Student debt is often thought of as a generational issue, plaguing 20- and 30-somethings as they make their way into adulthood.

And while it’s true that young adults are coping with levels of student debt rarely experienced by their parents and even older siblings, perhaps one of the biggest factors defining a borrower’s student loan experience is their race.

Student debt is ‘both a cause and a consequence of racial inequality.’

Just ask Ky’Lend Adams. For the 24-year-old living in New York City and working in arts education, adjusting to life as a young adult has been quite different from the experience of many of his white peers.

“When people graduate they think I’m going to take a trip, I’m going to take a cruise, I’m going to go abroad,” said Adams, who is African-American and graduated from George Mason University last year. “That can’t be my priority.”

That’s because he’s contending with roughly $90,000 in student debt.

Understanding the experiences of borrowers of color, like Adams, is key to understanding the ways in which our student loan system isn’t living up to its promise to make higher education — and the benefits that come with it — accessible. While a college degree is an investment that pays off, on average, for students of color and black students in particular, the risk that it won’t pay off is much higher.

Courtesy of Kylend Adams

Courtesy of Kylend Adams

The reasons why are complex, but broadly, they tie back to America’s history of systemic racism. That history has limited the resources black families have to pay for college, made it more likely that black students will attend colleges with limited resources and be targeted by predatory colleges, while still facing barriers to entering wealthy, elite higher education institutions . They’re also more likely to struggle to repay the debt after they leave school.

As Jason Houle, a sociology professor at Dartmouth College, who has studied how borrowers’ experiences vary by race, puts it, student debt is “both a cause and consequence of racial inequality.”

The role of the racial wealth gap

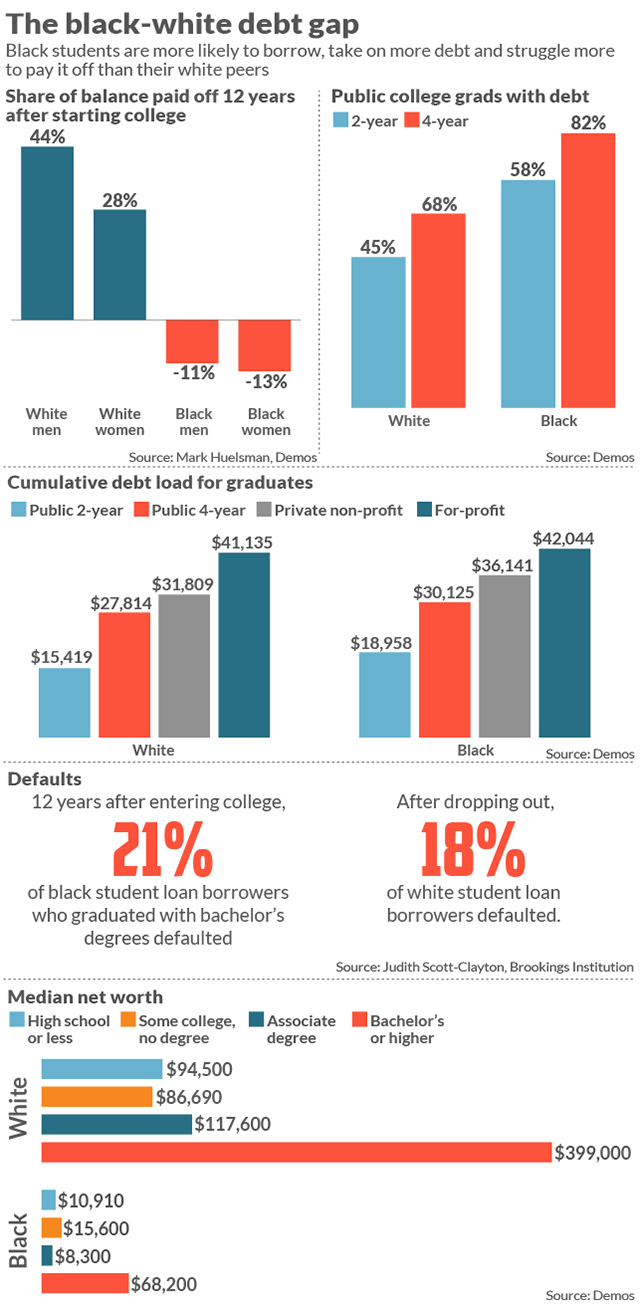

The gulf in wealth between black and white families underpins much of the disparity in borrowers’ experiences. The wealth gap means that black students are more likely to borrow for college than their white peers, and they tend to borrow more.

