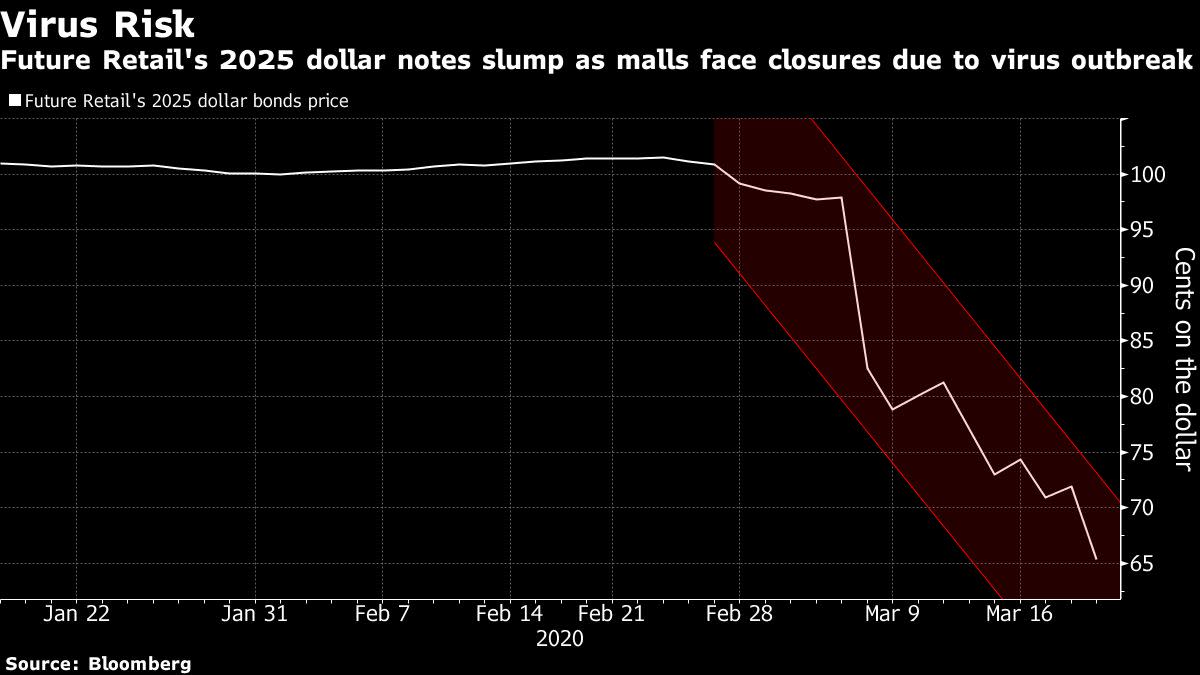

(Bloomberg) — An Indian brick-and-mortar retail partner of Amazon.com Inc. has slumped to a record low in the bond market as the fallout from the coronavirus pandemic fuels concerns about the founding family’s debt.

Future Retail Ltd. operates the popular hypermarket chain Big Bazaar in India. Its dollar notes fell to 65 cents on Thursday, the lowest since issuance in January. They were indicated a few cents above that level Friday.

The case echoes similar struggles around the world, as lockdowns, travel bans and the mounting human toll from the pandemic hit retailers and stretch finances across industries. India’s Prime Minister Narendra Modi has urged the country’s 1.3 billion citizens to stay indoors to protect themselves from the fast-spreading coronavirus. Read more about that here

The Indian retailer’s shares have also suffered a dramatic fall, as measures to fight the virus threaten sales at stores. The drop recently left the value of promoter shares barely above the required security cover, according to a Nomura report earlier this week.

Around 77%-78% of the founding family’s direct stake in the retailer is pledged, with the debt against which such shares are pledged at about 28 billion rupees ($373 million), according to the Nomura note.

The founding Biyani family owns about 41% of Future Retail – their group flagship – directly, and about 10% through a joint venture with Amazon.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”51″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”52″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.