Alphabet’s stock is a strong bargain in a market full of expensive stocks.

Alphabet (GOOG -0.10%) (GOOGL -0.18%), the parent company of Google, is getting absolutely no love from the public markets right now. In fact, from a valuation standpoint, it’s actually cheaper than the broader market, measured by the S&P 500.

That’s an odd statement, considering that Alphabet is one of the most dominant tech companies on the market today. There’s a reason for some pessimism with the stock, but is it enough to price it at a discount compared to the S&P 500?

Alphabet’s stock is slightly cheaper than the S&P 500

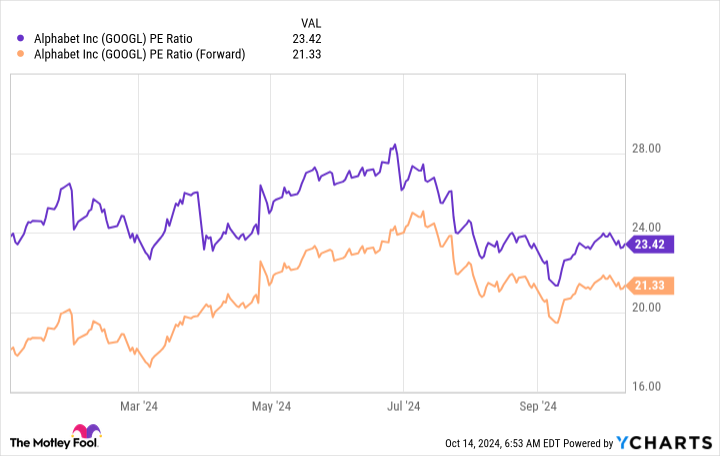

Alphabet’s stock has been fairly cheap throughout 2024, although its current state is about the cheapest it has been.

GOOGL PE Ratio data by YCharts.

On a price-to-earnings (P/E) basis, Alphabet is cheaper than the S&P 500, regardless of whether you look at trailing earnings or forward earnings. The S&P 500 currently trades for 24.7 times trailing earnings and 23.8 times forward earnings.

Essentially, the market is saying that Alphabet deserves a lower premium than the average S&P 500 constituent, which is an incredible statement.

Granted, Alphabet hasn’t put itself in the best place, either. The Department of Justice indicated that it could seek to break up the company after Alphabet was found guilty of monopolistic practices. This frightened many investors, as they don’t know how Alphabet would be broken up if it was forced to split up. However, this is years away, as Alphabet will challenge every part of this in court. Furthermore, when other companies are split up or divest a portion, the split often unlocks value, making the sum of the parts greater than the whole.

Although the DOJ case is one to watch, I don’t think it should factor into an investor’s decision to buy the stock.

Another reason Alphabet is being doubted is that some are worried the new search engines powered by generative AI could knock Alphabet from its pedestal atop the internet search market. I think there is a very low probability of this happening, as Alphabet’s incredible market share (about 90%) means that a large number of people would have to change their habits. Google already added a generative AI-powered summary to the top of its search result, so in some ways, it’s already evolved its platform before others could even try to usurp it.

There are many pessimistic headlines surrounding Alphabet, which led to its stock becoming so cheap. However, what remains is a company that’s still doing quite well and worth investing in now. Its cheap stock price allows both investors and the company itself to get a great deal on the stock.

A cheap stock means more effective buybacks

Because Alphabet is on the DOJ’s radar, any acquisitions it wants to make are highly scrutinized. So, instead of using its cash pile to buy up other complementary companies, it buys back stock.

Similar to how an investor’s money can buy more shares of a company with a cheap stock price, a company’s buybacks have the same effect. Last quarter, Alphabet bought back $15 billion worth of shares, which reduced the share count by 2.6% year over year.

Alphabet’s share repurchases will have a strong effect over a long time period and further amplify its earnings per share (EPS) growth. Because they reduce the denominator of this metric, they increase the output of the equation. Along with strong revenue growth (14% year over year), improved efficiencies, and share buybacks, Alphabet’s EPS increased from $1.44 to $1.89 year over year in the second quarter — a 31% rise.

Since stock price movements are highly correlated to earnings growth over the long term, Alphabet is poised to stomp the market in the future if it can keep delivering EPS growth like that. With it already trading at a discount to the broader market, it’s about as no-brainer a buy as you can get right now.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.