Terrence Horan/MarketWatch

Terrence Horan/MarketWatch

Student debt is “a fact of life for students of color if they want to attain higher education,” said Mark Huelsman, associate director, policy and research, at Demos, a left-leaning think tank. That’s the case if they attend public colleges and even public, two-year colleges, he added. “The bigger problem is that the payoff to a college degree is lower for students of color than it is for white students,” Huelsman said.

Student debt is ‘a fact of life for students of color if they want to attain higher education.’

That’s in part because students of color are more concentrated among less-selective schools with fewer resources to get students to and through college. As Huelsman puts it, these open access, regional public colleges are “fighting this battle with one hand tied behind their back.”

Historically black colleges and universities face a similar predicament. Billionaire Robert Smith’s decision earlier this year to pay off the student debt of the roughly 400 men in Morehouse’s class of 2019 brought renewed attention to the challenges graduates of historically black colleges and universities face paying for college and repaying their debt.

And the black-white wealth gap plays a role here too. These schools rarely draw the huge donations that have become commonplace at elite, majority-white institutions. And so they’re serving a larger population of under-resourced students with fewer resources themselves.

‘Our students come from lower socioeconomic backgrounds, where the family income just cannot support these young people in terms of paying for their college education.’

“Our students come from lower socioeconomic backgrounds, where the family income just cannot support these young people in terms of paying for their college education,” said Harry Williams, the president of the Thurgood Marshall College Fund, an association of public HBCUs.

But the student-debt crisis among black borrowers isn’t just explained by black students attending schools with fewer resources. There’s evidence to suggest that more exploitative behavior also plays a role.

Targeted by predatory colleges

There’s a well-documented history in lawsuits, including books like Tressie McMillan Cottom’s “Lower Ed.” For-profit colleges on average have worse graduation, job and student-loan repayment outcomes — using predatory marketing tactics to recruit black, low-income and female students.

Those tactics include advertising life-changing degrees on bus lines that are more likely to run through communities of color and on Black Entertainment Television — promises that often didn’t pan out.

William Jackson, a black veteran who served in Operation Desert Storm, described his experience of being recruited by and attending a for-profit college as predatory, though he said it’s hard to pinpoint whether race factored into the experience.

Jackson used up his GI bill and accumulated student debt attending a now-defunct for-profit college in the early 2000s. The school was later accused of enrolling students who couldn’t read or didn’t have a high-school diploma as part of a scheme where recruiters were rewarded based on how many students they could sign up.

‘I actually felt like I kind of got robbed at the end of the day because almost all of my money was gone, yet I still couldn’t get the job that I wanted.’

Jackson enrolled in a program to study media and audio engineering, but the expense pushed him to leave the school before getting a degree.

Though he still works in the entertainment industry, Jackson, 46, said he’s struggled to get his career off the ground and repay the roughly $15,000 he has in student loans. The experience of the debt is “like landing in quick sand, and your eyes are right above the mud and you can’t out,” he said.

It’s affected his credit rating, his quest for stable housing and his efforts to continue his education. “I actually felt like I kind of got robbed at the end of the day because almost all of my money was gone, yet I still couldn’t get the job that I wanted,” he said.

The predatory tactics used by for-profit colleges to target students of color combined with an elite higher-education system that’s disproportionately white and wealthy, goes a long way in explaining the disparate student-loan repayment outcomes between black and white students, said Eileen Connor, the director of litigation at the Project on Predatory Student Lending at Harvard Law School.

“If you take, on the one hand, the knowledge that there’s targeting and disproportionate enrollment in for-profit colleges of people of color,” Connor said. “On the other hand, you look at traditional higher education and you see that access is limited in numbers to those same groups — that’s the whole puzzle right there.”

Going from marginalized to included, but on bad terms

That pattern is part of a broader dynamic present in higher education and other areas of economic and financial life, that Louise Seamster, an incoming professor at the University of Iowa in sociology and African-American studies, calls predatory inclusion. She defines this phrase as: “A turn from former exclusion of a marginalized group, to inclusion, but on terms that negates the benefits.”

Predatory inclusion is defined as: ‘A turn from former exclusion of a marginalized group, to inclusion, but on terms that negates the benefits.’

