Never miss an important update on your stock portfolio and cut through the noise. Over 7 million investors trust Simply Wall St to stay informed where it matters for FREE.

-

Waymo, Alphabet’s self-driving unit, is under scrutiny after robotaxis reportedly failed to obey a school bus stop sign and entered an active police scene, prompting a voluntary recall and questions from legislators about remote operations.

-

Waymo is reportedly in advanced talks with Hyundai on a potential supply of more than 50,000 electric vehicles for its autonomous fleet.

-

Google has introduced “Project Genie,” an experimental AI world model that can generate interactive digital environments, while also pursuing new renewable energy deals to support more sustainable data center operations.

For investors tracking NasdaqGS:GOOGL, these updates sit at the intersection of autonomous driving, advanced AI models and large scale infrastructure. Alphabet is pushing its self driving ambitions through Waymo while addressing safety and regulatory pressure, and at the same time experimenting with AI systems that move beyond text and images into interactive digital worlds.

Google’s moves on data center sustainability, including new renewable energy agreements, highlight how the company is tying compute heavy AI research to power sourcing decisions. For your thesis on Alphabet, the mix of regulatory questions around robotaxis, emerging AI products such as Genie, and energy choices for data centers may all shape how you think about risk, capital needs and growth options across the group.

Stay updated on the most important news stories for Alphabet by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Alphabet.

📰 Beyond the headline: 1 risk and 4 things going right for Alphabet that every investor should see.

-

✅ Price vs Analyst Target: At US$303.33 versus a consensus target of US$373.24, Alphabet trades about 23% below analyst expectations.

-

✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading 12.1% below fair value, suggesting some valuation cushion.

-

❌ Recent Momentum: The 30 day return of 8.08% indicates recent weakness that you should factor into your timing.

There is only one way to know the right time to buy, sell or hold Alphabet. Head to Simply Wall St’s company report for the latest analysis of Alphabet’s Fair Value.

-

📊 Waymo’s safety questions and planned Hyundai expansion put execution risk and regulatory scrutiny alongside the autonomous driving opportunity in your Alphabet thesis.

-

📊 Keep an eye on progress around Genie, data center energy sourcing and any disclosures on capital spend for AI infrastructure versus returns.

-

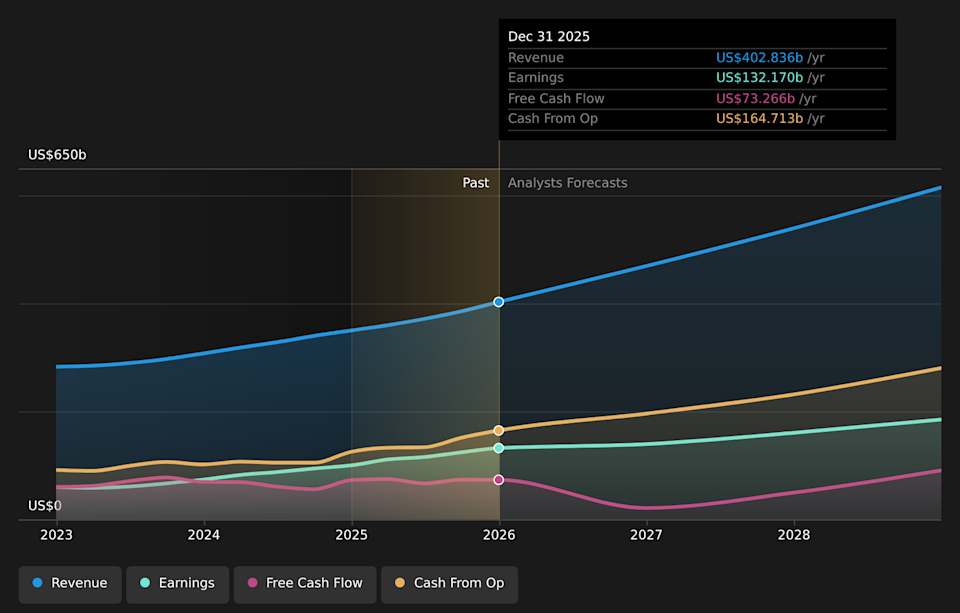

⚠️ One flagged risk is the high level of non cash earnings, so you may want to focus on cash flow quality when weighing these new projects.

For the full picture including more risks and rewards, check out the complete Alphabet analysis. Alternatively, you can visit the community page for Alphabet to see how other investors believe this latest news will impact the company’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include GOOGL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Add Comment