(Bloomberg) — Thailand is considering forcing online giants such as Amazon.com Inc. and Facebook Inc. to collect value-added tax on e-commerce sales, echoing an Indonesian clampdown on transactions that skirt the levy.

Cross-border purchases by Thais routed through global online marketplaces, as well as booming domestic sales in the so-called social-commerce sector, should incur the tax. But overseas vendors aren’t always aware of such obligations, and many Thais selling informally via social media avoid them.

“Our laws just can’t catch up with market trends,” Pinsai Suraswadi, principal adviser in Thailand’s Revenue Department, said in an interview Tuesday in Bangkok. “Current rules put the responsibility on the customer to come to us to pay the value-added tax. But in reality, it’s difficult to collect.”

Governments from Indonesia to Mexico say huge amounts of online sales and profits aren’t taxed properly, and they’re intensifying efforts to enforce their claims. Legislation to plug the gap may reach the Thai parliament by the end of the year, Pinsai said, adding that officials are also looking at taxing the Thailand-derived earnings of internet platforms.

Read more: Amazon, Google Face Tax Test as Indonesia Reins In E-Commerce

Thailand could put the onus on internet platforms to ensure the 7% consumption tax is collected and sent to the government, Pinsai said. A separate digital services levy could be imposed on the Thailand-derived earnings of such firms, he said. The rate hasn’t been decided yet.

Facebook declined to comment on Thailand’s efforts to tighten its rules. Amazon didn’t respond to a request for comment.

Levies on goods and services, such as the value-added charge, account for more than half of Thai tax revenue, an Organization for Economic Cooperation and Development report shows.

The country collected 806 billion baht ($27 billion) of value-added tax in 2018, according to official data. Pinsai said applying the charge to e-commerce will generate additional revenues exceeding “many billions of baht,” but declined to give an exact figure.

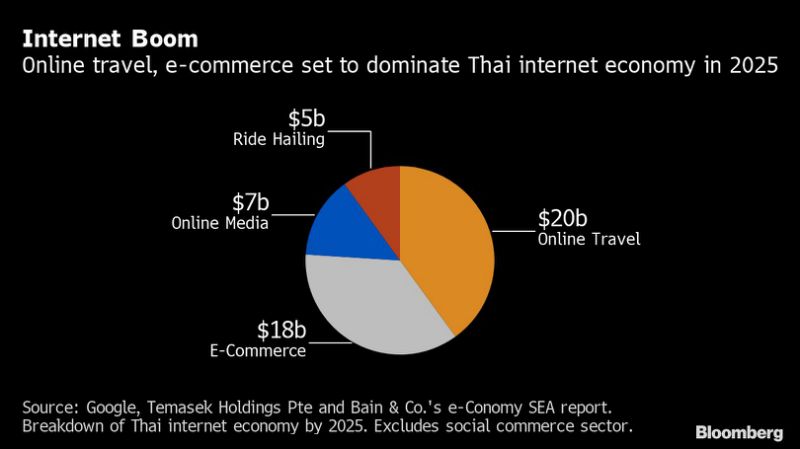

The Thai e-commerce sector may be worth $18 billion by 2025 and its wider Internet economy could more than triple to $50 billion from the current $16 billion, research by Google, Temasek Holdings Pte and Bain & Co. shows.

However, these figures don’t cover social commerce because of a lack of reliable data. Social commerce refers to burgeoning purchases of goods and services through Line, Facebook and Instagram, where buyers may haggle over price and often skirt value-added tax, as the sector is relatively new and part of the gray economy.

Officials should think carefully about whether taxes will stunt the e-commerce sector, said Somprawin Manprasert, chief economist at the research division at Bank of Ayudhya in Bangkok.

‘Foregone Opportunities’

“If the government is only looking to add more revenue by imposing this tax without contemplating foregone opportunities, it won’t be good in the long-term,” he said. “If they used that revenue to build a better digital ecosystem, operators, tech companies and investors would be able to accept that.”

With an economic slowdown is squeezing tax collection, Pinsai said Thailand’s revenue department may have to cut its 2.1-trillion-baht target for this fiscal year.

Pinsai said the administration is also weighing whether to impose customs duties on low-value cross-border purchases by Thais, which are growing fast. These sub-1,500 baht ($49) imports — for example, orders placed with Chinese sellers on Alibaba Group Holding Ltd.’s AliExpress platform — are below the current threshold for customs levies.

Adam Najberg, a spokesman for Alibaba, didn’t immediately respond to requests for comment.

“There’s exponential growth in the revenue of e-commerce in comparison to the flat growth of tax revenue collection,” Pinsai said. “It’s a very big gap.”

–With assistance from Lulu Yilun Chen.

To contact the reporters on this story: Natnicha Chuwiruch in Bangkok at [email protected];Suttinee Yuvejwattana in Bangkok at [email protected]

To contact the editors responsible for this story: Sunil Jagtiani at [email protected], Michael S. Arnold

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”61″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment