(Bloomberg Opinion) — International expansion is one of Amazon.com Inc.’s greatest opportunities. The company generates close to two-thirds of its e-commerce revenue in the U.S., but it has been bulking up its bet on India and stretching its Prime shopping club into more countries to bring Jeff Bezos’s online bazaar to the world.

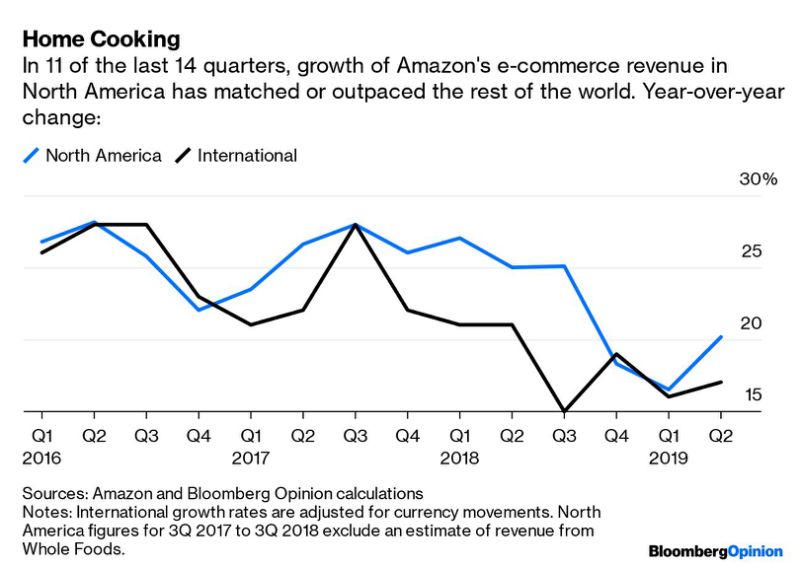

The scale of those international efforts makes it surprising to see Amazon’s relatively lagging growth outside its home market. Amazon posted roughly the same or quicker e-commerce revenue growth in North America than outside for 11 out of the last 14 quarters, adjusted for foreign-currency movements and making a rough estimate of the lift from Amazon’s acquisition of Whole Foods.

This is not an anomaly. In research published this month, RBC Capital Markets analyst Mark Mahaney said the annual growth rate of Amazon’s core North America e-commerce segment had topped currency-adjusted international growth each year since 2010.(2)

The pessimistic take on these figures is that Amazon’s international segment isn’t pulling its weight despite heavy investment and the debut of Amazon’s e-commerce services and Prime in more countries. The optimistic scenario is that Amazon is poised for explosive growth once its globe-trotting strategy takes hold.

Which of these views proves true rests in part on a question: Does the rest of the world behave like people in Amazon’s domestic market? If the shopping habits of Brazilians, Australians and Indians start to look like those of Americans who reflexively surf to Amazon whenever they need to buy something, Amazon is golden. If not, then optimistic expectations of Amazon’s future might not pan out.

Amazon says little about revenue trends by country. I imagine one reason for the growth gap between North America and the rest of the world is Prime, which is the most established in the U.S. out of the 18 or so countries where people can pay for fast, free shipping and other perks. Analysts estimate that Prime members spend at least twice as much on Amazon as customers who aren’t, which makes Prime the engine of Amazon’s e-commerce machine.

In large population countries, Prime is a few years old in India and offered with limited features in Brazil, but it’s relatively established in Amazon’s three biggest individual markets outside of North America — Germany, the U.K. and Japan. In Germany and Japan, Amazon’s reported revenue growth last year was about half the pace in the U.S., according to company disclosures that don’t adjust for effects of foreign currency movements.(4) In the U.K., the rate of reported revenue has accelerated significantly in the last few years.

It’s tough to draw conclusions from Amazon’s bare-bones geographic disclosures. It’s certainly not encouraging, however, that sales growth in two of Amazon’s biggest and most established international markets are flat-lining or going in the wrong direction. And it’s not great that Amazon’s shopping revenue at home is outpacing its international segment, which has less than half the annual revenue of Amazon’s North America segment.(7) The international segment also posts consistent operating losses.

On its quarterly conference calls with analysts, Amazon executives tend to be vague about its geographic sales trends, apart from their eagerness to talk — without many specifics — about the company’s progress in India. Amazon’s chief financial officer, Brian Olsavsky, has said that Amazon is in different stages of growth depending on the country and that over time, “customers behave the same globally.”

That’s the optimistic take, that the globe will look like the U.S., where Amazon grabs a 38% share of online retail spending, according to eMarketer. But Amazon’s lagging pace of international sales shows that the company’s considerable savvy and spending power don’t make it a lock in every country.

It may be that something isn’t working about Amazon’s appeal in some countries, or the company is having trouble with local retail competition, thorny logistical challenges, apathy among shoppers or prospective vendors or other forces. Maybe the virtuous circle of Prime simply is more powerful in the U.S. than anywhere else. Like many U.S. internet companies, Amazon has been a flop in China, by far the world’s biggest e-commerce market.

Honestly, Amazon’s international e-commerce performance is a bit of a mystery, and there’s something to chew on for both Amazon’s bulls and bears. Mahaney estimates that if Amazon can gain even relatively small shares of online shopping in big population countries such as India, Turkey and Mexico, Amazon’s growth will get a significant lift. He forecasts that five countries(5) can generate a combined $25 billion or more in revenue for the company by 2023, at a five-year compound annual growth rate of 31%.

To state the obvious, every country is different, and that makes it difficult to predict Amazon’s international prospects. It may be safer to assume that Amazon can’t get traction everywhere in the world but in select markets where Amazon works because of some combination of people’s interest in online shopping, the capability of Amazon or its partners’ delivery networks to move merchandise effectively, the absence of savvy rivals, limited regulatory barriers and other factors.

Amazon can see where it’s taking hold and accelerate its efforts in those countries — as the company appears to be doing in India. Even if Amazon doesn’t conquer the entire world, there is plenty of potential. That would, however, take a bite out of Amazon’s total market. It might not be easy for Amazon to conquer the planet.

(1) My calculations try to adjust for the temporary lift in year-over-year growth rates from Amazon’s August 2017 acquisition of Whole Foods. In the few quarters after the purchase, I assumed that 95% of Amazon’s disclosed revenue from its physical stores came from Whole Foods and that all of those sales were reflected in North America, where nearly all Whole Foods stores are situated. In Mahaney’s estimates, he takes Whole Foods’ estimated revenue out of the equation completely.

(2) Amazon’s North America and international segments include only e-commerce revenue. The country-by-country disclosure includes both e-commerce sales and revenue from Amazon’s cloud-computing operation, Amazon Web Services.

(3) A counterpoint: It’s impressive that Amazon can post fairly consistent 20% growth rates in North America.

(4) Mahaney’s big five are India, Brazil, Mexico, Australia and Turkey.

To contact the author of this story: Shira Ovide at [email protected]

To contact the editor responsible for this story: Daniel Niemi at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shira Ovide is a Bloomberg Opinion columnist covering technology. She previously was a reporter for the Wall Street Journal.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”66″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.