Predatory inclusion plays out in a variety of ways in the higher-education space. For-profit colleges serving students who traditionally have been excluded from higher education — but with a relatively poor product — is just one example. Over the past few years, consumer advocates have demanded data from the government to try and determine whether student-loan debt collectors treat borrowers of different races differently, a pattern that’s well-documented in other areas of consumer lending.

But company executives and higher-education leaders aren’t the only ones contributing to the gap in student-loan outcomes between black and white borrowers, Seamster said, lawmakers play a role too. Just as a college degree is becoming more necessary than ever to compete in today’s economy and more students of color are enrolling in college, higher education has become less of a public good. State governments are less willing to invest in their public colleges and keep the costs low for students.

Gap between college’s promises and reality

Adams, the New York City resident working in arts nonprofits, said he was sold on the benefits of a college education and its power to push him ahead by both his high school and his family. But he knows it’s a right that people of color like him have been historically denied, which can make accessing it even more challenging.

For example, many of the people in Adams’ community don’t have access to the inter-generational wealth often available to white students to finance college or at least offer a cushion when repaying student debt, he said.

‘Getting a loan and trying to go to college and trying to pay for it when you’re already marginalized and disenfranchised financially due to racism is challenging.’

“Getting a loan and trying to go to college, and trying to pay for it when you’re already marginalized and disenfranchised financially due to racism is challenging,” he said.

That compounds the gap between the power of a college degree he bought into as a high-school student — and the reality.

“Being a first-generation college student, my family is not aware of what this looks like,” Adams said of the debt. “They’ve always been told — and really what they’ve known — is that you finish college with a degree, and you get a job.”

“Sometimes it’s unfortunate because the pay that you make from graduating is not sustainable to pay your loans, pay your rent,” he said.

Labor-market discrimination and access to fewer family resources while repaying debt means that this juggle can be tougher for black student-loan borrowers than their white peers.

Twelve years after starting college, white men have paid off 44% of their student-loan balance on average, white women 28%, according to a recent analysis from Huelsman at Demos. Black women saw their balances grow 13% during the same period, black men saw theirs increase by 11%.

Debt’s complicated role in pursuing dreams

When Jessica Saint-Paul first started planning how to manage her student debt, she wasn’t thinking much about how race played into it — she was more concerned about getting access to promised loan forgiveness.

Sait-Paul, who is black, will have more than $100,000 in student debt by the time she completes her education in September, which includes a master’s in public health and a doctoral degree in medical science.

The 42-year-old always knew she wanted to continue her education and she thought of the debt as an investment in her dream of starting a comprehensive adolescent health and wellness center. It wasn’t until the past several months that Saint-Paul began to think more critically about her debt, when she became one of thousands to struggle to access promised loan forgiveness for public servants.

Kerry James Photography

Kerry James Photography

Now, she’s noticed the difference between the way education is discussed in spaces where most participants are white versus spaces where many are black. At social and cultural events within Saint-Paul’s community where college is discussed, there’s often a conversation surrounding finances.

At professional and academic events, where many of the participants are white, “that’s not their focus, that’s already taken care of,” she said. Instead, they’re discussing advancing and how to get to the next level in their career. “I’m thinking about people who can’t even sit in this room,” she said.

Those experiences have inspired Saint-Paul to make sure that when she is in a position of power, she brings up the challenges students of color face getting to and paying for college. Already, Saint-Paul teaches both high school and college students and, though she says she isn’t quite ready to talk with them about college financing because her own student-loan experience is just sinking in, she plans and hopes to get to a place where she can provide some guidance.

“Every time we ignore it or let it go because we can’t do anything about it ourselves, that’s another generation not dealing with it, and I could have done something,” she said.

Policy makers are thinking more about student debt and racial inequality

Over the past several months, policy makers have also been thinking more critically about how the student-debt experience varies by race.

Sen. Doug Jones, a Democrat from Alabama, requested information from stakeholders earlier this year about the disparate impact of student debt on communities of color. Senators Elizabeth Warren and Bernie Sanders, have framed their presidential-campaign proposals to cancel student debt as a tool to help close the racial wealth gap.

It’s a conversation that experts say is important to understanding the student-debt crisis overall and it’s possible solutions.

“We’ve been talking about college as a risk — there’s risk involved, but on average it pays off very well,” said Judith Scott-Clayton, a professor of economics and education at Teachers College, Columbia University. “But when you break it out by race, it’s not just this small chance that it won’t work out — there’s a huge chance.”