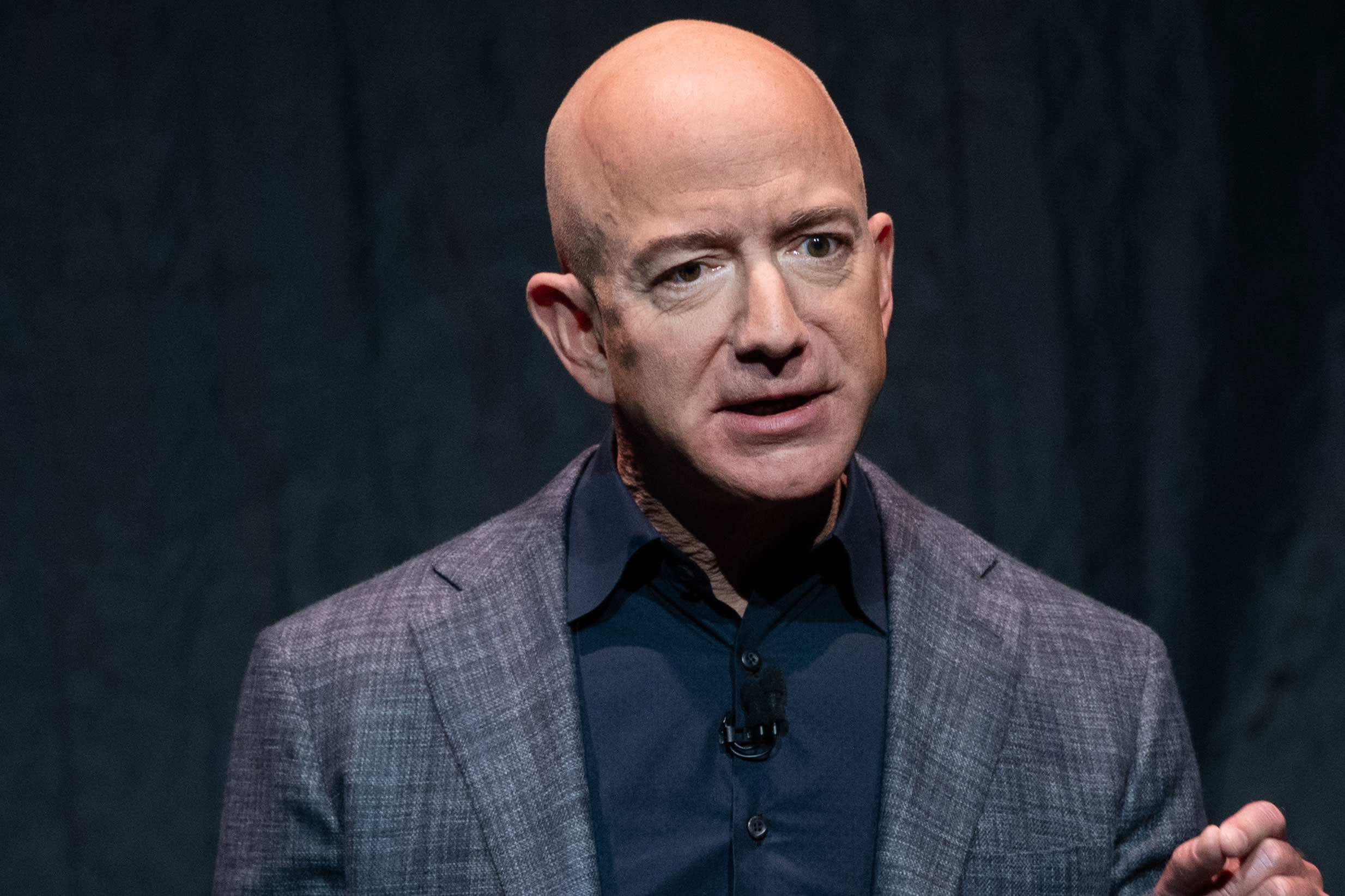

Amazon CEO Jeff Bezos announces Blue Moon, a lunar landing vehicle for the Moon, during a Blue Origin event in Washington, DC, May 9, 2019.

Saul Loeb | AFP | Getty Images

Amazon is expected to report its second-quarter earnings on Thursday but one analyst at BMO is warning investors that Wall Street’s estimates for the next quarter “are too high,” especially for the company’s operating income (OI).

“We think 3Q OI guidance will come in below consensus as we do not believe consensus properly reflects the fact that 3Q is often a heavy investment period and continued investment in one-day shipping,” BMO analyst Daniel Salmon wrote in a note on Tuesday.

BMO expects that in its coming earnings report that Amazon will note about $850 million in spending for the third quarter, “related to the move to one-day shipping,” Salmon said. Despite the caution, BMO told investors to buy “any pullback” in the stock if the forecast does come in lower than expected. The firm has an outperform rating on Amazon shares with a price target of $2,250.

“We continue to view Amazon as a structural Outperform due to the positive revenue mix shift of adding higher-margin businesses like AWS and advertising which we believe will support margin expansion over the long term,” Salmon said.

– CNBC’s Michael Bloom contributed to this report.