It’s no secret that technology has had a brutal stretch in 2022. These stocks that felt seemingly unstoppable over the last few years have come to a screeching halt, leaving dents in many portfolios.

Simply put, we’ve found ourselves amidst one of the most challenging macroeconomic backdrops in some time.

However, over the past month, some buyers have finally started to reappear in tech – a fascinating development that could signal that the rally has already begun. Fortunately, these buyers have started to reappear just when earnings season has arrived.

One tech titan slated to release quarterly results on July 26th after the market closes is Alphabet GOOGL.

Alphabet is currently a Zacks Rank #3 (Hold) with an overall VGM Score of a B.

Let’s look at how the Google parent shapes up heading into the quarterly release.

Share Performance & Valuation

Year-to-date, Alphabet shares have tumbled, losing more than a fourth of their value and underperforming the S&P 500 by a wide margin.

Image Source: Zacks Investment Research

Upon widening the timeframe to encompass the last year’s share performance, the story primarily remains the same – GOOGL shares have been stuck in a downtrend since last November, losing 20% in value and underperforming the S&P 500 in this timeframe as well.

Image Source: Zacks Investment Research

Alphabet sports a 20.1X forward earnings multiple, nowhere near its five-year median value of 27.1X and highs of 39.1X in 2020.

In addition, the value represents a 13% premium relative to the S&P 500. However, Alphabet shares are at their cheapest level since early 2020.

Image Source: Zacks Investment Research

Quarterly Estimates

Over the last 60 days, analysts have been overwhelmingly bearish, with seven downwards estimate revisions hitting the tape. For the quarter to be reported, the Zacks Consensus EPS Estimate resides at $1.28, penciling in a slight 5% decrease in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

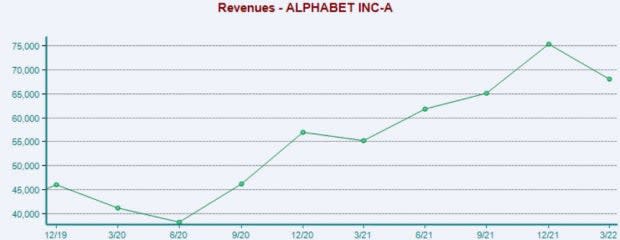

However, the top-line appears to be in exceptional health – Alphabet is forecasted to generate a mighty $57.7 billion in quarterly revenue, good enough for a 13% double-digit increase from year-ago quarterly sales of $50.9 billion. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Quarterly Performance & Market Reactions

Alphabet has repeatedly reported bottom-line results above expectations, exceeding the Zacks Consensus EPS Estimate in eight of its previous ten quarters. However, in its latest quarter, the tech titan posted a 4.6% bottom-line miss.

Quarterly sales results have also been stellar; GOOGL has exceeded top-line estimates in eight of its previous ten earnings releases.

Additionally, the market has reacted very well to the company’s bottom-line beats, with shares moving upwards in all five of its previous EPS beats.

Bottom Line

Analysts have dialed back their quarterly estimates quite notably over the last 60 days, with the EPS estimate now reflecting a decreasing bottom-line. However, the company’s top-line is forecasted to register solid growth.

In addition, shares are at the cheapest level we’ve seen in years, and the market has reacted spectacularly to the company’s previous bottom-line beats as of late. Heading into the quarterly report, Alphabet carries an Earnings ESP Score of -0.03%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research