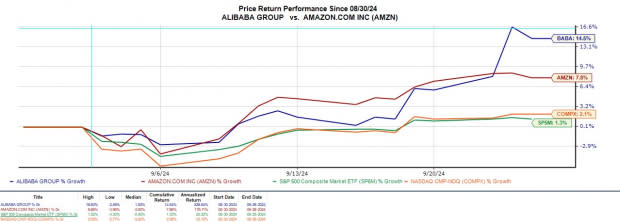

News of China’s economic stimulus has given Chinese equities a spike this week with Alibaba BABA starting to turn heads again.

Alibaba’s stock has catapulted +14% this month with BABA now sitting on +30% gains for the year to top American e-commerce giant Amazon’s AMZN +25%.

Seeing as Alibaba and Amazon shares have had nice momentum in September, it’s certainly a worthy topic of which e-commerce stock may be the better buy. To that point, its notable that their Zacks Internet-Commerce Industry is currently in the top 27% of over 250 Zacks industries.

Image Source: Zacks Investment Research

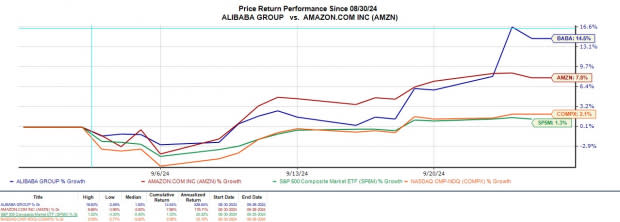

Growth Investors Favor Amazon

Diving into the outlook for these retail leaders, Amazon’s growth trajectory is more compelling with annual earnings now expected to climb 63% in fiscal 2024 to $4.74 per share versus EPS of $2.90 in FY23. Plus, FY25 EPS is projected to pop another 23%.

Amazon Web Services (AWS) has largely attributed to the tech behemoths’ expansion as Amazon’s total sales are forecasted to increase more than 10% in FY24 and FY25 with projections edging toward $700 billion. As the world’s largest cloud provider, Amazon’s AWS segment sales increased 18% during Q2 to $26.28 billion.

Image Source: Zacks Investment Research

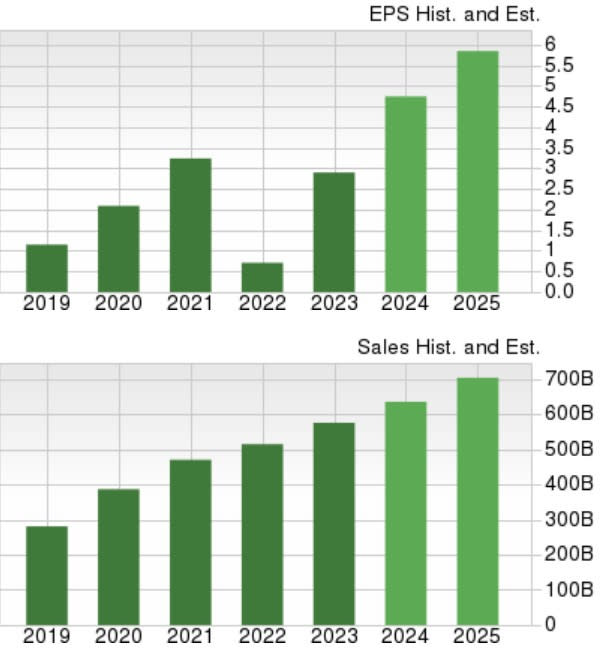

Alibaba has diverse operations outside of its e-commerce business as well which also includes cloud computing but the company’s earnings growth has slowed in recent years.

Already in its FY25, Alibaba’s EPS is expected to be up roughly 1% in its current fiscal year and is slated to be virtually flat in FY26 with projections at $8.74 per share. However, Alibaba’s top line is projected to expand 7% in FY25 and FY26 with forecasts edging toward $150 billion in annual sales.

Image Source: Zacks Investment Research

Value Investors Favor Alibaba

Despite Amazon’s more attractive growth trajectory, value investors may be more drawn to Alibaba’s stock. Amid the recent rally BABA still trades at just 10.9X forward earnings and at a significant discount to the industry average of 28.7X.

In contrast, AMZN is at a 40.5X forward earnings multiple which is also a noticeable premium to the S&P 500’s 24.2X.

Image Source: Zacks Investment Research

Furthermore, BABA trades at less than 2X sales with AMZN at 3.1X.

Image Source: Zacks Investment Research

Balance Sheet Comparison

Regarding the balance sheet, Amazon had $89 billion in cash & equivalents at the end of Q2 2024 compared to Alibaba’s $68 billion.

Amazon’s total assets stood at $554.81 billion with $318.37 billion in total liabilities.

Image Source: Zacks Investment Research

Equally as impressive, Alibaba has $245.63 billion in total assets compared to $102.18 billion in total liabilities.

Image Source: Zacks Investment Research

Bottom Line

At the moment, Alibaba and Amazon’s stock land a Zacks Rank #3 (Hold). It’s easy to see how growth investors may favor Amazon while value investors may be more inclined to choose Alibaba’s stock. Still, there could be better buying opportunities ahead after the recent surge in these e-com stocks although they remain viable long-term investments.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.