Amazon.com (NasdaqGS:AMZN) is currently experiencing significant growth, with a notable 11% increase in revenue year-over-year and a 91% rise in operating income. However, the company faces challenges such as high costs and competitive pressures. In the discussion that follows, we will explore Amazon’s core strengths, financial weaknesses, growth opportunities, and potential threats to provide a comprehensive overview of its current business situation.

Click here and access our complete analysis report to understand the dynamics of Amazon.com.

Strengths: Core Advantages Driving Sustained Success For Amazon.com

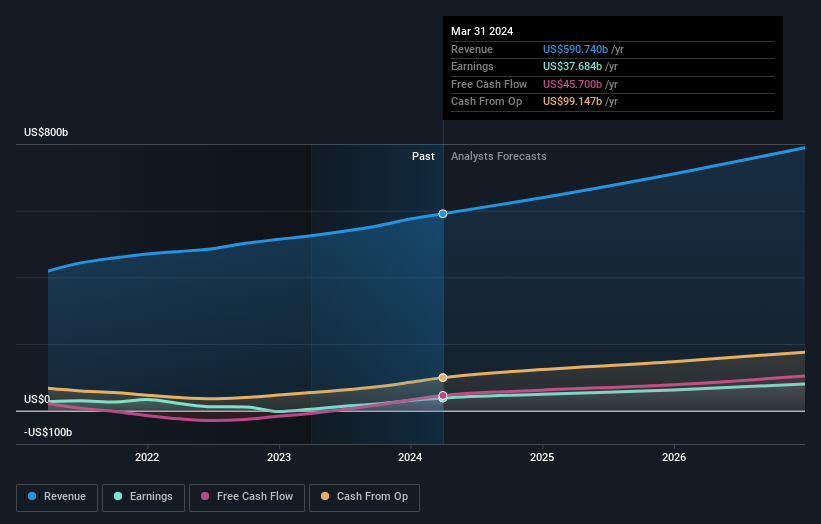

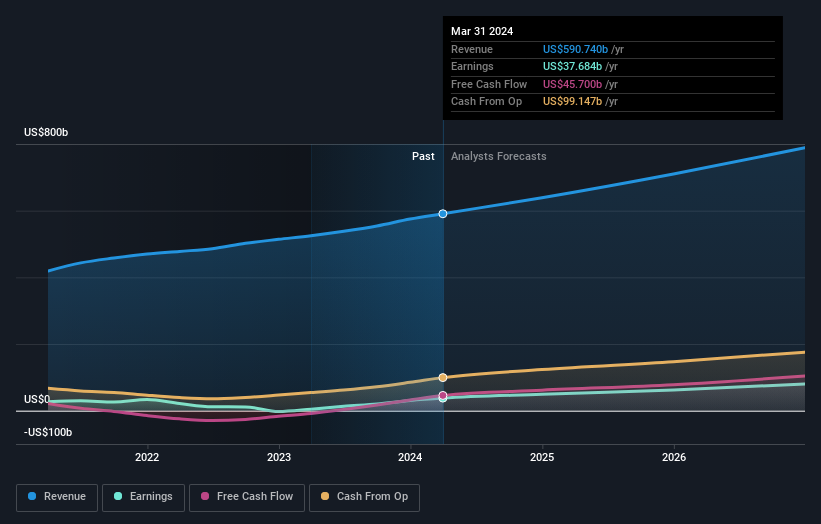

Amazon continues to demonstrate impressive revenue growth, reporting $148 billion in revenue, up 11% year-over-year, excluding the impact from foreign exchange rates, as highlighted by CEO Andy Jassy. This growth is further supported by a significant increase in operating income, which rose by 91% year-over-year to $14.7 billion. Additionally, Amazon’s free cash flow adjusted for equipment finance leases soared by 664% to $51.4 billion, indicating strong financial health. The company’s AWS segment remains a key driver, with revenue growth accelerating from 17.2% in Q1 to 18.8% in Q2. Furthermore, Amazon’s advertising revenue added over $2 billion year-over-year, generating more than $50 billion in the trailing 12 months. Prime member engagement also continues to rise, with members increasing their shopping frequency and spending more on Amazon. These strengths are reflected in Amazon’s valuation, with the company trading at $191.16, which is below the estimated fair value of $332.64, indicating it may be undervalued despite its high Price-To-Earnings Ratio compared to industry averages.

Weaknesses: Critical Issues Affecting Amazon.com’s Performance and Areas For Growth

Amazon faces several financial challenges, including high costs and retail margin pressure. CFO Brian Olsavsky noted an uptick in expenses and investment in Q2 compared to Q1, which impacted segment operating margins, decreasing by 20 basis points sequentially. The company is also experiencing lower average selling prices (ASPs) as customers trade down on price, reflecting cautious consumer spending. Despite these challenges, Amazon’s Price-To-Earnings Ratio (45.2x) remains high compared to the Global Multiline Retail industry average (19.8x) and the peer average (31.5x), indicating that the stock is expensive relative to its peers. Additionally, Amazon’s Return on Equity (ROE) is forecasted to be low at 17.1% in three years, which is below the benchmark for high returns. These weaknesses highlight areas where Amazon needs to improve its cost management and pricing strategies to enhance profitability.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Amazon has several growth opportunities, particularly in AI and cloud services. CEO Andy Jassy emphasized the dramatic growth in the company’s AI business, with a multibillion-dollar revenue run rate. The expansion into pharmacy services also presents a significant growth avenue, with Amazon optimistic about its potential. Project Kuiper, which aims to ship production satellites late this year, is another promising venture that could become a large business for Amazon. Additionally, the company sees further opportunities in advertising growth and customer experience enhancements, such as introducing free restaurant delivery for Prime members. These strategic initiatives can enhance Amazon’s market position and capitalize on emerging opportunities, driving long-term growth and competitive advantage.

Threats: Key Risks and Challenges That Could Impact Amazon.com’s Success

Amazon faces several external threats, including intense competition, economic factors, and regulatory risks. The company’s AWS segment, despite being a leader in cloud services, continues to face competition from other major players in the industry. Economic factors, such as cautious consumer spending, pose a risk to Amazon’s revenue growth, as noted by CFO Brian Olsavsky. Regulatory risks are also a concern, with ongoing scrutiny and potential legal challenges that could impact Amazon’s operations. Furthermore, market risks related to macroeconomic factors and consumer behavior could affect the company’s performance. These threats highlight the need for Amazon to navigate competitive pressures and regulatory environments carefully to sustain its growth trajectory.

Conclusion

Amazon’s strong revenue growth, significant increase in operating income, and soaring free cash flow highlight its solid financial foundation, suggesting potential for sustained success. However, challenges such as high costs, retail margin pressure, and cautious consumer spending indicate areas where Amazon must refine its cost management and pricing strategies to enhance profitability. The company’s strategic initiatives in AI, cloud services, pharmacy services, and Project Kuiper present substantial growth opportunities that could further strengthen its market position. Despite facing intense competition, economic factors, and regulatory risks, Amazon’s current trading price of $191.16, which is below its estimated fair value of $332.64, suggests that the market may not fully recognize its growth potential and financial health. These factors collectively indicate a promising outlook for Amazon, provided it navigates its challenges effectively.

Have a stake in Amazon.com? Integrate your holdings into Simply Wall St’s portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.